Space debris cleanup startups address the growing threat of orbital debris by developing technologies to safely remove defunct satellites and fragments, reducing collision risks and preserving satellite functionality. In contrast, satellite manufacturing companies focus on designing and producing advanced satellites to meet increasing demands for communication, navigation, and Earth observation services. Explore the evolving investment opportunities in both sectors to understand their impact on the future of space infrastructure and commercial growth.

Why it is important

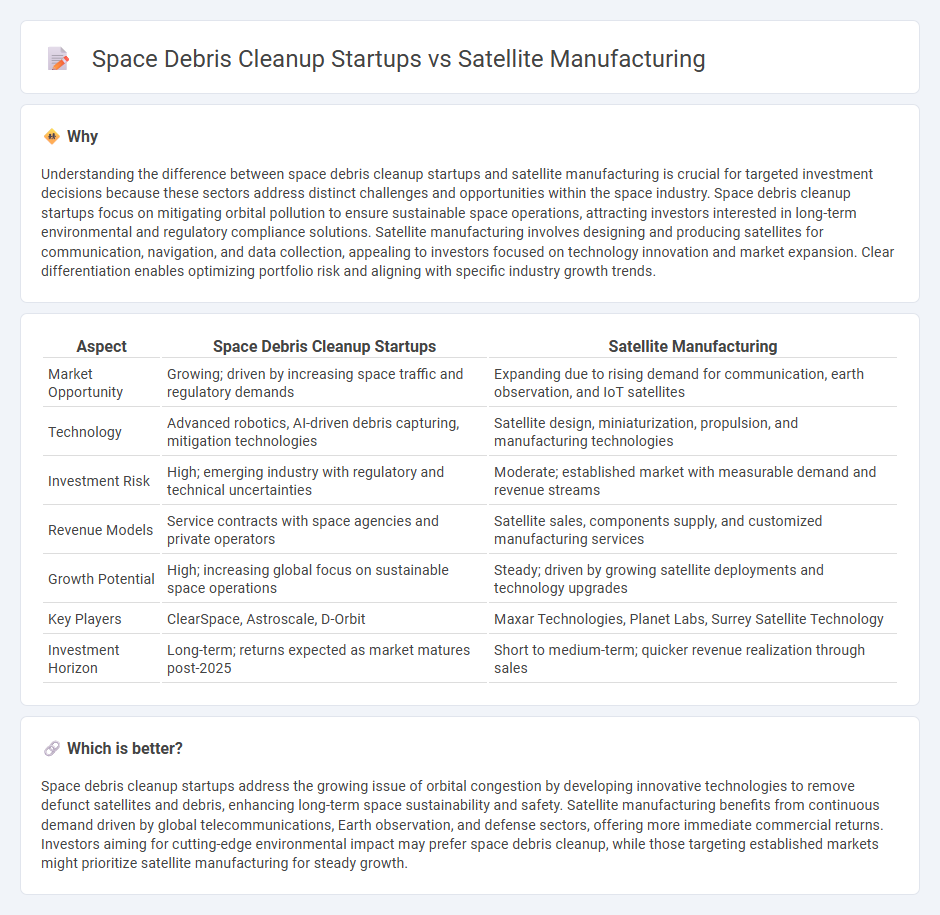

Understanding the difference between space debris cleanup startups and satellite manufacturing is crucial for targeted investment decisions because these sectors address distinct challenges and opportunities within the space industry. Space debris cleanup startups focus on mitigating orbital pollution to ensure sustainable space operations, attracting investors interested in long-term environmental and regulatory compliance solutions. Satellite manufacturing involves designing and producing satellites for communication, navigation, and data collection, appealing to investors focused on technology innovation and market expansion. Clear differentiation enables optimizing portfolio risk and aligning with specific industry growth trends.

Comparison Table

| Aspect | Space Debris Cleanup Startups | Satellite Manufacturing |

|---|---|---|

| Market Opportunity | Growing; driven by increasing space traffic and regulatory demands | Expanding due to rising demand for communication, earth observation, and IoT satellites |

| Technology | Advanced robotics, AI-driven debris capturing, mitigation technologies | Satellite design, miniaturization, propulsion, and manufacturing technologies |

| Investment Risk | High; emerging industry with regulatory and technical uncertainties | Moderate; established market with measurable demand and revenue streams |

| Revenue Models | Service contracts with space agencies and private operators | Satellite sales, components supply, and customized manufacturing services |

| Growth Potential | High; increasing global focus on sustainable space operations | Steady; driven by growing satellite deployments and technology upgrades |

| Key Players | ClearSpace, Astroscale, D-Orbit | Maxar Technologies, Planet Labs, Surrey Satellite Technology |

| Investment Horizon | Long-term; returns expected as market matures post-2025 | Short to medium-term; quicker revenue realization through sales |

Which is better?

Space debris cleanup startups address the growing issue of orbital congestion by developing innovative technologies to remove defunct satellites and debris, enhancing long-term space sustainability and safety. Satellite manufacturing benefits from continuous demand driven by global telecommunications, Earth observation, and defense sectors, offering more immediate commercial returns. Investors aiming for cutting-edge environmental impact may prefer space debris cleanup, while those targeting established markets might prioritize satellite manufacturing for steady growth.

Connection

Space debris cleanup startups and satellite manufacturing firms are interconnected through their shared goal of sustainable space operations, as the increasing volume of satellites launched annually directly contributes to orbital congestion and collision risks. Satellite manufacturers collaborate with debris removal companies by designing satellites equipped with end-of-life disposal technologies or tracking capabilities that facilitate efficient cleanup efforts. Investment in both sectors is crucial to advancing technological solutions that ensure long-term space environment safety, protecting valuable satellite infrastructure and supporting the growth of space-based industries.

Key Terms

Cost Efficiency

Satellite manufacturing startups prioritize cost efficiency by leveraging advanced materials and streamlined production techniques to reduce launch and operational expenses. Space debris cleanup startups focus on minimizing costs through innovative autonomous technologies and scalable solutions to manage the increasing volume of orbital debris. Discover how these industry players balance cost efficiency with mission success in the evolving space economy.

Technology Readiness Level (TRL)

Satellite manufacturing startups typically operate at higher Technology Readiness Levels (TRL 6-8) as they leverage proven aerospace technologies for design, assembly, and testing in controlled environments. Space debris cleanup startups often work within lower TRLs (3-6) due to the nascent stage of active debris removal technologies, relying on experimental prototypes and in-orbit demonstration missions. Explore our detailed analysis to understand how TRL influences investment and development in these emerging space sectors.

Regulatory Compliance

Satellite manufacturing startups face stringent regulatory compliance requirements involving spectrum allocation, launch licenses, and orbital slot coordination governed by agencies like the FCC and ITU. Space debris cleanup startups must navigate complex legal frameworks addressing liability, environmental impact assessments, and adherence to international treaties such as the Outer Space Treaty and the Liability Convention. Explore how these regulatory landscapes shape innovation and operational strategies in the evolving space industry.

Source and External Links

Satellite manufacturing - Spire - Spire operates a state-of-the-art, vertically integrated manufacturing facility in Glasgow, UK, capable of designing, building, and testing over 200 satellites annually using their in-house LEMUR satellite bus platform.

Small Satellite Manufacturing - Airbus U.S. Space & Defense, Inc. - Airbus's Florida facility mass-produces small satellites, including the ARROW series, leveraging innovative supply chain collaboration to achieve rates of up to two satellites per day for constellations like OneWeb.

Satellite Manufacturing Market Size, Growth Trends 2025-2034 - The global satellite manufacturing market is projected to grow rapidly, driven by demand for small satellites and CubeSats, despite high capital costs and regulatory challenges.

dowidth.com

dowidth.com