Penny jump and spread are key concepts in trading that influence order execution and price movement in financial markets. Penny jump refers to the minimum price increment traders use to outbid others, while the spread is the difference between the bid and ask prices, reflecting market liquidity and volatility. Explore the nuances of penny jump versus spread to enhance your trading strategy and decision-making.

Why it is important

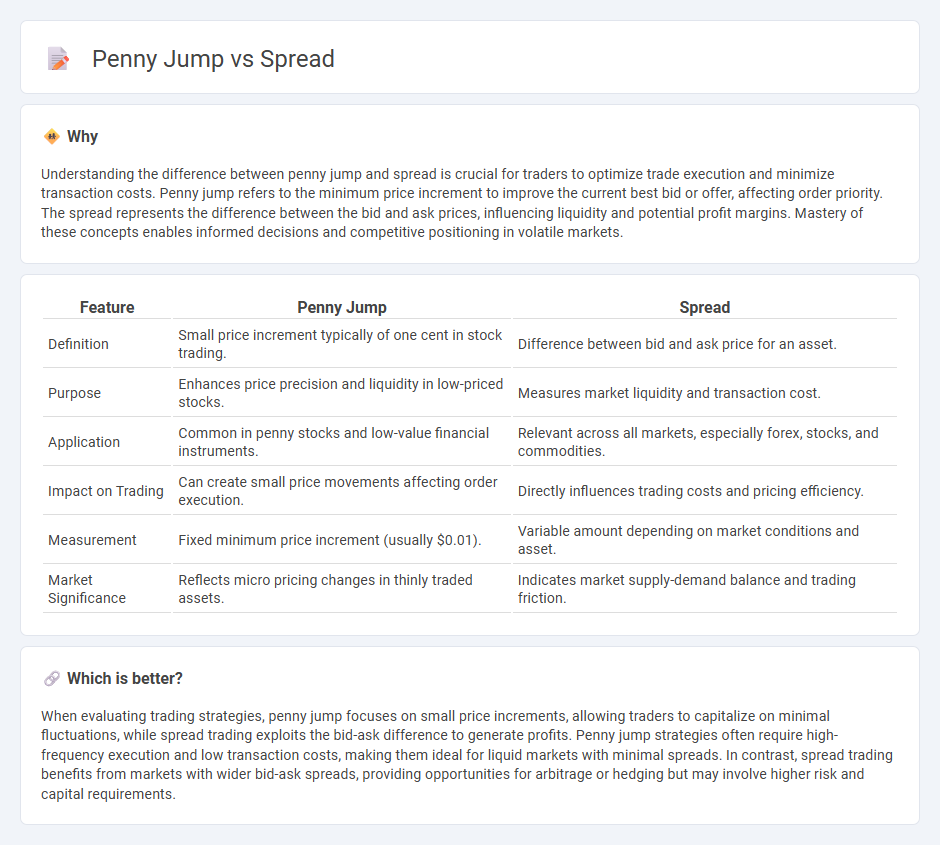

Understanding the difference between penny jump and spread is crucial for traders to optimize trade execution and minimize transaction costs. Penny jump refers to the minimum price increment to improve the current best bid or offer, affecting order priority. The spread represents the difference between the bid and ask prices, influencing liquidity and potential profit margins. Mastery of these concepts enables informed decisions and competitive positioning in volatile markets.

Comparison Table

| Feature | Penny Jump | Spread |

|---|---|---|

| Definition | Small price increment typically of one cent in stock trading. | Difference between bid and ask price for an asset. |

| Purpose | Enhances price precision and liquidity in low-priced stocks. | Measures market liquidity and transaction cost. |

| Application | Common in penny stocks and low-value financial instruments. | Relevant across all markets, especially forex, stocks, and commodities. |

| Impact on Trading | Can create small price movements affecting order execution. | Directly influences trading costs and pricing efficiency. |

| Measurement | Fixed minimum price increment (usually $0.01). | Variable amount depending on market conditions and asset. |

| Market Significance | Reflects micro pricing changes in thinly traded assets. | Indicates market supply-demand balance and trading friction. |

Which is better?

When evaluating trading strategies, penny jump focuses on small price increments, allowing traders to capitalize on minimal fluctuations, while spread trading exploits the bid-ask difference to generate profits. Penny jump strategies often require high-frequency execution and low transaction costs, making them ideal for liquid markets with minimal spreads. In contrast, spread trading benefits from markets with wider bid-ask spreads, providing opportunities for arbitrage or hedging but may involve higher risk and capital requirements.

Connection

Penny jumps, the smallest price movements in trading, directly influence the bid-ask spread by determining its minimum increment size. A narrower penny jump results in tighter spreads, enhancing market liquidity and reducing transaction costs for traders. Understanding this connection is crucial for optimizing trade execution and assessing market efficiency.

Key Terms

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller will accept (ask), reflecting market liquidity and transaction costs. A penny jump refers to a minimal one-cent price increase or decrease in a security, often signaling fine-tuned price adjustments within the spread. Explore deeper insights into how bid-ask spreads and penny jumps influence trading strategies and market behavior.

Tick Size

The spread represents the difference between the bid and ask prices, influenced heavily by the tick size, which is the minimum price movement allowed for a trading instrument. A penny jump refers to a one-cent increment in price, impacting liquidity and trade execution speed within markets constrained by tick size. Explore how tick size regulations shape market efficiency and trading strategies in greater detail.

Liquidity

Spread reflects the price difference between bid and ask quotes, indicating market liquidity depth, while a penny jump signifies a minimal price movement often influenced by market orders and low liquidity conditions. Tight spreads generally signal high liquidity and efficient markets, whereas frequent penny jumps can denote volatility in less liquid assets. Explore more to understand how liquidity impacts trading strategies and market dynamics.

Source and External Links

Synonyms & Antonyms for SPREAD - Definitions and extensive synonyms for "spread," including meanings as noun (expansion, meal) and verb (to open, publicize, cover, disseminate).

Spread - Wikipedia - Overview of various meanings of "spread" such as in places, media, finance (price difference between securities), gambling, and sports contexts.

SPREAD | Cambridge Dictionary - The verb "spread" defined as covering or reaching a wider area, or making something do this, with examples and related phrasal verbs.

dowidth.com

dowidth.com