Quantitative sentiment analysis leverages natural language processing and machine learning to assess market sentiment by analyzing news, social media, and financial reports, providing traders with insights into market psychology. Algorithmic trading uses predefined mathematical models and statistical techniques to execute trades automatically based on various market conditions and data inputs, including sentiment indicators. Explore the nuances between these innovative trading approaches to enhance your investment strategies.

Why it is important

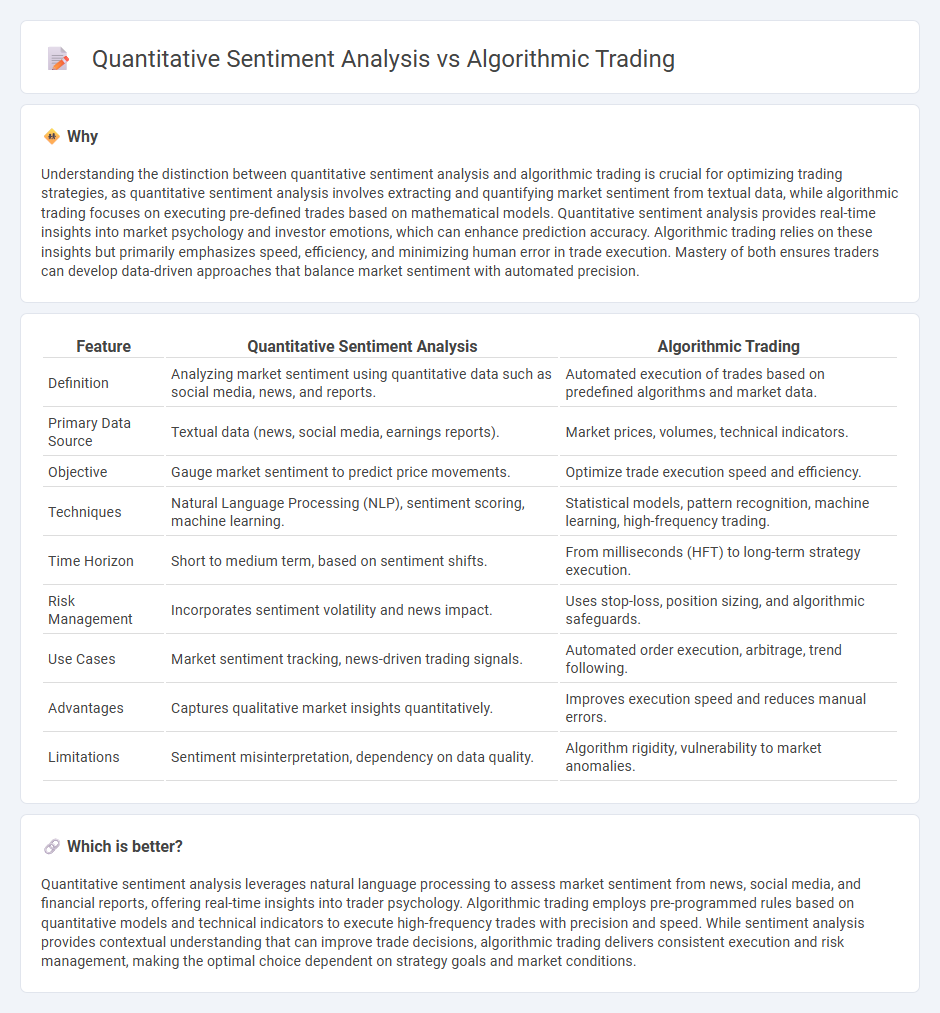

Understanding the distinction between quantitative sentiment analysis and algorithmic trading is crucial for optimizing trading strategies, as quantitative sentiment analysis involves extracting and quantifying market sentiment from textual data, while algorithmic trading focuses on executing pre-defined trades based on mathematical models. Quantitative sentiment analysis provides real-time insights into market psychology and investor emotions, which can enhance prediction accuracy. Algorithmic trading relies on these insights but primarily emphasizes speed, efficiency, and minimizing human error in trade execution. Mastery of both ensures traders can develop data-driven approaches that balance market sentiment with automated precision.

Comparison Table

| Feature | Quantitative Sentiment Analysis | Algorithmic Trading |

|---|---|---|

| Definition | Analyzing market sentiment using quantitative data such as social media, news, and reports. | Automated execution of trades based on predefined algorithms and market data. |

| Primary Data Source | Textual data (news, social media, earnings reports). | Market prices, volumes, technical indicators. |

| Objective | Gauge market sentiment to predict price movements. | Optimize trade execution speed and efficiency. |

| Techniques | Natural Language Processing (NLP), sentiment scoring, machine learning. | Statistical models, pattern recognition, machine learning, high-frequency trading. |

| Time Horizon | Short to medium term, based on sentiment shifts. | From milliseconds (HFT) to long-term strategy execution. |

| Risk Management | Incorporates sentiment volatility and news impact. | Uses stop-loss, position sizing, and algorithmic safeguards. |

| Use Cases | Market sentiment tracking, news-driven trading signals. | Automated order execution, arbitrage, trend following. |

| Advantages | Captures qualitative market insights quantitatively. | Improves execution speed and reduces manual errors. |

| Limitations | Sentiment misinterpretation, dependency on data quality. | Algorithm rigidity, vulnerability to market anomalies. |

Which is better?

Quantitative sentiment analysis leverages natural language processing to assess market sentiment from news, social media, and financial reports, offering real-time insights into trader psychology. Algorithmic trading employs pre-programmed rules based on quantitative models and technical indicators to execute high-frequency trades with precision and speed. While sentiment analysis provides contextual understanding that can improve trade decisions, algorithmic trading delivers consistent execution and risk management, making the optimal choice dependent on strategy goals and market conditions.

Connection

Quantitative sentiment analysis converts vast amounts of unstructured textual data from news, social media, and financial reports into measurable sentiment scores that inform trading signals. These sentiment metrics feed algorithmic trading models, enabling automated strategies to execute trades based on real-time market mood and investor behavior patterns. By integrating natural language processing with high-frequency trading algorithms, firms can enhance predictive accuracy and optimize portfolio performance in volatile markets.

Key Terms

Execution Algorithms

Execution algorithms in algorithmic trading optimize trade order placement by leveraging pre-set rules and real-time market data to minimize market impact and transaction costs. Quantitative sentiment analysis, while primarily used for forecasting asset price movements using news and social media data, can enhance execution algorithms by providing sentiment-driven signals that adjust order timing and size. Explore how integrating sentiment analysis into execution algorithms can improve trade efficiency and outcomes.

Machine Learning Models

Algorithmic trading leverages machine learning models to execute trades based on predefined rules, utilizing historical price data and technical indicators for predictive accuracy. Quantitative sentiment analysis applies natural language processing techniques to extract market sentiment from news, social media, and financial reports, feeding this data into machine learning algorithms to forecast asset movements. Explore how advanced machine learning models integrate both strategies to optimize trading performance and risk management.

Sentiment Indicators

Algorithmic trading leverages advanced mathematical models and real-time data to execute trades at optimal times, while quantitative sentiment analysis evaluates market sentiment through text mining social media, news, and financial reports to inform trading decisions. Sentiment indicators such as the Fear & Greed Index, Twitter sentiment scores, and news sentiment polarity offer quantifiable insights influencing price movements and volatility. Explore how integrating these sentiment indicators can enhance algorithmic trading strategies for improved market predictions.

Source and External Links

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading uses computer programs with pre-set rules to execute trades automatically when certain market conditions are met, such as moving average crossovers, enabling traders to make systematic and large trades without disrupting the market price.

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading strategies include price action, technical analysis, or a combination, where algorithms execute trades based on price levels or technical indicators, often used by high-frequency traders looking for quick profits in volatile markets.

Algorithmic trading - Wikipedia - Algorithmic trading systems involve market data input, server-side processing, and application of user-defined trading strategies to automate order execution with modern systems using low-latency technology and standard communication protocols like FIX for efficient trading and risk management.

dowidth.com

dowidth.com