Virtual land real estate offers a cutting-edge investment opportunity by leveraging blockchain technology and metaverse platforms, providing digital ownership with potential for high appreciation. Wine investment, on the other hand, combines tangible asset value and cultural appeal, with rare vintages appreciating steadily over time due to limited supply and increasing demand among collectors. Explore deeper insights into how these distinctive assets can diversify your investment portfolio.

Why it is important

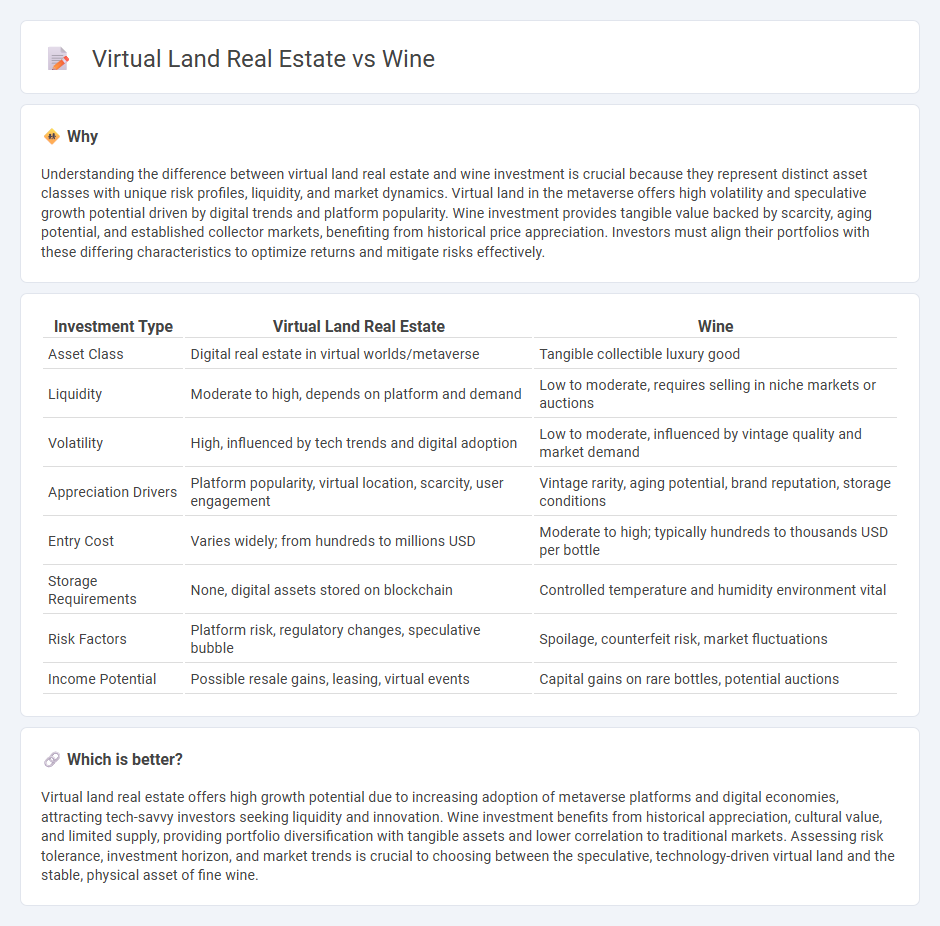

Understanding the difference between virtual land real estate and wine investment is crucial because they represent distinct asset classes with unique risk profiles, liquidity, and market dynamics. Virtual land in the metaverse offers high volatility and speculative growth potential driven by digital trends and platform popularity. Wine investment provides tangible value backed by scarcity, aging potential, and established collector markets, benefiting from historical price appreciation. Investors must align their portfolios with these differing characteristics to optimize returns and mitigate risks effectively.

Comparison Table

| Investment Type | Virtual Land Real Estate | Wine |

|---|---|---|

| Asset Class | Digital real estate in virtual worlds/metaverse | Tangible collectible luxury good |

| Liquidity | Moderate to high, depends on platform and demand | Low to moderate, requires selling in niche markets or auctions |

| Volatility | High, influenced by tech trends and digital adoption | Low to moderate, influenced by vintage quality and market demand |

| Appreciation Drivers | Platform popularity, virtual location, scarcity, user engagement | Vintage rarity, aging potential, brand reputation, storage conditions |

| Entry Cost | Varies widely; from hundreds to millions USD | Moderate to high; typically hundreds to thousands USD per bottle |

| Storage Requirements | None, digital assets stored on blockchain | Controlled temperature and humidity environment vital |

| Risk Factors | Platform risk, regulatory changes, speculative bubble | Spoilage, counterfeit risk, market fluctuations |

| Income Potential | Possible resale gains, leasing, virtual events | Capital gains on rare bottles, potential auctions |

Which is better?

Virtual land real estate offers high growth potential due to increasing adoption of metaverse platforms and digital economies, attracting tech-savvy investors seeking liquidity and innovation. Wine investment benefits from historical appreciation, cultural value, and limited supply, providing portfolio diversification with tangible assets and lower correlation to traditional markets. Assessing risk tolerance, investment horizon, and market trends is crucial to choosing between the speculative, technology-driven virtual land and the stable, physical asset of fine wine.

Connection

Virtual land real estate and wine share investment appeal through their scarcity and potential for high returns in niche markets. Both assets offer portfolio diversification by blending traditional tangible goods with innovative digital properties on blockchain platforms. Advanced valuation methods, including tokenization of virtual land and rare wine bottles, enable increased liquidity and market accessibility for investors.

Key Terms

Asset Class

Wine as an asset class offers tangible value through rare vintages and limited production, appealing to collectors and investors seeking diversification beyond traditional markets. Virtual land real estate represents a digital asset class within metaverse platforms, driven by blockchain technology and digital scarcity, attracting tech-savvy investors and gamers. Explore the comparative benefits and risks of physical versus digital asset classes to optimize your investment portfolio.

Liquidity

Wine investment offers moderate liquidity, with the ability to sell bottles or shares through auction houses and specialized platforms, though transactions can be time-consuming and market-dependent. Virtual land real estate, traded on blockchain-based marketplaces, provides higher liquidity due to 24/7 global access and instant transactions via smart contracts. Explore deeper insights into how liquidity impacts the value and investment strategies of wine and virtual land assets.

Appreciation Potential

Wine as an investment often appreciates due to rarity, vintage quality, and brand reputation, with top bottles increasing in value over 10% annually. Virtual land real estate gains appreciation through platform popularity, digital scarcity, and development potential within metaverse projects like Decentraland and The Sandbox. Explore deeper insights into how these asset classes compare in growth prospects and risk factors.

Source and External Links

Wine - Wikipedia - Wine is an alcoholic beverage made from fermented grapes, produced globally in various styles and with deep historical, cultural, and religious significance.

Wine.com - A major online retailer offering thousands of wines for purchase, including red, white, sparkling, and rose varieties, with options for shipping, gifts, and expert recommendations.

WineHQ - Wine (Wine Is Not an Emulator) is a compatibility layer that allows users to run Windows applications on Linux, macOS, and other POSIX-compliant operating systems without emulation.

dowidth.com

dowidth.com