Music royalties provide a steady passive income derived from ongoing sales, streaming, and licensing, while real estate investments generate returns through rental income and property appreciation. Both asset classes offer diversification benefits, but music royalties often require lower initial capital and less active management compared to real estate. Explore the advantages and risks of each to decide which aligns best with your investment goals.

Why it is important

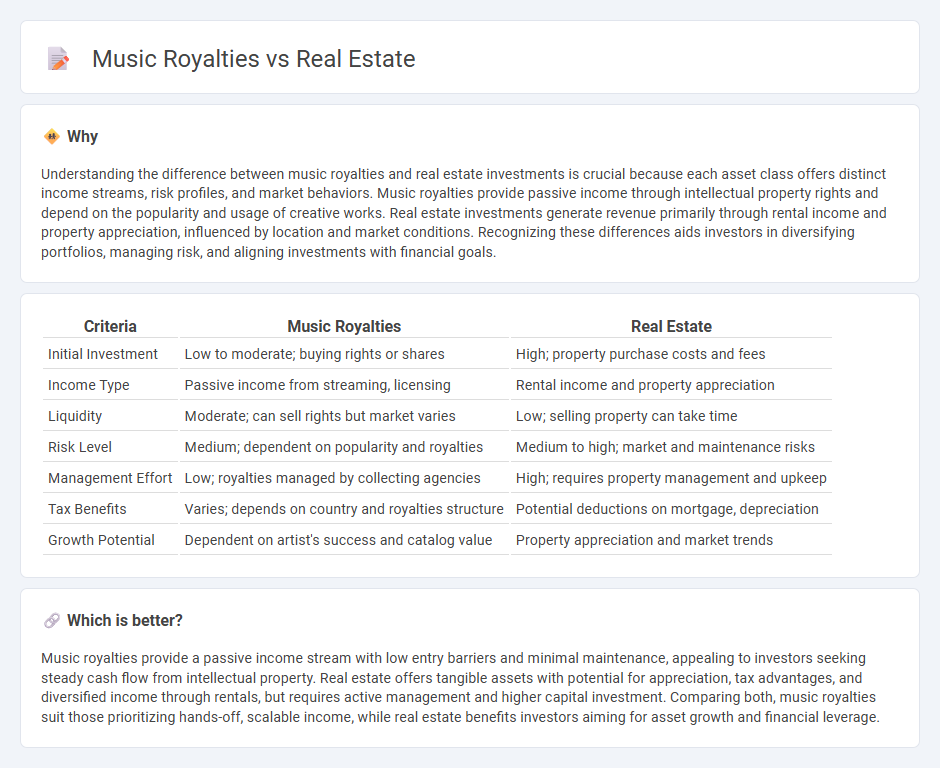

Understanding the difference between music royalties and real estate investments is crucial because each asset class offers distinct income streams, risk profiles, and market behaviors. Music royalties provide passive income through intellectual property rights and depend on the popularity and usage of creative works. Real estate investments generate revenue primarily through rental income and property appreciation, influenced by location and market conditions. Recognizing these differences aids investors in diversifying portfolios, managing risk, and aligning investments with financial goals.

Comparison Table

| Criteria | Music Royalties | Real Estate |

|---|---|---|

| Initial Investment | Low to moderate; buying rights or shares | High; property purchase costs and fees |

| Income Type | Passive income from streaming, licensing | Rental income and property appreciation |

| Liquidity | Moderate; can sell rights but market varies | Low; selling property can take time |

| Risk Level | Medium; dependent on popularity and royalties | Medium to high; market and maintenance risks |

| Management Effort | Low; royalties managed by collecting agencies | High; requires property management and upkeep |

| Tax Benefits | Varies; depends on country and royalties structure | Potential deductions on mortgage, depreciation |

| Growth Potential | Dependent on artist's success and catalog value | Property appreciation and market trends |

Which is better?

Music royalties provide a passive income stream with low entry barriers and minimal maintenance, appealing to investors seeking steady cash flow from intellectual property. Real estate offers tangible assets with potential for appreciation, tax advantages, and diversified income through rentals, but requires active management and higher capital investment. Comparing both, music royalties suit those prioritizing hands-off, scalable income, while real estate benefits investors aiming for asset growth and financial leverage.

Connection

Music royalties provide a steady income stream that can be strategically reinvested into real estate, creating diversified wealth portfolios. Real estate investments offer tangible assets that balance the fluctuating earnings from royalties, enhancing overall financial stability. Both asset classes benefit from long-term appreciation, tax advantages, and passive income potential, reinforcing their interconnected value in investment strategies.

Key Terms

Asset Appreciation

Real estate typically offers tangible asset appreciation through property value increases influenced by location, market demand, and economic conditions. Music royalties provide ongoing income streams with potential growth tied to an artist's popularity, licensing deals, and emerging platforms, reflecting intangible asset appreciation. Explore how these two investment types compare in building long-term wealth and diversification opportunities.

Passive Income

Real estate generates passive income through rental properties, offering consistent cash flow and potential property appreciation. Music royalties provide ongoing income from the use of copyrighted songs, with earnings linked to streaming, radio play, and licensing. Explore comprehensive strategies to maximize returns from both passive income sources.

Liquidity

Real estate investments typically offer lower liquidity due to the time-consuming process of buying or selling property, often requiring weeks to months to finalize transactions. Music royalties provide higher liquidity as they can be sold or licensed relatively quickly, generating passive income streams with less capital tied up over long periods. Explore the advantages and challenges of both investment types to determine which aligns best with your financial goals.

Source and External Links

Lincoln, NE Homes For Sale & Real Estate - Offers a comprehensive overview of homes for sale in Lincoln, NE, including detailed neighborhood information and home pricing by size.

Lincoln Real Estate for Sale - Provides insight into Lincoln's diverse real estate market, featuring historic homes, modern builds, and various property types.

Lincoln, NE Homes for Sale & Real Estate - Lists various homes for sale in Lincoln, NE, including condos and single-family houses with detailed property information.

dowidth.com

dowidth.com