Crowdlending platforms and real estate crowdfunding both provide avenues for investors to access diverse investment opportunities with lower capital requirements than traditional methods. Crowdlending platforms focus on peer-to-peer loans, enabling investors to earn interest by funding personal or business loans, whereas real estate crowdfunding pools funds specifically for property development or acquisition projects. Explore the unique benefits and risks of each to determine the best fit for your investment portfolio.

Why it is important

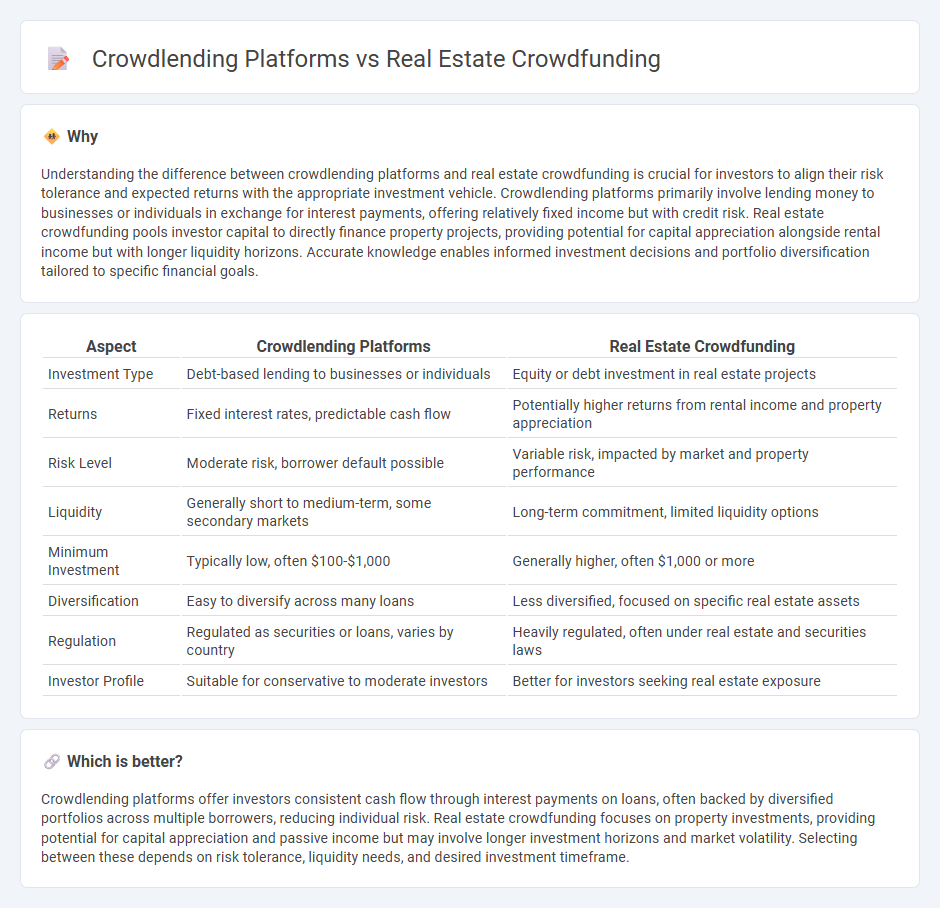

Understanding the difference between crowdlending platforms and real estate crowdfunding is crucial for investors to align their risk tolerance and expected returns with the appropriate investment vehicle. Crowdlending platforms primarily involve lending money to businesses or individuals in exchange for interest payments, offering relatively fixed income but with credit risk. Real estate crowdfunding pools investor capital to directly finance property projects, providing potential for capital appreciation alongside rental income but with longer liquidity horizons. Accurate knowledge enables informed investment decisions and portfolio diversification tailored to specific financial goals.

Comparison Table

| Aspect | Crowdlending Platforms | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Debt-based lending to businesses or individuals | Equity or debt investment in real estate projects |

| Returns | Fixed interest rates, predictable cash flow | Potentially higher returns from rental income and property appreciation |

| Risk Level | Moderate risk, borrower default possible | Variable risk, impacted by market and property performance |

| Liquidity | Generally short to medium-term, some secondary markets | Long-term commitment, limited liquidity options |

| Minimum Investment | Typically low, often $100-$1,000 | Generally higher, often $1,000 or more |

| Diversification | Easy to diversify across many loans | Less diversified, focused on specific real estate assets |

| Regulation | Regulated as securities or loans, varies by country | Heavily regulated, often under real estate and securities laws |

| Investor Profile | Suitable for conservative to moderate investors | Better for investors seeking real estate exposure |

Which is better?

Crowdlending platforms offer investors consistent cash flow through interest payments on loans, often backed by diversified portfolios across multiple borrowers, reducing individual risk. Real estate crowdfunding focuses on property investments, providing potential for capital appreciation and passive income but may involve longer investment horizons and market volatility. Selecting between these depends on risk tolerance, liquidity needs, and desired investment timeframe.

Connection

Crowdlending platforms and real estate crowdfunding both facilitate alternative financing by pooling funds from multiple investors to support projects, with real estate crowdfunding specifically targeting property ventures. These platforms leverage technology to democratize investments, allowing individual investors to participate in real estate markets typically dominated by institutional players. By connecting borrowers seeking capital with a broad base of lenders or investors, they optimize liquidity and enable diversified real estate portfolios with relatively low entry points.

Key Terms

Equity Ownership

Real estate crowdfunding platforms enable investors to acquire equity ownership in properties, providing potential returns through rental income and property appreciation. Crowdlending platforms focus on debt financing, where investors earn fixed interest payments without gaining ownership rights. Explore the key differences and benefits of each model to make informed investment decisions.

Debt Instrument

Real estate crowdfunding and crowdlending platforms both enable investors to fund property projects, but debt instruments are primarily featured in crowdlending, where investors receive fixed interest payments and principal repayments over time. Crowdlending platforms focus on debt-based financing, providing loans to developers with structured repayment schedules, whereas real estate crowdfunding may include equity investments that offer ownership shares and profit-sharing. Explore detailed comparisons to understand how debt instruments shape investment returns and risk profiles in each platform.

Risk-Return Profile

Real estate crowdfunding platforms typically offer equity stakes in property projects, exposing investors to higher potential returns alongside proportional risks such as market fluctuations and project delays. Crowdlending platforms emphasize debt investments with fixed interest returns, presenting lower risk but limited upside compared to equity crowdfunding. Explore detailed comparisons of risk-return profiles to choose the best funding strategy for your investment goals.

Source and External Links

Crowdfunding real estate: What to know - Real estate crowdfunding allows investors to pool money online to buy shares in residential or commercial properties, making real estate investment accessible and diversified for both accredited and nonaccredited investors.

Crowdfunding - Crowdfunding in real estate lets investors pool funds to finance projects and earn passive income, simplifying portfolio building without the usual maintenance work.

Arrived | Easily Invest in Real Estate - Arrived enables investors to easily invest in rental properties starting from $100, offering passive income through dividends and potential property appreciation, with property management handled by the platform.

dowidth.com

dowidth.com