Dark pool activity involves private trading venues where large orders are executed anonymously, minimizing market impact compared to traditional exchanges. Order flow refers to the continuous stream of buy and sell orders that drive price discovery, reflecting real-time market sentiment and liquidity levels. Explore how understanding dark pools and order flow can enhance your trading strategies and market insights.

Why it is important

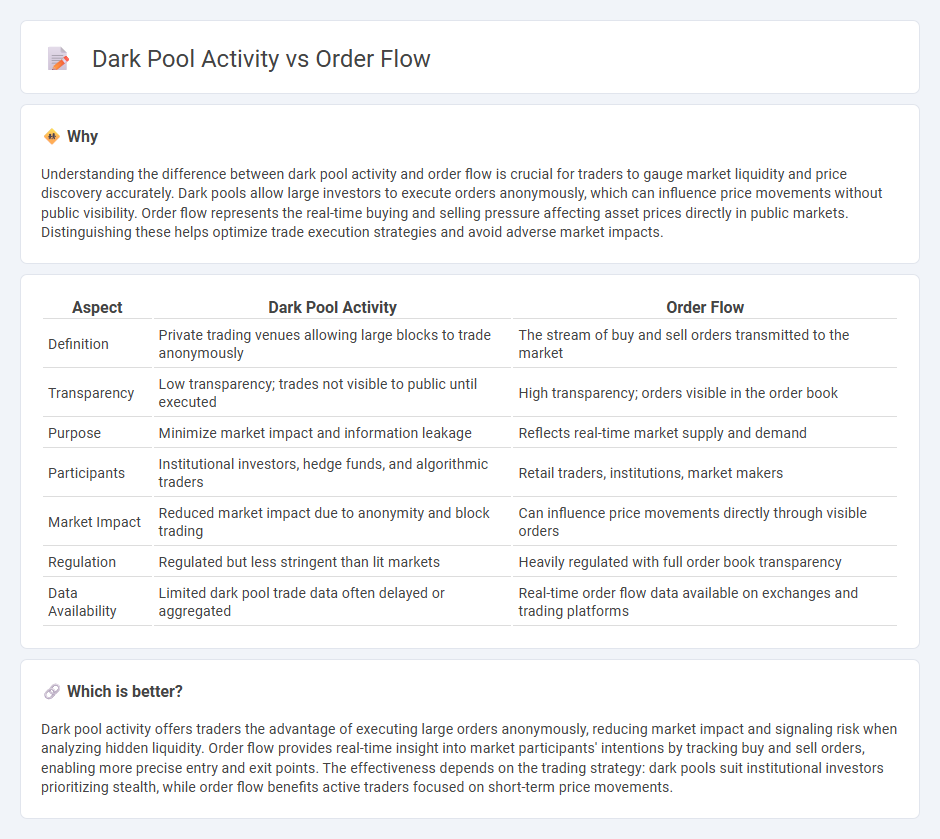

Understanding the difference between dark pool activity and order flow is crucial for traders to gauge market liquidity and price discovery accurately. Dark pools allow large investors to execute orders anonymously, which can influence price movements without public visibility. Order flow represents the real-time buying and selling pressure affecting asset prices directly in public markets. Distinguishing these helps optimize trade execution strategies and avoid adverse market impacts.

Comparison Table

| Aspect | Dark Pool Activity | Order Flow |

|---|---|---|

| Definition | Private trading venues allowing large blocks to trade anonymously | The stream of buy and sell orders transmitted to the market |

| Transparency | Low transparency; trades not visible to public until executed | High transparency; orders visible in the order book |

| Purpose | Minimize market impact and information leakage | Reflects real-time market supply and demand |

| Participants | Institutional investors, hedge funds, and algorithmic traders | Retail traders, institutions, market makers |

| Market Impact | Reduced market impact due to anonymity and block trading | Can influence price movements directly through visible orders |

| Regulation | Regulated but less stringent than lit markets | Heavily regulated with full order book transparency |

| Data Availability | Limited dark pool trade data often delayed or aggregated | Real-time order flow data available on exchanges and trading platforms |

Which is better?

Dark pool activity offers traders the advantage of executing large orders anonymously, reducing market impact and signaling risk when analyzing hidden liquidity. Order flow provides real-time insight into market participants' intentions by tracking buy and sell orders, enabling more precise entry and exit points. The effectiveness depends on the trading strategy: dark pools suit institutional investors prioritizing stealth, while order flow benefits active traders focused on short-term price movements.

Connection

Dark pool activity influences order flow by allowing institutional investors to execute large trades anonymously, reducing market impact and price slippage. The hidden transactions in dark pools affect the overall order flow by modifying supply and demand dynamics before trades reach public exchanges. Monitoring dark pool activity provides insights into institutional trading behaviors that shape future price movements in traditional markets.

Key Terms

Liquidity

Order flow reveals the real-time buying and selling pressure, offering transparency into market liquidity by tracking executed trades across public exchanges. Dark pool activity, conducted off-exchange, provides insights into hidden liquidity, where large institutional orders are matched anonymously to minimize market impact and price slippage. Explore how understanding these liquidity sources enhances trading strategies and market analysis.

Execution Venue

Order flow reflects the real-time buying and selling pressure in visible markets like exchanges, while dark pool activity involves large, non-displayed trades executed in private venues to minimize market impact. Execution venues influence liquidity and price discovery differently, with order flow venues providing transparency compared to the opaque nature of dark pools. Explore further to understand how these venues affect trading strategies and market efficiency.

Market Transparency

Order flow provides real-time insights into buy and sell transactions on public exchanges, enhancing market transparency by revealing participants' intentions. Dark pool activity, by contrast, occurs off-exchange and lacks immediate visibility, contributing to opacity and potential market fragmentation. Explore how balancing order flow analysis and monitoring dark pool trades can improve overall market transparency.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools - Order flow analysis involves observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume at price levels

Lesson 1 - The Basics of Order Flow & Volume Analysis - Order flow analysis studies market orders and limit orders to understand buying and selling pressure, where aggressive market orders move price by consuming bids or offers and imbalance in these flows drives price changes

Order Flow Trading & Volumetric Bars - Order flow trading uses tools like volumetric bars, volume profiles, cumulative delta, and order flow VWAP to visualize and quantify buying and selling pressure for identifying trends, support/resistance, and market reversals

dowidth.com

dowidth.com