Litigation finance involves funding legal cases in exchange for a portion of the settlement or judgment, offering an alternative investment vehicle that is uncorrelated with traditional markets. Private equity focuses on acquiring equity stakes in companies to drive growth and generate returns through operational improvements and eventual exit strategies. Explore the distinctions and opportunities within litigation finance and private equity to optimize your investment portfolio.

Why it is important

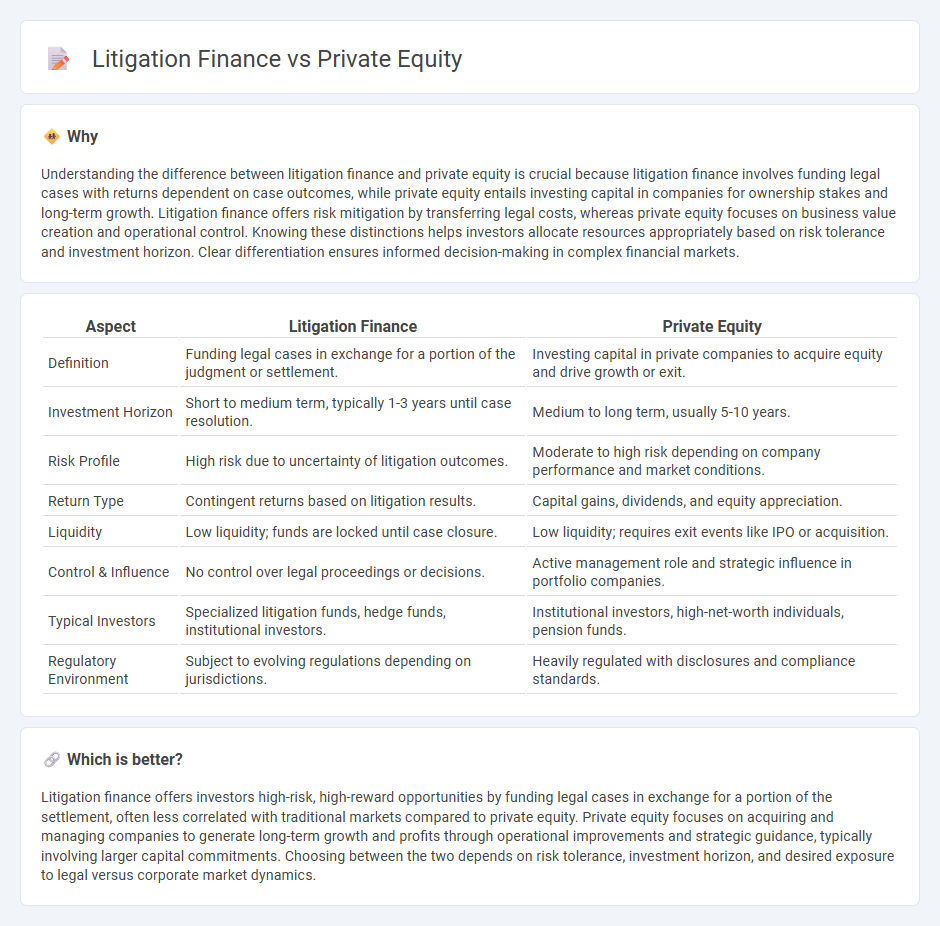

Understanding the difference between litigation finance and private equity is crucial because litigation finance involves funding legal cases with returns dependent on case outcomes, while private equity entails investing capital in companies for ownership stakes and long-term growth. Litigation finance offers risk mitigation by transferring legal costs, whereas private equity focuses on business value creation and operational control. Knowing these distinctions helps investors allocate resources appropriately based on risk tolerance and investment horizon. Clear differentiation ensures informed decision-making in complex financial markets.

Comparison Table

| Aspect | Litigation Finance | Private Equity |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the judgment or settlement. | Investing capital in private companies to acquire equity and drive growth or exit. |

| Investment Horizon | Short to medium term, typically 1-3 years until case resolution. | Medium to long term, usually 5-10 years. |

| Risk Profile | High risk due to uncertainty of litigation outcomes. | Moderate to high risk depending on company performance and market conditions. |

| Return Type | Contingent returns based on litigation results. | Capital gains, dividends, and equity appreciation. |

| Liquidity | Low liquidity; funds are locked until case closure. | Low liquidity; requires exit events like IPO or acquisition. |

| Control & Influence | No control over legal proceedings or decisions. | Active management role and strategic influence in portfolio companies. |

| Typical Investors | Specialized litigation funds, hedge funds, institutional investors. | Institutional investors, high-net-worth individuals, pension funds. |

| Regulatory Environment | Subject to evolving regulations depending on jurisdictions. | Heavily regulated with disclosures and compliance standards. |

Which is better?

Litigation finance offers investors high-risk, high-reward opportunities by funding legal cases in exchange for a portion of the settlement, often less correlated with traditional markets compared to private equity. Private equity focuses on acquiring and managing companies to generate long-term growth and profits through operational improvements and strategic guidance, typically involving larger capital commitments. Choosing between the two depends on risk tolerance, investment horizon, and desired exposure to legal versus corporate market dynamics.

Connection

Litigation finance leverages private equity by attracting institutional investors who provide capital to fund legal cases in exchange for a portion of the settlement or judgment. Private equity firms view litigation finance as an alternative asset class with potential high returns uncorrelated to traditional markets. This synergy allows private equity to diversify portfolios while enabling plaintiffs to access necessary funds for costly litigation.

Key Terms

Capital Commitment

Private equity typically involves long-term capital commitments where investors allocate funds to buy ownership stakes in private companies, expecting returns over several years through growth or exit events. Litigation finance allocates capital to fund legal cases, with investors committing capital to fund plaintiffs' lawsuits in exchange for a portion of the settlement or judgment, often with shorter investment horizons compared to private equity. Explore the detailed dynamics of capital commitments in these two investment fields to understand risk profiles and return timelines.

Return on Investment (ROI)

Private equity typically targets higher long-term ROI through equity ownership in growing companies, often expecting returns between 15% and 25% annually. Litigation finance offers potentially quicker returns secured against legal claim outcomes, with ROI ranging from 20% to 50% depending on case risk and duration. Explore how each investment approach balances risk and reward to maximize your portfolio's performance.

Risk Assessment

Private equity involves comprehensive risk assessment centered on market volatility, business performance, and exit strategies to maximize returns for investors over a medium to long-term horizon. Litigation finance risk assessment prioritizes case merits, potential legal outcomes, and enforceability of judgments to gauge investment viability amidst legal uncertainties and timeline unpredictability. Explore more about how risk frameworks differentiate these alternative investment strategies.

Source and External Links

Private equity - Private equity is ownership in private companies not publicly traded, where investment managers raise funds from institutional investors to buy equity stakes with a goal of increasing value through growth, margin expansion, cash flow, and governance improvements over typically 4-7 years.

What is Private Equity? - Private equity provides medium to long-term capital in return for stakes in mature companies, working closely with management to drive growth and improve operations, usually holding investments for four to seven years before exiting via sale or public offering.

Private Equity: What You Need to Know - Private equity invests in non-public companies, improving them through management strengthening, business acquisitions, strategy shaping, product development, operational improvements, and capital structure optimization to deliver strong returns.

dowidth.com

dowidth.com