Private credit funds focus on lending directly to companies, offering secured loans with fixed interest payments that provide steady income and lower risk profiles compared to public markets. Mezzanine funds occupy a hybrid position, combining debt and equity features to finance growth initiatives with higher yields and increased risk due to subordinated debt structures. Explore deeper insights on how these investment vehicles differ in risk, return, and portfolio diversification.

Why it is important

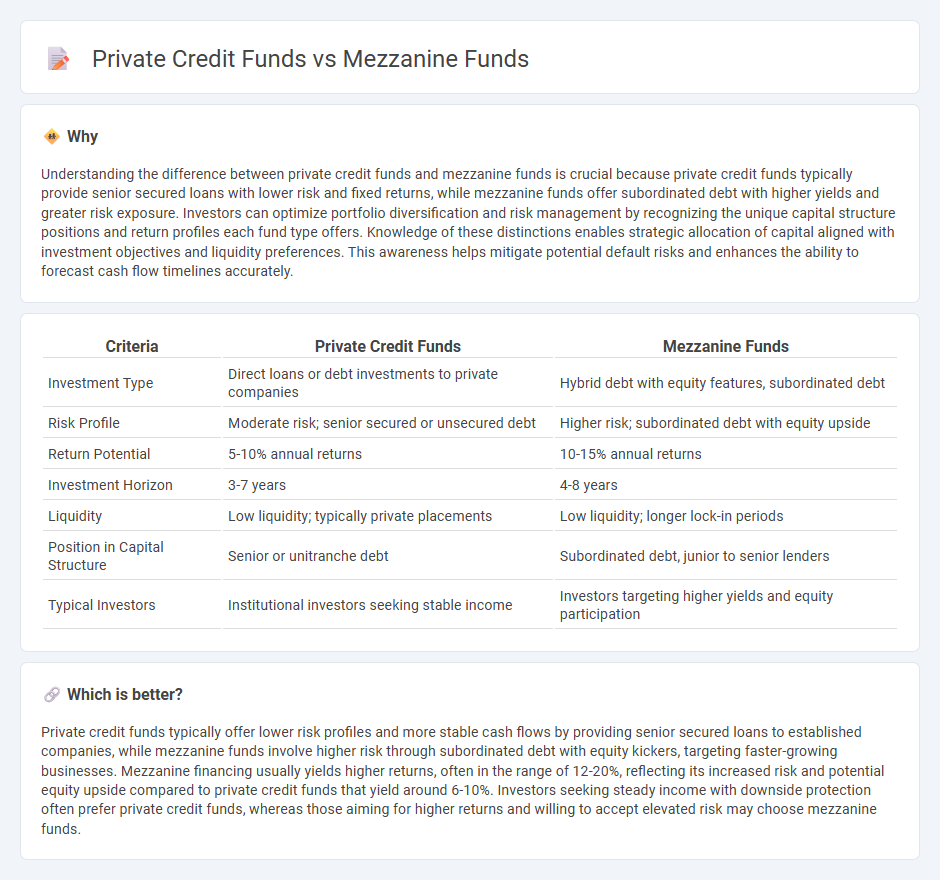

Understanding the difference between private credit funds and mezzanine funds is crucial because private credit funds typically provide senior secured loans with lower risk and fixed returns, while mezzanine funds offer subordinated debt with higher yields and greater risk exposure. Investors can optimize portfolio diversification and risk management by recognizing the unique capital structure positions and return profiles each fund type offers. Knowledge of these distinctions enables strategic allocation of capital aligned with investment objectives and liquidity preferences. This awareness helps mitigate potential default risks and enhances the ability to forecast cash flow timelines accurately.

Comparison Table

| Criteria | Private Credit Funds | Mezzanine Funds |

|---|---|---|

| Investment Type | Direct loans or debt investments to private companies | Hybrid debt with equity features, subordinated debt |

| Risk Profile | Moderate risk; senior secured or unsecured debt | Higher risk; subordinated debt with equity upside |

| Return Potential | 5-10% annual returns | 10-15% annual returns |

| Investment Horizon | 3-7 years | 4-8 years |

| Liquidity | Low liquidity; typically private placements | Low liquidity; longer lock-in periods |

| Position in Capital Structure | Senior or unitranche debt | Subordinated debt, junior to senior lenders |

| Typical Investors | Institutional investors seeking stable income | Investors targeting higher yields and equity participation |

Which is better?

Private credit funds typically offer lower risk profiles and more stable cash flows by providing senior secured loans to established companies, while mezzanine funds involve higher risk through subordinated debt with equity kickers, targeting faster-growing businesses. Mezzanine financing usually yields higher returns, often in the range of 12-20%, reflecting its increased risk and potential equity upside compared to private credit funds that yield around 6-10%. Investors seeking steady income with downside protection often prefer private credit funds, whereas those aiming for higher returns and willing to accept elevated risk may choose mezzanine funds.

Connection

Private credit funds and mezzanine funds are interconnected through their role in providing alternative debt financing to middle-market companies that may not have access to traditional bank loans. Mezzanine funds, a subset of private credit, offer subordinated debt with equity-like features, bridging the gap between senior debt and equity financing. Both fund types deliver flexible capital solutions aimed at fueling business growth, acquisitions, or recapitalizations while generating higher risk-adjusted returns for investors.

Key Terms

Subordinated Debt

Mezzanine funds primarily invest in subordinated debt which sits between senior debt and equity in the capital structure, offering higher yields with moderate risk due to their junior claim on assets. Private credit funds also provide subordinated debt but tend to emphasize direct lending with tailored terms, appealing to mid-market companies seeking flexible financing solutions outside traditional bank loans. Explore the distinct strategies and risk-return profiles of mezzanine and private credit funds to understand their roles in structured finance.

Senior Secured Loans

Mezzanine funds typically provide subordinated debt or preferred equity, offering higher yields but increased risk compared to private credit funds, which focus on senior secured loans that have priority claims on assets in case of default. Senior secured loans within private credit funds often feature collateral protection and covenant structures, enhancing investor security and reducing credit risk exposure. Explore detailed comparisons to understand how these financing structures meet diverse investment strategies.

Equity Kicker

Mezzanine funds typically include an equity kicker, granting investors a percentage of equity upside tied to the company's growth, which enhances return potential beyond fixed interest payments. Private credit funds generally rely on fixed income returns with limited or no equity participation, focusing on steady cash flow through interest and principal repayments. Explore the nuances of equity kickers in mezzanine financing to understand their impact on investment returns and risk profiles.

Source and External Links

Mezzanine Funds: Job Description And Interview Questions Answered - Mezzanine funds invest in subordinated loans or preferred stock that sit between senior debt and equity, aiming for annualized returns typically in the 10-20% range, characterized by high fixed coupon rates, no amortization, and call protection clauses.

Mezzanine capital - Wikipedia - Mezzanine capital is a subordinated form of debt or preferred equity used to fund growth or acquisitions, with repayment priority below senior debt but above common equity, usually offering higher returns due to increased risk and unsecured status.

Mezzanine Fund (Mez Funds) - Definition, How They Work - A mezzanine fund pools capital to invest in mezzanine finance, a hybrid of equity and debt, often through preferred stock or subordinated debt, used for acquisitions, growth, recapitalizations, or buyouts, filling the gap between senior debt and equity in the capital structure.

dowidth.com

dowidth.com