Secondaries in venture capital offer liquidity to early investors by enabling the purchase and sale of pre-existing shares in private companies, often at various stages of the startup lifecycle. Growth equity focuses on providing capital to more mature startups aiming to scale operations and accelerate revenue without transferring company control. Explore how these investment strategies differ in risk, return, and portfolio fit for informed decision-making.

Why it is important

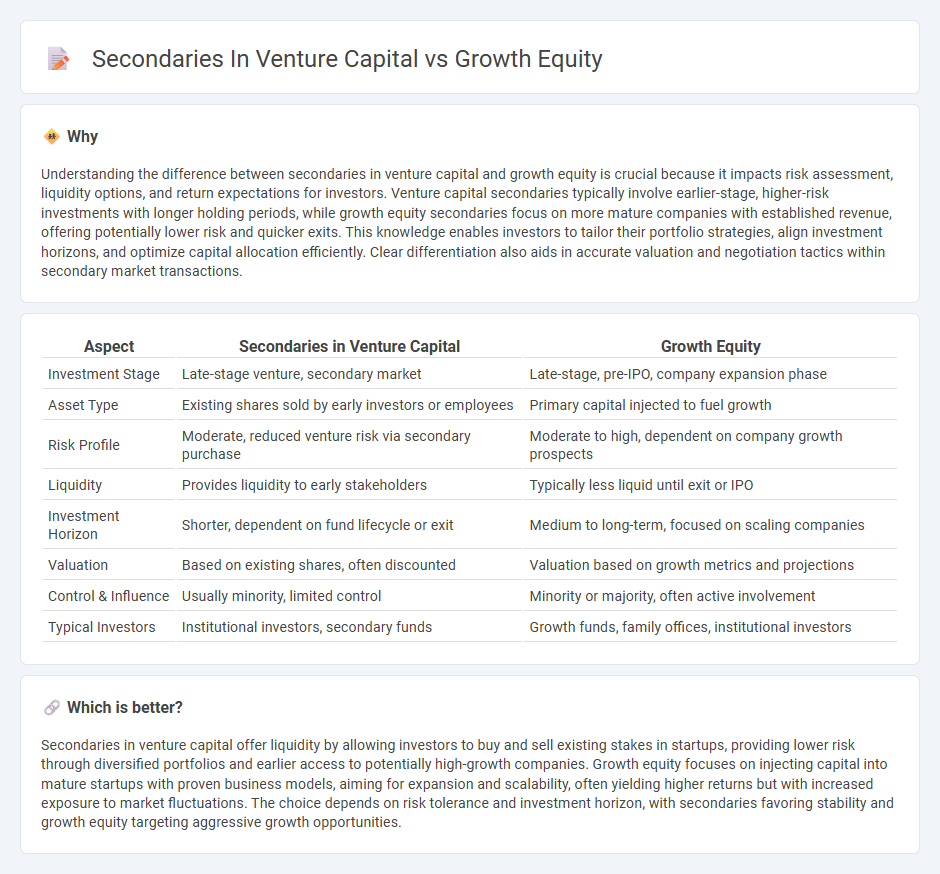

Understanding the difference between secondaries in venture capital and growth equity is crucial because it impacts risk assessment, liquidity options, and return expectations for investors. Venture capital secondaries typically involve earlier-stage, higher-risk investments with longer holding periods, while growth equity secondaries focus on more mature companies with established revenue, offering potentially lower risk and quicker exits. This knowledge enables investors to tailor their portfolio strategies, align investment horizons, and optimize capital allocation efficiently. Clear differentiation also aids in accurate valuation and negotiation tactics within secondary market transactions.

Comparison Table

| Aspect | Secondaries in Venture Capital | Growth Equity |

|---|---|---|

| Investment Stage | Late-stage venture, secondary market | Late-stage, pre-IPO, company expansion phase |

| Asset Type | Existing shares sold by early investors or employees | Primary capital injected to fuel growth |

| Risk Profile | Moderate, reduced venture risk via secondary purchase | Moderate to high, dependent on company growth prospects |

| Liquidity | Provides liquidity to early stakeholders | Typically less liquid until exit or IPO |

| Investment Horizon | Shorter, dependent on fund lifecycle or exit | Medium to long-term, focused on scaling companies |

| Valuation | Based on existing shares, often discounted | Valuation based on growth metrics and projections |

| Control & Influence | Usually minority, limited control | Minority or majority, often active involvement |

| Typical Investors | Institutional investors, secondary funds | Growth funds, family offices, institutional investors |

Which is better?

Secondaries in venture capital offer liquidity by allowing investors to buy and sell existing stakes in startups, providing lower risk through diversified portfolios and earlier access to potentially high-growth companies. Growth equity focuses on injecting capital into mature startups with proven business models, aiming for expansion and scalability, often yielding higher returns but with increased exposure to market fluctuations. The choice depends on risk tolerance and investment horizon, with secondaries favoring stability and growth equity targeting aggressive growth opportunities.

Connection

Secondaries in venture capital and growth equity involve the buying and selling of pre-existing investor stakes, providing liquidity to early investors and enabling new entrants to access mature portfolios. These transactions help redistribute ownership in high-growth companies without new capital issuance, aligning risk profiles between initial investors and secondary buyers. The secondary market fosters efficient capital allocation and offers strategic opportunities for diversification and portfolio optimization within the venture and growth equity landscape.

Key Terms

Minority Ownership

Growth equity investments typically target minority ownership stakes in rapidly scaling private companies, allowing investors to support expansion without taking control. Secondaries in venture capital involve purchasing existing minority shares from early investors or employees, providing liquidity while often securing ownership at a discount. Explore deeper insights into how minority ownership impacts returns and governance in both growth equity and secondary markets.

Liquidity

Growth equity investments in venture capital focus on providing capital to mature startups with proven business models, often offering limited liquidity compared to secondaries, which enable investors to buy or sell existing shares for quicker cash realization. Secondaries enhance liquidity by allowing early investors, employees, and founders to monetize their holdings before an exit event, balancing risk and return for both buyers and sellers. Explore deeper insights into how growth equity and secondaries impact liquidity dynamics in venture capital portfolios.

Valuation

Growth equity investments typically command higher valuations due to their focus on scaling companies with proven business models and strong revenue growth, whereas secondaries often acquire stakes at discounted prices reflecting liquidity and risk considerations. Valuation in growth equity is driven by forward-looking revenue multiples and growth potential, while secondaries hinge on the underlying investment's vintage, fund performance, and market demand. Explore more to understand how each strategy balances risk, return, and valuation nuances in venture capital.

Source and External Links

Growth Equity Primer - Growth equity is an investment strategy focused on acquiring minority stakes in late-stage companies with high growth potential to fund expansion plans.

Growth Equity - Growth equity is a type of investment in mature companies undergoing transformation with potential for significant growth, often involving minority investments and preferred shares.

Growth Equity Definition - Growth equity funds target companies with scalable growth potential, typically taking minority stakes to grow the business before exiting at a higher multiple.

dowidth.com

dowidth.com