Fractional farmland ownership offers investors tangible assets and potential long-term appreciation through shared equity in agricultural land, contrasting with commodity futures that involve speculative contracts tied to price fluctuations of agricultural products. Farmland investment provides stable cash flow from crop production and land value increases, while futures demand active market timing and carry higher volatility risks. Explore the advantages and challenges of each investment type to enhance your agricultural portfolio strategy.

Why it is important

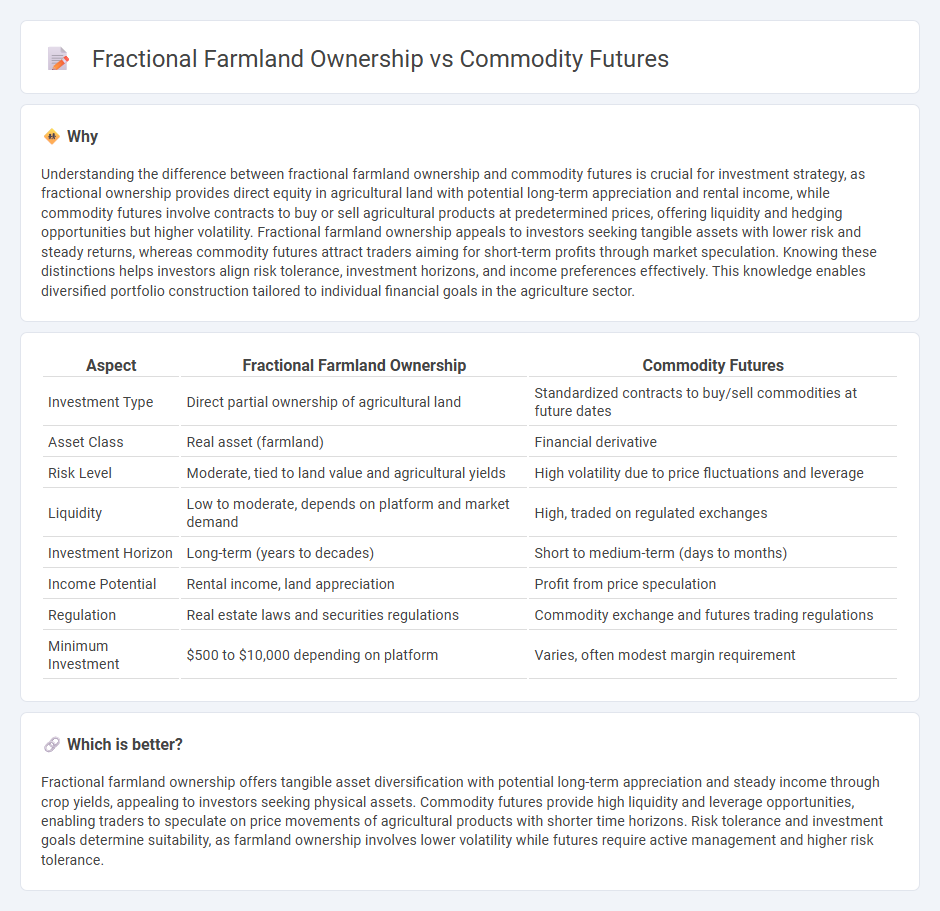

Understanding the difference between fractional farmland ownership and commodity futures is crucial for investment strategy, as fractional ownership provides direct equity in agricultural land with potential long-term appreciation and rental income, while commodity futures involve contracts to buy or sell agricultural products at predetermined prices, offering liquidity and hedging opportunities but higher volatility. Fractional farmland ownership appeals to investors seeking tangible assets with lower risk and steady returns, whereas commodity futures attract traders aiming for short-term profits through market speculation. Knowing these distinctions helps investors align risk tolerance, investment horizons, and income preferences effectively. This knowledge enables diversified portfolio construction tailored to individual financial goals in the agriculture sector.

Comparison Table

| Aspect | Fractional Farmland Ownership | Commodity Futures |

|---|---|---|

| Investment Type | Direct partial ownership of agricultural land | Standardized contracts to buy/sell commodities at future dates |

| Asset Class | Real asset (farmland) | Financial derivative |

| Risk Level | Moderate, tied to land value and agricultural yields | High volatility due to price fluctuations and leverage |

| Liquidity | Low to moderate, depends on platform and market demand | High, traded on regulated exchanges |

| Investment Horizon | Long-term (years to decades) | Short to medium-term (days to months) |

| Income Potential | Rental income, land appreciation | Profit from price speculation |

| Regulation | Real estate laws and securities regulations | Commodity exchange and futures trading regulations |

| Minimum Investment | $500 to $10,000 depending on platform | Varies, often modest margin requirement |

Which is better?

Fractional farmland ownership offers tangible asset diversification with potential long-term appreciation and steady income through crop yields, appealing to investors seeking physical assets. Commodity futures provide high liquidity and leverage opportunities, enabling traders to speculate on price movements of agricultural products with shorter time horizons. Risk tolerance and investment goals determine suitability, as farmland ownership involves lower volatility while futures require active management and higher risk tolerance.

Connection

Fractional farmland ownership enables investors to purchase shares of agricultural land, providing direct exposure to the farmland market while diversifying risk. Commodity futures are financial contracts that allow investors to hedge or speculate on the price movements of agricultural products grown on such land. The connection lies in the ability of fractional farmland investors to leverage commodity futures for price stability and portfolio optimization.

Key Terms

Leverage

Commodity futures offer high leverage, allowing traders to control large contract values with a relatively small margin, which increases potential profits and risks. Fractional farmland ownership involves less financial leverage but provides stable, long-term asset exposure with tangible asset backing and potential income through agricultural yields. Explore deeper insights on leveraging strategies in commodity futures and fractional farmland ownership for informed investment decisions.

Diversification

Commodity futures offer exposure to raw materials like metals, energy, and agriculture with high liquidity and the potential for quick gains, but they carry significant price volatility and require active management. Fractional farmland ownership provides access to agricultural land assets, promoting portfolio diversification through stable, income-generating land investments less correlated with traditional markets. Explore the benefits and risks of each to determine the best fit for your diversified investment strategy.

Liquidity

Commodity futures offer high liquidity with standardized contracts traded on major exchanges, enabling investors to quickly enter or exit positions with minimal transaction costs. Fractional farmland ownership provides lower liquidity as it involves physical land assets with longer holding periods and less frequent trading opportunities. Explore more to understand the trade-offs between liquidity and asset stability in these investment options.

Source and External Links

Corn Futures Overview - CME Group - Provides access to a central and transparent point of global price discovery for corn futures, allowing traders to profit from or hedge against price movements.

Basics of Futures Trading | CFTC - Explains the basics of commodity futures contracts and their trading mechanisms, including hedging and speculation.

Futures and Commodities | FINRA.org - Discusses the risks and benefits of investing in commodity futures, highlighting their role in diversification and the potential for volatility.

dowidth.com

dowidth.com