Virtual land real estate offers investors opportunities in digital assets within metaverse platforms, leveraging blockchain technology for transparent ownership and liquidity. Private equity involves direct investments in private companies, focusing on long-term value creation through business growth and operational improvements. Explore the detailed differences and potential benefits of these investment types to make informed decisions.

Why it is important

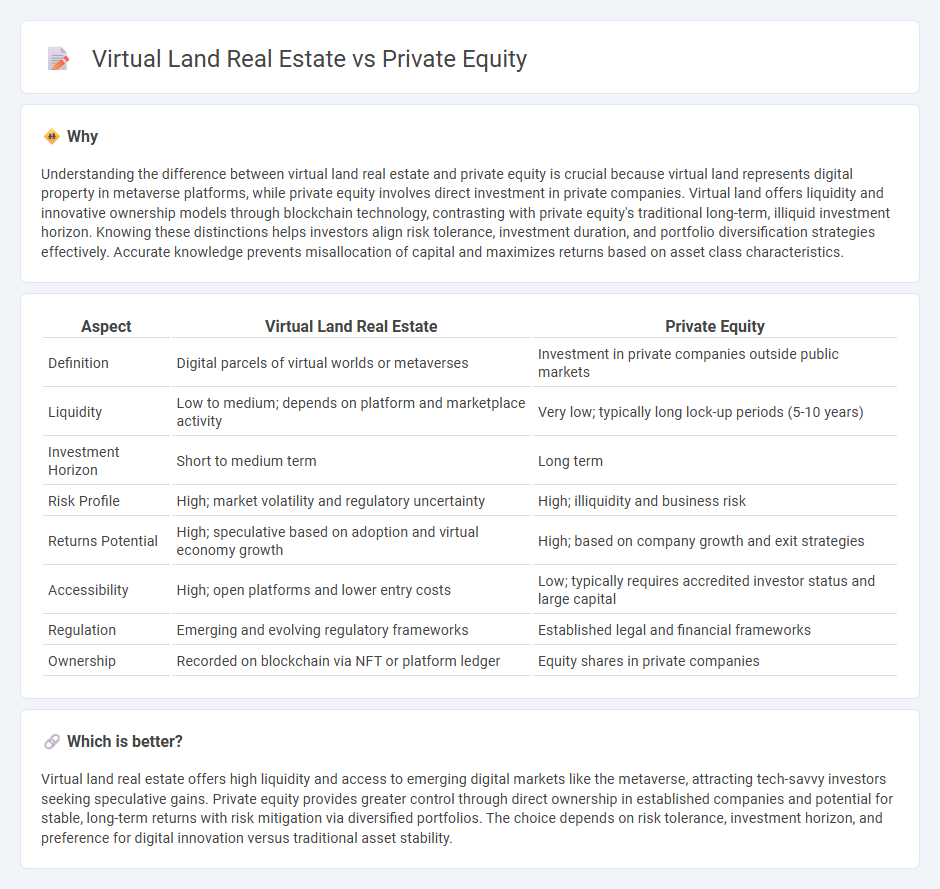

Understanding the difference between virtual land real estate and private equity is crucial because virtual land represents digital property in metaverse platforms, while private equity involves direct investment in private companies. Virtual land offers liquidity and innovative ownership models through blockchain technology, contrasting with private equity's traditional long-term, illiquid investment horizon. Knowing these distinctions helps investors align risk tolerance, investment duration, and portfolio diversification strategies effectively. Accurate knowledge prevents misallocation of capital and maximizes returns based on asset class characteristics.

Comparison Table

| Aspect | Virtual Land Real Estate | Private Equity |

|---|---|---|

| Definition | Digital parcels of virtual worlds or metaverses | Investment in private companies outside public markets |

| Liquidity | Low to medium; depends on platform and marketplace activity | Very low; typically long lock-up periods (5-10 years) |

| Investment Horizon | Short to medium term | Long term |

| Risk Profile | High; market volatility and regulatory uncertainty | High; illiquidity and business risk |

| Returns Potential | High; speculative based on adoption and virtual economy growth | High; based on company growth and exit strategies |

| Accessibility | High; open platforms and lower entry costs | Low; typically requires accredited investor status and large capital |

| Regulation | Emerging and evolving regulatory frameworks | Established legal and financial frameworks |

| Ownership | Recorded on blockchain via NFT or platform ledger | Equity shares in private companies |

Which is better?

Virtual land real estate offers high liquidity and access to emerging digital markets like the metaverse, attracting tech-savvy investors seeking speculative gains. Private equity provides greater control through direct ownership in established companies and potential for stable, long-term returns with risk mitigation via diversified portfolios. The choice depends on risk tolerance, investment horizon, and preference for digital innovation versus traditional asset stability.

Connection

Virtual land real estate and private equity intersect through the allocation of capital into emerging digital assets, where private equity firms invest in blockchain-based platforms that develop and monetize virtual properties. This connection leverages private equity's expertise in managing high-value, illiquid assets while capitalizing on the growing metaverse economy driven by digital land sales and virtual real estate development. The synergy enhances portfolio diversification by combining traditional private equity strategies with innovative virtual real estate growth opportunities.

Key Terms

Ownership structure

Private equity investments in real estate typically involve acquiring partial or full ownership stakes in physical properties through limited partnerships or LLCs, providing investors with direct equity and governance rights. Virtual land real estate ownership exists on blockchain platforms, where ownership is represented by NFTs that grant users control and transferability within a decentralized virtual environment. Explore further to understand how these distinct ownership structures impact control, liquidity, and investment strategies.

Asset tangibility

Private equity investments are typically characterized by their direct ownership of tangible assets, such as real companies, machinery, and real estate properties. Virtual land real estate, found in metaverses or blockchain-based platforms, offers an intangible asset that exists solely in digital form and lacks physical substance. Explore the differences in asset tangibility and investment dynamics to better understand which suits your portfolio goals.

Liquidity

Private equity investments often lack liquidity due to long lock-up periods and limited secondary markets, making it challenging to quickly convert assets into cash. In contrast, virtual land real estate, especially on blockchain platforms, offers enhanced liquidity through digital marketplaces that enable faster buying and selling processes. Explore further to understand how liquidity dynamics shape investment strategies across these asset classes.

Source and External Links

Private equity - Wikipedia - Private equity (PE) is equity investment in private companies not publicly traded, where investment managers raise funds from institutional investors to buy ownership stakes, typically aiming to create value through growth, margin expansion, and operational improvements over a 4-7 year horizon.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance to support growth, buyouts, and operational improvements in mature unquoted companies, with active management engagement to enhance value before exiting investments usually within 4 to 7 years.

Private Equity: What You Need to Know - KKR - Private equity firms invest in non-public companies aiming to improve performance by strengthening management, refining business strategy, expanding operations, and optimizing capital structure to achieve robust returns and diversification beyond public markets.

dowidth.com

dowidth.com