Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, such as reforestation or renewable energy initiatives, allowing investors to balance out their carbon footprints. Impact investing targets measurable social and environmental benefits alongside financial returns, supporting sectors like education, healthcare, and clean technology to drive systemic change. Explore the differences and advantages of each approach to align your portfolio with your sustainability goals.

Why it is important

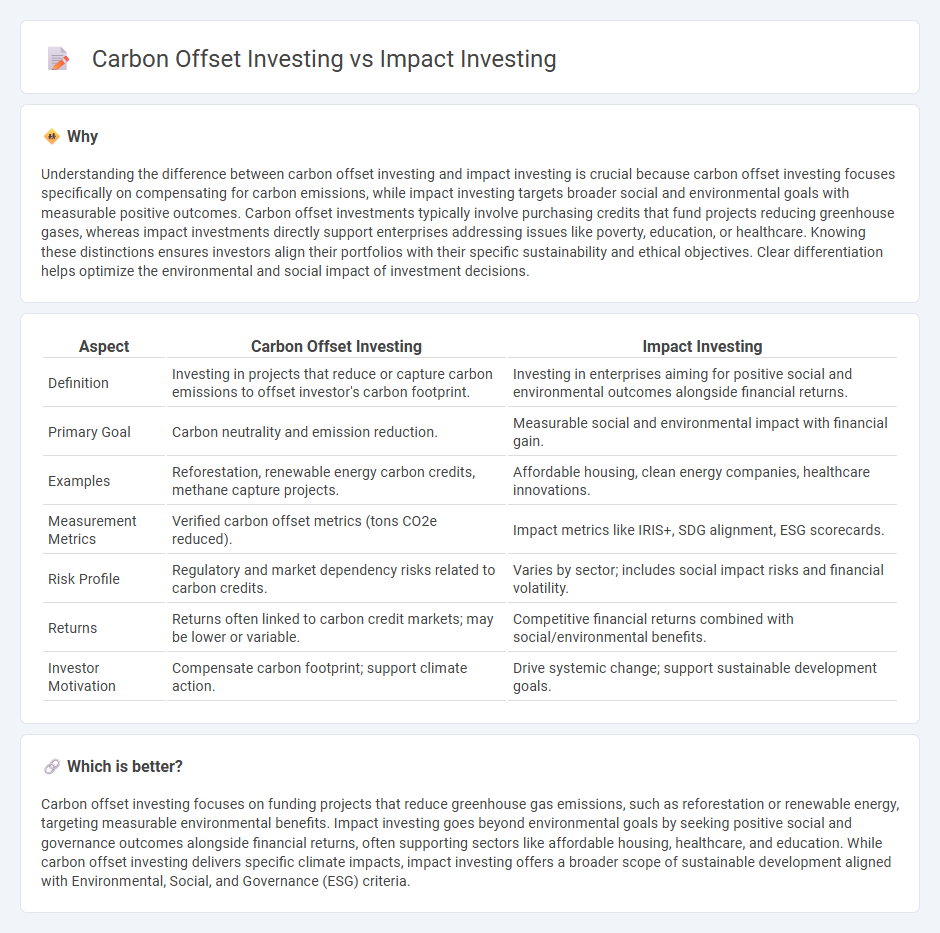

Understanding the difference between carbon offset investing and impact investing is crucial because carbon offset investing focuses specifically on compensating for carbon emissions, while impact investing targets broader social and environmental goals with measurable positive outcomes. Carbon offset investments typically involve purchasing credits that fund projects reducing greenhouse gases, whereas impact investments directly support enterprises addressing issues like poverty, education, or healthcare. Knowing these distinctions ensures investors align their portfolios with their specific sustainability and ethical objectives. Clear differentiation helps optimize the environmental and social impact of investment decisions.

Comparison Table

| Aspect | Carbon Offset Investing | Impact Investing |

|---|---|---|

| Definition | Investing in projects that reduce or capture carbon emissions to offset investor's carbon footprint. | Investing in enterprises aiming for positive social and environmental outcomes alongside financial returns. |

| Primary Goal | Carbon neutrality and emission reduction. | Measurable social and environmental impact with financial gain. |

| Examples | Reforestation, renewable energy carbon credits, methane capture projects. | Affordable housing, clean energy companies, healthcare innovations. |

| Measurement Metrics | Verified carbon offset metrics (tons CO2e reduced). | Impact metrics like IRIS+, SDG alignment, ESG scorecards. |

| Risk Profile | Regulatory and market dependency risks related to carbon credits. | Varies by sector; includes social impact risks and financial volatility. |

| Returns | Returns often linked to carbon credit markets; may be lower or variable. | Competitive financial returns combined with social/environmental benefits. |

| Investor Motivation | Compensate carbon footprint; support climate action. | Drive systemic change; support sustainable development goals. |

Which is better?

Carbon offset investing focuses on funding projects that reduce greenhouse gas emissions, such as reforestation or renewable energy, targeting measurable environmental benefits. Impact investing goes beyond environmental goals by seeking positive social and governance outcomes alongside financial returns, often supporting sectors like affordable housing, healthcare, and education. While carbon offset investing delivers specific climate impacts, impact investing offers a broader scope of sustainable development aligned with Environmental, Social, and Governance (ESG) criteria.

Connection

Carbon offset investing and impact investing both prioritize environmental sustainability by channeling funds into projects that reduce greenhouse gas emissions and support renewable energy. These investment strategies aim to generate measurable positive ecological outcomes while delivering financial returns, aligning investor goals with global climate action initiatives. By integrating carbon offset credits and measurable social impact metrics, investors contribute to long-term carbon neutrality and sustainable development objectives.

Key Terms

**Impact Investing:**

Impact investing involves allocating capital to projects and companies that generate measurable social and environmental benefits alongside financial returns, targeting sectors such as renewable energy, sustainable agriculture, and affordable housing. This approach emphasizes long-term positive change, transparency, and accountability, often measured through Environmental, Social, and Governance (ESG) criteria and Sustainable Development Goals (SDGs). Discover more about how impact investing can drive sustainable growth and create meaningful societal impact.

Social Return

Impact investing targets measurable social and environmental benefits alongside financial returns, often supporting projects that address social challenges such as affordable housing, education, and renewable energy access. Carbon offset investing specifically funds initiatives that reduce greenhouse gas emissions, like reforestation or clean energy projects, primarily aiming to neutralize carbon footprints. Explore the distinctions and synergies between these approaches to optimize social return on investment.

ESG (Environmental, Social, Governance)

Impact investing targets companies generating measurable environmental or social benefits while delivering financial returns, aligning closely with ESG criteria to promote sustainable development. Carbon offset investing specifically funds projects that reduce or capture greenhouse gas emissions, directly addressing the environmental component of ESG by mitigating climate impact. Explore deeper insights into how these investment strategies drive ESG objectives and long-term sustainability outcomes.

Source and External Links

What you need to know about impact investing - Impact investing involves making investments with the intention to generate positive, measurable social or environmental impact alongside financial returns, spanning various sectors like energy, microfinance, healthcare, and sustainable agriculture; it emphasizes intentionality, data-driven design, management toward impact, and shared learning among investors.

What Is Impact Investing? | NPTrust - Impact investing strategically leverages capital to achieve both positive social or environmental change and financial returns, challenging the traditional divide between philanthropy and market investments with a growing market projected to reach $6 trillion by 2031.

What is Impact Investing? | Fidelity - Impact investing intentionally aligns investment strategies with social and environmental benefits while generating financial returns, driven by interest from wealthy individuals, women, and Millennials, and includes investments in mission-aligned companies and funds.

dowidth.com

dowidth.com