Whisky cask investment offers unique opportunities tied to the aging process and rarity of spirits, often yielding high returns as casks mature in value over time. Fine art investment relies on the provenance, artist reputation, and market trends, providing both aesthetic pleasure and potential financial appreciation. Explore detailed comparisons to understand which asset aligns best with your investment goals.

Why it is important

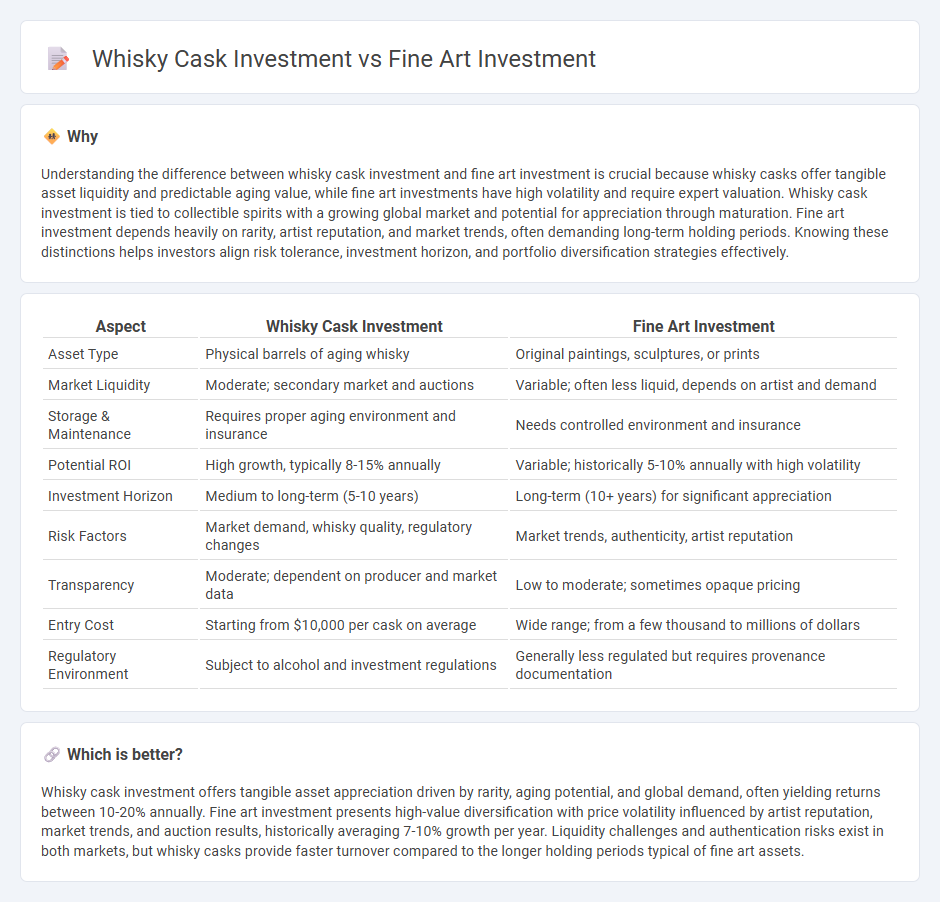

Understanding the difference between whisky cask investment and fine art investment is crucial because whisky casks offer tangible asset liquidity and predictable aging value, while fine art investments have high volatility and require expert valuation. Whisky cask investment is tied to collectible spirits with a growing global market and potential for appreciation through maturation. Fine art investment depends heavily on rarity, artist reputation, and market trends, often demanding long-term holding periods. Knowing these distinctions helps investors align risk tolerance, investment horizon, and portfolio diversification strategies effectively.

Comparison Table

| Aspect | Whisky Cask Investment | Fine Art Investment |

|---|---|---|

| Asset Type | Physical barrels of aging whisky | Original paintings, sculptures, or prints |

| Market Liquidity | Moderate; secondary market and auctions | Variable; often less liquid, depends on artist and demand |

| Storage & Maintenance | Requires proper aging environment and insurance | Needs controlled environment and insurance |

| Potential ROI | High growth, typically 8-15% annually | Variable; historically 5-10% annually with high volatility |

| Investment Horizon | Medium to long-term (5-10 years) | Long-term (10+ years) for significant appreciation |

| Risk Factors | Market demand, whisky quality, regulatory changes | Market trends, authenticity, artist reputation |

| Transparency | Moderate; dependent on producer and market data | Low to moderate; sometimes opaque pricing |

| Entry Cost | Starting from $10,000 per cask on average | Wide range; from a few thousand to millions of dollars |

| Regulatory Environment | Subject to alcohol and investment regulations | Generally less regulated but requires provenance documentation |

Which is better?

Whisky cask investment offers tangible asset appreciation driven by rarity, aging potential, and global demand, often yielding returns between 10-20% annually. Fine art investment presents high-value diversification with price volatility influenced by artist reputation, market trends, and auction results, historically averaging 7-10% growth per year. Liquidity challenges and authentication risks exist in both markets, but whisky casks provide faster turnover compared to the longer holding periods typical of fine art assets.

Connection

Whisky cask investment and fine art investment both serve as alternative asset classes offering portfolio diversification and hedging against inflation. Both markets rely on scarcity and provenance, with limited-edition casks and renowned artworks driving value appreciation over time. Investor interest in tangible, culturally significant assets underpins the growing popularity of these non-traditional investments.

Key Terms

Fine art investment:

Fine art investment offers a unique blend of cultural value and potential financial appreciation, driven by the global demand for works by renowned artists and the rarity of exceptional pieces. The art market is less volatile than traditional assets, providing portfolio diversification through tangible, historically significant artworks that often appreciate over time. Explore the benefits and considerations of fine art investment to discover how it can enhance your investment strategy.

Provenance

Provenance plays a crucial role in both fine art and whisky cask investments, as it authenticates origin, ownership history, and enhances asset value. Fine art pieces with well-documented provenance often achieve higher auction prices and reduce the risk of forgery, while whisky casks with traceable sourcing assure quality and aging authenticity. Explore more about how provenance impacts investment security and profitability in these markets.

Authenticity

Authenticity is a crucial factor in both fine art investment and whisky cask investment, as provenance and verification impact market value significantly. Fine art requires rigorous documentation, expert appraisal, and often a verified chain of ownership, while whisky casks demand certified distillery records, authentic bottling histories, and proper storage conditions. Explore more about how authenticity standards affect returns and risks in these two distinctive investment markets.

Source and External Links

Investing in art: What to know about turning a passion into a ... - Fine art can be a valuable investment for diversified wealth management, offering portfolio diversification, inflation protection, and potential high returns, but it carries unique risks including lack of liquidity, need for careful maintenance, and subjective value that fluctuates with cultural trends.

Invest in Art - Own Shares in Masterpieces - Yieldstreet - Yieldstreet offers fractional ownership in contemporary fine art through an art equity fund, enabling investors to diversify their portfolios and potentially grow capital by investing in a broad pool of artworks, though this investment remains highly speculative and illiquid.

The Art of Fine Art Investing - Rockefeller Capital Management - Fine art is considered an asset class requiring careful appraisal and expert advice; innovative options like art-secured lending allow collectors to leverage art holdings for liquidity without selling their pieces.

dowidth.com

dowidth.com