Music royalties platforms offer investors a unique opportunity to earn passive income through royalty payments generated by popular songs and catalogs, leveraging the growing digital streaming market. Wine investment platforms provide access to a tangible asset class by enabling investments in fine wines with potential appreciation based on rarity, vintage, and market demand. Explore how these alternative investment options align with your portfolio goals and risk tolerance.

Why it is important

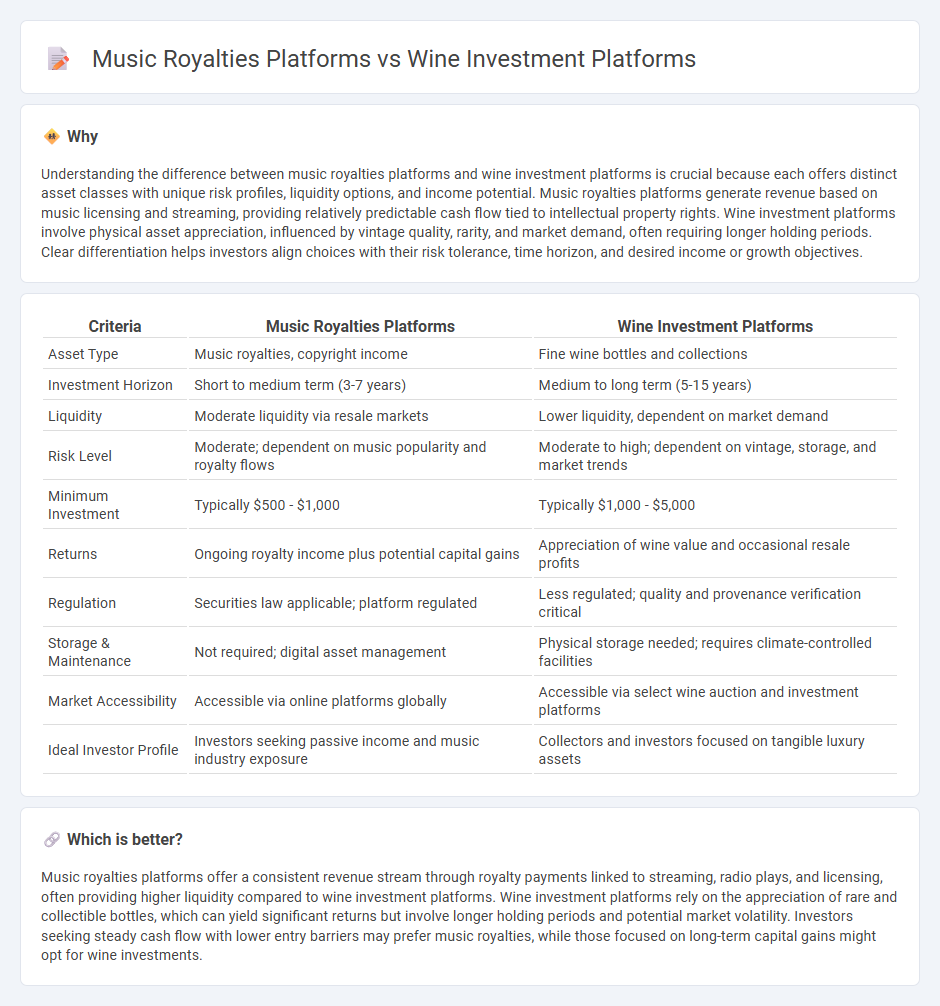

Understanding the difference between music royalties platforms and wine investment platforms is crucial because each offers distinct asset classes with unique risk profiles, liquidity options, and income potential. Music royalties platforms generate revenue based on music licensing and streaming, providing relatively predictable cash flow tied to intellectual property rights. Wine investment platforms involve physical asset appreciation, influenced by vintage quality, rarity, and market demand, often requiring longer holding periods. Clear differentiation helps investors align choices with their risk tolerance, time horizon, and desired income or growth objectives.

Comparison Table

| Criteria | Music Royalties Platforms | Wine Investment Platforms |

|---|---|---|

| Asset Type | Music royalties, copyright income | Fine wine bottles and collections |

| Investment Horizon | Short to medium term (3-7 years) | Medium to long term (5-15 years) |

| Liquidity | Moderate liquidity via resale markets | Lower liquidity, dependent on market demand |

| Risk Level | Moderate; dependent on music popularity and royalty flows | Moderate to high; dependent on vintage, storage, and market trends |

| Minimum Investment | Typically $500 - $1,000 | Typically $1,000 - $5,000 |

| Returns | Ongoing royalty income plus potential capital gains | Appreciation of wine value and occasional resale profits |

| Regulation | Securities law applicable; platform regulated | Less regulated; quality and provenance verification critical |

| Storage & Maintenance | Not required; digital asset management | Physical storage needed; requires climate-controlled facilities |

| Market Accessibility | Accessible via online platforms globally | Accessible via select wine auction and investment platforms |

| Ideal Investor Profile | Investors seeking passive income and music industry exposure | Collectors and investors focused on tangible luxury assets |

Which is better?

Music royalties platforms offer a consistent revenue stream through royalty payments linked to streaming, radio plays, and licensing, often providing higher liquidity compared to wine investment platforms. Wine investment platforms rely on the appreciation of rare and collectible bottles, which can yield significant returns but involve longer holding periods and potential market volatility. Investors seeking steady cash flow with lower entry barriers may prefer music royalties, while those focused on long-term capital gains might opt for wine investments.

Connection

Music royalties platforms and wine investment platforms both offer alternative investment opportunities by allowing investors to diversify portfolios beyond traditional assets. Both platforms leverage digital technology to provide fractional ownership, enabling investors to acquire shares in music royalties or fine wines with lower capital requirements. These investment types generate passive income through royalty payments or wine appreciation, appealing to investors seeking tangible, non-correlated asset classes.

Key Terms

Asset valuation

Wine investment platforms base asset valuation on vintage quality, provenance, market demand, and expert ratings, with prices influenced by rarity and storage conditions. Music royalties platforms assess asset value through streaming data, licensing agreements, catalog size, and historical earnings, reflecting future income potential and rights ownership. Explore deeper insights into asset valuation methods in alternative investment markets.

Liquidity

Wine investment platforms often provide limited liquidity due to the physical nature of assets, requiring longer holding periods and specialized markets for resale. Music royalties platforms typically offer enhanced liquidity through digital trading of revenue streams, enabling quicker buy-sell actions and fractional ownership. Explore deeper how liquidity dynamics impact investment strategies across these unique asset classes.

Regulatory compliance

Wine investment platforms must comply with securities laws, including investor accreditation and anti-money laundering (AML) regulations, to ensure lawful trading of shares in wine assets. Music royalties platforms adhere to copyright laws and royalty collection regulations, requiring licenses from rights holders and transparent royalty distribution to investors. Explore more about how regulatory frameworks shape these unique investment opportunities.

Source and External Links

Best Wine Investment Apps (2025): Features, Benefits - Vinovest - Vinovest offers seamless access to investment-grade wines globally with expert authentication, transparent pricing, no minimums, and real-time marketplace access for buying and selling at actual market value and guarantees secure, insured, provenance-backed storage.

Top Wine Investing Platforms 2024 - Wine International Association - Vindome is a blockchain-driven, smartphone-based platform in Monaco offering curated wine collections or live market bottle purchases, backed by secure warehousing and guaranteed provenance with real-time market insights for both beginners and seasoned investors.

It's Never Been Easier to Invest in Wine and Spirits. Should You? - Vint enables fractional investing in wine and spirits funds starting as low as $2,500, with SEC-registered portfolios and a focus on diversification across global producers, while Vinovest allows entry-level investment from $1,000, both charging annual fees for storage, insurance, and management.

dowidth.com

dowidth.com