Social sentiment analysis trading leverages real-time data from social media, news, and online forums to gauge market sentiment and predict price movements more objectively than discretionary trading, which relies on a trader's intuition and experience. Sentiment analysis tools process vast amounts of unstructured data to identify trends, making it a data-driven approach aligned with quantitative trading strategies. Explore how integrating social sentiment analysis can enhance your trading decisions and outperform traditional discretionary methods.

Why it is important

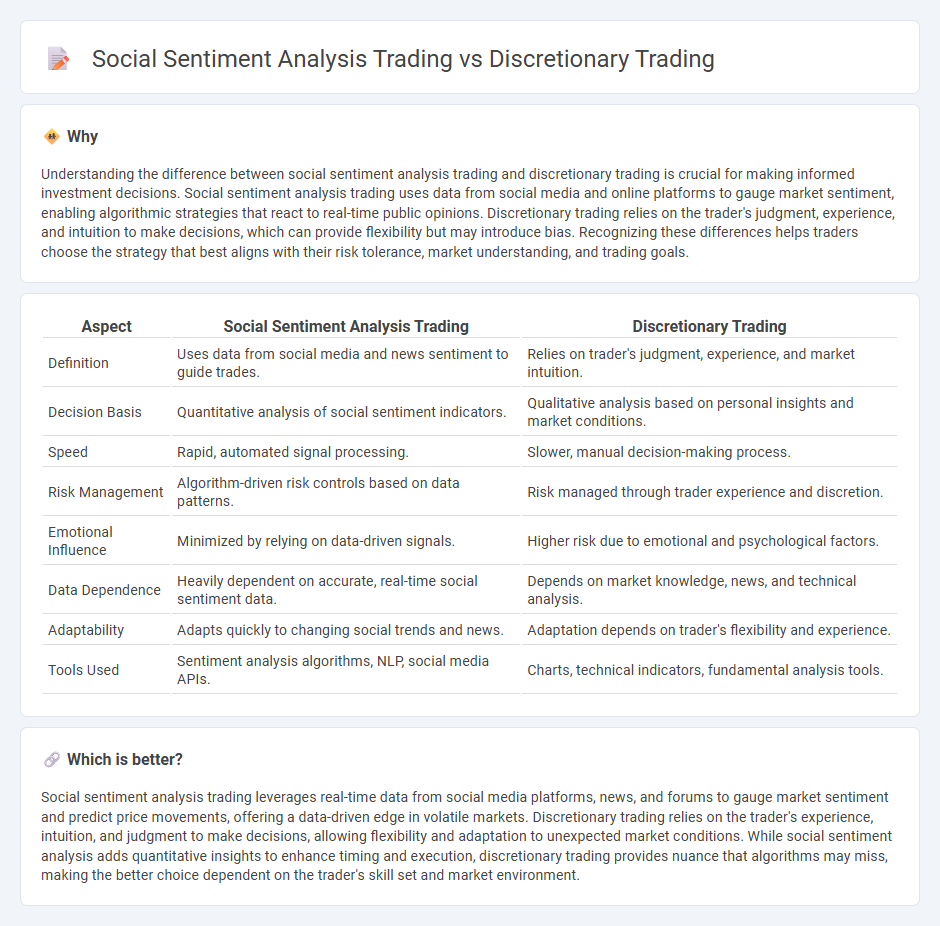

Understanding the difference between social sentiment analysis trading and discretionary trading is crucial for making informed investment decisions. Social sentiment analysis trading uses data from social media and online platforms to gauge market sentiment, enabling algorithmic strategies that react to real-time public opinions. Discretionary trading relies on the trader's judgment, experience, and intuition to make decisions, which can provide flexibility but may introduce bias. Recognizing these differences helps traders choose the strategy that best aligns with their risk tolerance, market understanding, and trading goals.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | Discretionary Trading |

|---|---|---|

| Definition | Uses data from social media and news sentiment to guide trades. | Relies on trader's judgment, experience, and market intuition. |

| Decision Basis | Quantitative analysis of social sentiment indicators. | Qualitative analysis based on personal insights and market conditions. |

| Speed | Rapid, automated signal processing. | Slower, manual decision-making process. |

| Risk Management | Algorithm-driven risk controls based on data patterns. | Risk managed through trader experience and discretion. |

| Emotional Influence | Minimized by relying on data-driven signals. | Higher risk due to emotional and psychological factors. |

| Data Dependence | Heavily dependent on accurate, real-time social sentiment data. | Depends on market knowledge, news, and technical analysis. |

| Adaptability | Adapts quickly to changing social trends and news. | Adaptation depends on trader's flexibility and experience. |

| Tools Used | Sentiment analysis algorithms, NLP, social media APIs. | Charts, technical indicators, fundamental analysis tools. |

Which is better?

Social sentiment analysis trading leverages real-time data from social media platforms, news, and forums to gauge market sentiment and predict price movements, offering a data-driven edge in volatile markets. Discretionary trading relies on the trader's experience, intuition, and judgment to make decisions, allowing flexibility and adaptation to unexpected market conditions. While social sentiment analysis adds quantitative insights to enhance timing and execution, discretionary trading provides nuance that algorithms may miss, making the better choice dependent on the trader's skill set and market environment.

Connection

Social sentiment analysis trading leverages real-time data from social media and news sources to gauge market mood and inform trading decisions. Discretionary trading relies on human judgment and experience, integrating sentiment insights to evaluate market trends beyond pure technical indicators. Combining social sentiment analysis with discretionary trading enhances decision-making by incorporating qualitative market signals into strategic trade executions.

Key Terms

Human Judgment

Discretionary trading relies heavily on human judgment, with traders using experience and intuition to make decisions, often adapting to market nuances that algorithms may overlook. Social sentiment analysis trading leverages real-time data from social media platforms and news to gauge collective market sentiment, aiming to predict price movements based on crowd behavior. Explore the contrasts further to understand how human intuition and data-driven insights shape trading strategies.

Crowd Psychology

Discretionary trading relies on individual judgment and experience to make decisions, often influenced by traders' interpretation of market cues and psychological factors. Social sentiment analysis trading uses data from social media, news, and crowd behavior to gauge market sentiment and predict price movements driven by collective emotions and reactions. Explore how integrating crowd psychology with advanced analytics can enhance trading strategies and decision-making.

Signal Interpretation

Discretionary trading relies heavily on the trader's personal judgment and experience to interpret market signals, allowing flexibility in responding to complex market dynamics. Social sentiment analysis trading utilizes data-driven algorithms to analyze social media trends, investor opinions, and public sentiment, providing quantifiable insights for decision-making. Explore how combining signal interpretation methods can enhance trading strategies and optimize performance.

Source and External Links

Systematic vs. Discretionary Trading Strategies - Discretionary trading relies on a trader's judgment, experience, and intuition, allowing for real-time adaptability and flexibility in decision-making, but it is more susceptible to emotional influence and inconsistency compared to systematic trading.

What is discretionary trading? | FBS Glossary - Discretionary trading involves direct control of trades by relying on intuition and understanding of market conditions rather than strict rules, offering high profitability and adaptability but requiring experience to avoid emotional decision-making.

What Is Discretionary Trading and How Does It Differ from Algorithmic Trading? - Discretionary trading is a traditional method where human traders manually make buy and sell decisions using judgment, experience, and market analysis, allowing flexibility and qualitative considerations but also exposing the process to emotional bias.

dowidth.com

dowidth.com