Social token investment involves purchasing tokens that represent ownership or influence within a specific community or project, often tied to creators or social platforms. Index token investment provides diversified exposure by bundling multiple assets into one token, reducing risk through a balanced portfolio of securities or cryptocurrencies. Explore deeper to understand which investment aligns best with your financial goals and risk appetite.

Why it is important

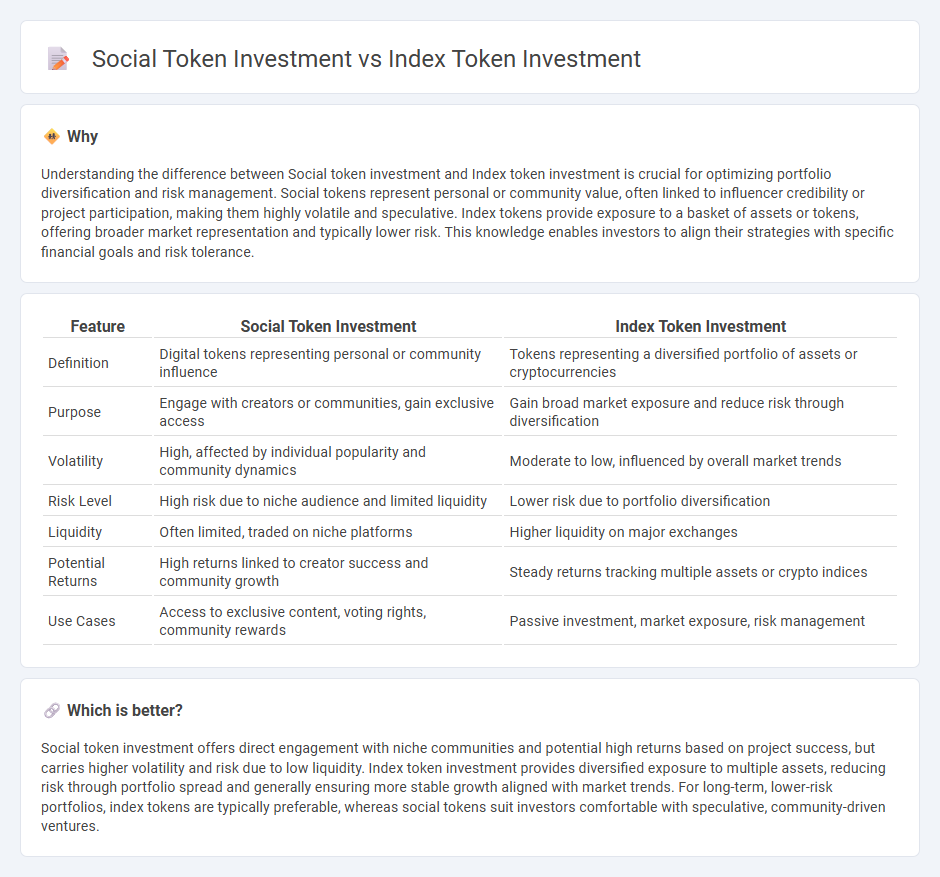

Understanding the difference between Social token investment and Index token investment is crucial for optimizing portfolio diversification and risk management. Social tokens represent personal or community value, often linked to influencer credibility or project participation, making them highly volatile and speculative. Index tokens provide exposure to a basket of assets or tokens, offering broader market representation and typically lower risk. This knowledge enables investors to align their strategies with specific financial goals and risk tolerance.

Comparison Table

| Feature | Social Token Investment | Index Token Investment |

|---|---|---|

| Definition | Digital tokens representing personal or community influence | Tokens representing a diversified portfolio of assets or cryptocurrencies |

| Purpose | Engage with creators or communities, gain exclusive access | Gain broad market exposure and reduce risk through diversification |

| Volatility | High, affected by individual popularity and community dynamics | Moderate to low, influenced by overall market trends |

| Risk Level | High risk due to niche audience and limited liquidity | Lower risk due to portfolio diversification |

| Liquidity | Often limited, traded on niche platforms | Higher liquidity on major exchanges |

| Potential Returns | High returns linked to creator success and community growth | Steady returns tracking multiple assets or crypto indices |

| Use Cases | Access to exclusive content, voting rights, community rewards | Passive investment, market exposure, risk management |

Which is better?

Social token investment offers direct engagement with niche communities and potential high returns based on project success, but carries higher volatility and risk due to low liquidity. Index token investment provides diversified exposure to multiple assets, reducing risk through portfolio spread and generally ensuring more stable growth aligned with market trends. For long-term, lower-risk portfolios, index tokens are typically preferable, whereas social tokens suit investors comfortable with speculative, community-driven ventures.

Connection

Social token investment and index token investment are connected through their shared foundation in blockchain technology and decentralized finance (DeFi), enabling diversified and community-driven asset portfolios. Social tokens represent value tied to individual creators or communities, while index tokens aggregate multiple assets into a single, tradable unit, offering exposure to a broader market segment. Investing in social tokens can complement index token strategies by providing niche, high-engagement assets that enhance portfolio diversification and potential returns.

Key Terms

Index token investment:

Index token investment offers diversified exposure to a basket of assets, reducing risk compared to investing in single tokens. These tokens track the performance of underlying asset groups, enabling investors to benefit from market trends without individual asset volatility. Discover how index token investment can streamline portfolio management and enhance long-term growth potential.

Diversification

Index token investment offers diversified exposure by bundling multiple assets into a single financial instrument, reducing risk through distribution across various sectors. Social token investment typically centers on individual creators or communities, fostering personalized engagement but exposing investors to higher volatility due to concentrated asset focus. Explore the strategic benefits and risks of each investment type to optimize your portfolio diversification.

Benchmark tracking

Index token investment offers diversified exposure by tracking a benchmark of multiple assets, reducing individual asset risk and providing stable returns aligned with market performance. Social token investment, tied to individual creators or communities, carries higher volatility and potential for unique value appreciation based on social influence and engagement metrics. Explore deeper insights on how benchmark tracking impacts these investment types for optimal portfolio strategies.

Source and External Links

TCAP: Crypto Index Token Investing via Cryptex - Gemini - Index tokens represent a diversified investment vehicle that bundles multiple crypto assets to reduce risk, lower taxes, and simplify the portfolio management process while providing long-term exposure to crypto markets.

What Is Index Coop? INDEX Crypto Governance Token - Gemini - Index Cooperative is a DAO that offers tokenized crypto index products, which are smart contract-based baskets of assets that automatically rebalance and allow simple, cost-effective passive investing in themed crypto indices.

Index Fund Tokens - What They Are and How Do They Work - Cryptocurrency index tokens allow investors to gain broad market exposure by purchasing tokens backed by a basket of digital assets held in smart contracts, enabling easy redemption and diversified holdings without selecting individual cryptocurrencies.

dowidth.com

dowidth.com