Dark pool activity involves private trading venues where institutional investors execute large orders anonymously to minimize market impact, enhancing liquidity without revealing trading intentions. Crossing networks facilitate direct matching of buy and sell orders within a single platform, offering improved price discovery and reduced transaction costs by avoiding public market exposure. Explore deeper insights into how dark pools and crossing networks shape modern trading ecosystems.

Why it is important

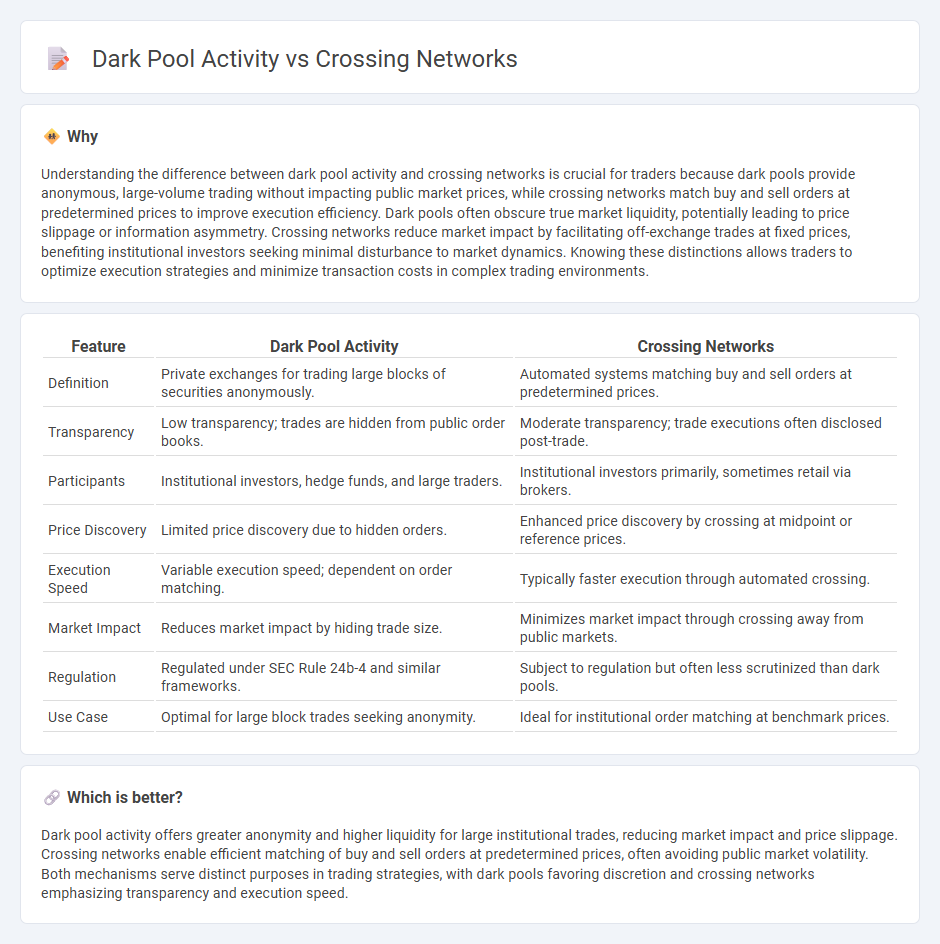

Understanding the difference between dark pool activity and crossing networks is crucial for traders because dark pools provide anonymous, large-volume trading without impacting public market prices, while crossing networks match buy and sell orders at predetermined prices to improve execution efficiency. Dark pools often obscure true market liquidity, potentially leading to price slippage or information asymmetry. Crossing networks reduce market impact by facilitating off-exchange trades at fixed prices, benefiting institutional investors seeking minimal disturbance to market dynamics. Knowing these distinctions allows traders to optimize execution strategies and minimize transaction costs in complex trading environments.

Comparison Table

| Feature | Dark Pool Activity | Crossing Networks |

|---|---|---|

| Definition | Private exchanges for trading large blocks of securities anonymously. | Automated systems matching buy and sell orders at predetermined prices. |

| Transparency | Low transparency; trades are hidden from public order books. | Moderate transparency; trade executions often disclosed post-trade. |

| Participants | Institutional investors, hedge funds, and large traders. | Institutional investors primarily, sometimes retail via brokers. |

| Price Discovery | Limited price discovery due to hidden orders. | Enhanced price discovery by crossing at midpoint or reference prices. |

| Execution Speed | Variable execution speed; dependent on order matching. | Typically faster execution through automated crossing. |

| Market Impact | Reduces market impact by hiding trade size. | Minimizes market impact through crossing away from public markets. |

| Regulation | Regulated under SEC Rule 24b-4 and similar frameworks. | Subject to regulation but often less scrutinized than dark pools. |

| Use Case | Optimal for large block trades seeking anonymity. | Ideal for institutional order matching at benchmark prices. |

Which is better?

Dark pool activity offers greater anonymity and higher liquidity for large institutional trades, reducing market impact and price slippage. Crossing networks enable efficient matching of buy and sell orders at predetermined prices, often avoiding public market volatility. Both mechanisms serve distinct purposes in trading strategies, with dark pools favoring discretion and crossing networks emphasizing transparency and execution speed.

Connection

Dark pool activity and crossing networks are connected through their shared function of facilitating large-volume, off-exchange trades that minimize market impact and preserve anonymity. Dark pools provide private venues for institutional investors to execute sizable orders without revealing intentions to the public market, while crossing networks match buy and sell orders internally at predetermined prices. This synergy enhances liquidity and price stability by reducing information leakage and avoiding the price volatility often associated with large trades on public exchanges.

Key Terms

Anonymity

Crossing networks and dark pools both provide anonymous trading environments, yet crossing networks match buy and sell orders internally before routing to public exchanges, ensuring reduced market impact. Dark pools aggregate large institutional orders off-exchange with strict confidentiality to prevent signaling and predatory trading, enhancing execution quality for sizable transactions. Explore more about how anonymity in these venues influences market efficiency and trading strategies.

Liquidity

Crossing networks facilitate large block trades by matching buy and sell orders within a single platform, enhancing liquidity while minimizing market impact. Dark pools offer anonymous trading venues where institutional investors execute large orders without revealing their intentions, preserving price stability and contributing to hidden liquidity. Explore how crossing networks and dark pool activity shape overall market liquidity and trading efficiency.

Execution price

Crossing networks and dark pools both aim to provide institutional investors with non-displayed liquidity, minimizing market impact and price slippage during trade executions. Crossing networks typically match buy and sell orders at predetermined prices, like the midpoint of the National Best Bid and Offer (NBBO), ensuring execution prices close to market consensus. Explore further to understand how each platform's execution pricing influences trading strategies and market transparency.

Source and External Links

Crossing network - Wikipedia - A crossing network is an alternative trading system that electronically matches buy and sell orders, typically for large blocks of shares, without routing them to public exchanges, thereby minimizing market impact and providing anonymity to traders.

Crossing network: Explained | TIOmarkets - Crossing networks serve as alternative trading venues mainly for institutional investors to match buy and sell orders directly, reducing costs and market price impact by avoiding traditional exchanges.

Trade Crossing Networks - QuestDB - Trade crossing networks are specialized electronic venues that match block trades between institutional investors at reference prices like VWAP or NBBO midpoint, focusing on anonymity and reducing market impact.

dowidth.com

dowidth.com