Play-to-earn gaming offers users an innovative way to earn digital assets through interactive gameplay, blending entertainment with financial rewards. Cryptocurrency trading involves buying and selling digital currencies like Bitcoin and Ethereum to capitalize on market volatility and asset appreciation. Explore the unique investment opportunities and risks in both play-to-earn gaming and cryptocurrency trading to make informed decisions.

Why it is important

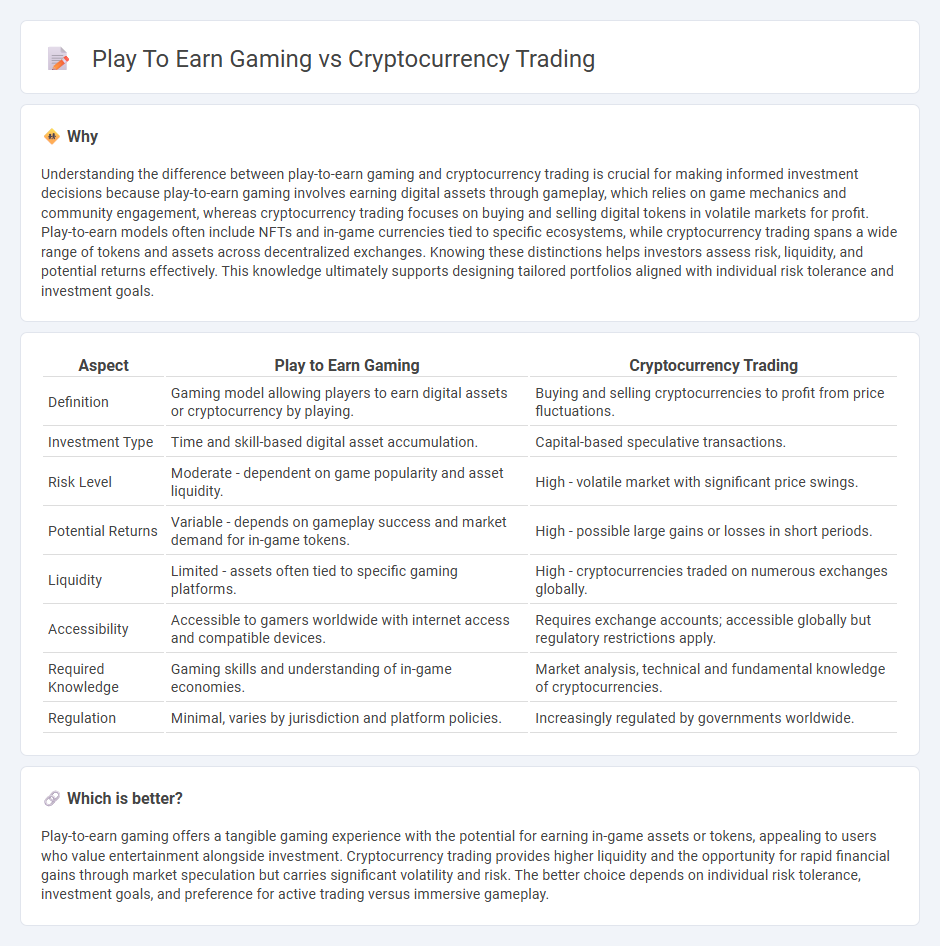

Understanding the difference between play-to-earn gaming and cryptocurrency trading is crucial for making informed investment decisions because play-to-earn gaming involves earning digital assets through gameplay, which relies on game mechanics and community engagement, whereas cryptocurrency trading focuses on buying and selling digital tokens in volatile markets for profit. Play-to-earn models often include NFTs and in-game currencies tied to specific ecosystems, while cryptocurrency trading spans a wide range of tokens and assets across decentralized exchanges. Knowing these distinctions helps investors assess risk, liquidity, and potential returns effectively. This knowledge ultimately supports designing tailored portfolios aligned with individual risk tolerance and investment goals.

Comparison Table

| Aspect | Play to Earn Gaming | Cryptocurrency Trading |

|---|---|---|

| Definition | Gaming model allowing players to earn digital assets or cryptocurrency by playing. | Buying and selling cryptocurrencies to profit from price fluctuations. |

| Investment Type | Time and skill-based digital asset accumulation. | Capital-based speculative transactions. |

| Risk Level | Moderate - dependent on game popularity and asset liquidity. | High - volatile market with significant price swings. |

| Potential Returns | Variable - depends on gameplay success and market demand for in-game tokens. | High - possible large gains or losses in short periods. |

| Liquidity | Limited - assets often tied to specific gaming platforms. | High - cryptocurrencies traded on numerous exchanges globally. |

| Accessibility | Accessible to gamers worldwide with internet access and compatible devices. | Requires exchange accounts; accessible globally but regulatory restrictions apply. |

| Required Knowledge | Gaming skills and understanding of in-game economies. | Market analysis, technical and fundamental knowledge of cryptocurrencies. |

| Regulation | Minimal, varies by jurisdiction and platform policies. | Increasingly regulated by governments worldwide. |

Which is better?

Play-to-earn gaming offers a tangible gaming experience with the potential for earning in-game assets or tokens, appealing to users who value entertainment alongside investment. Cryptocurrency trading provides higher liquidity and the opportunity for rapid financial gains through market speculation but carries significant volatility and risk. The better choice depends on individual risk tolerance, investment goals, and preference for active trading versus immersive gameplay.

Connection

Play-to-earn gaming leverages blockchain technology to enable players to earn cryptocurrency rewards through in-game achievements and asset ownership. Cryptocurrency trading facilitates liquidity and market access for these digital assets, allowing investors to buy, sell, or speculate on tokens earned in play-to-earn ecosystems. This symbiotic relationship drives both the valuation of gaming tokens and the broader adoption of decentralized financial markets.

Key Terms

Volatility

Cryptocurrency trading is characterized by extreme price volatility, driven by speculative markets, regulatory news, and macroeconomic factors, resulting in rapid value fluctuations within minutes or hours. Play-to-earn gaming offers more stable earning opportunities, as in-game tokens and rewards experience relatively lower volatility due to controlled game economies and community engagement. Explore the differences in volatility to better understand risk management strategies in these digital asset domains.

Tokenomics

Cryptocurrency trading relies heavily on market liquidity, token supply dynamics, and price volatility to generate profit, with tokenomics focusing on aspects like staking rewards, token burn mechanisms, and inflation control. Play-to-earn gaming integrates tokenomics through in-game economy design, balancing token distribution, utility, and scarcity to incentivize player engagement and sustainable earning models. Explore further to understand how tokenomics shapes both industries and influences user value creation.

Liquidity

Cryptocurrency trading offers high liquidity with the ability to buy and sell digital assets instantly on global exchanges, providing seamless entry and exit opportunities. Play-to-earn gaming, while generating tokens and NFTs with real-world value, often faces lower liquidity due to limited marketplaces and fewer participants. Explore how liquidity dynamics impact your investment and earning potential in these evolving digital economies.

Source and External Links

Crypto.com | Securely Buy, Sell & Trade Bitcoin, Ethereum and 400+ ... - A premier platform where you can create an account, verify your ID, deposit funds, select crypto pairs, and trade using market or limit orders with various order types for buying and selling cryptocurrencies.

What is Cryptocurrency Trading and How Does it Work? - IG - Trading involves speculating on price movements through CFDs or buying/selling actual coins, allowing both long and short positions with leverage to magnify gains or losses.

How to Trade Cryptocurrency: A Practical Guide for Beginners - Cryptocurrency trading consists of buying coins at a certain value and selling them when prices rise, focused on short-term market trends rather than long-term investment.

dowidth.com

dowidth.com