Whiskey barrel investment offers a tangible asset with potential value appreciation driven by aging and market demand in the luxury spirits sector, contrasting with private equity investment that involves allocating capital into private companies for growth and exit value. Whiskey barrels provide diversification through alternative asset exposure, while private equity investments focus on operational improvements and strategic growth within portfolio companies. Explore the distinctive benefits and risks of whiskey barrel versus private equity investments to optimize your portfolio.

Why it is important

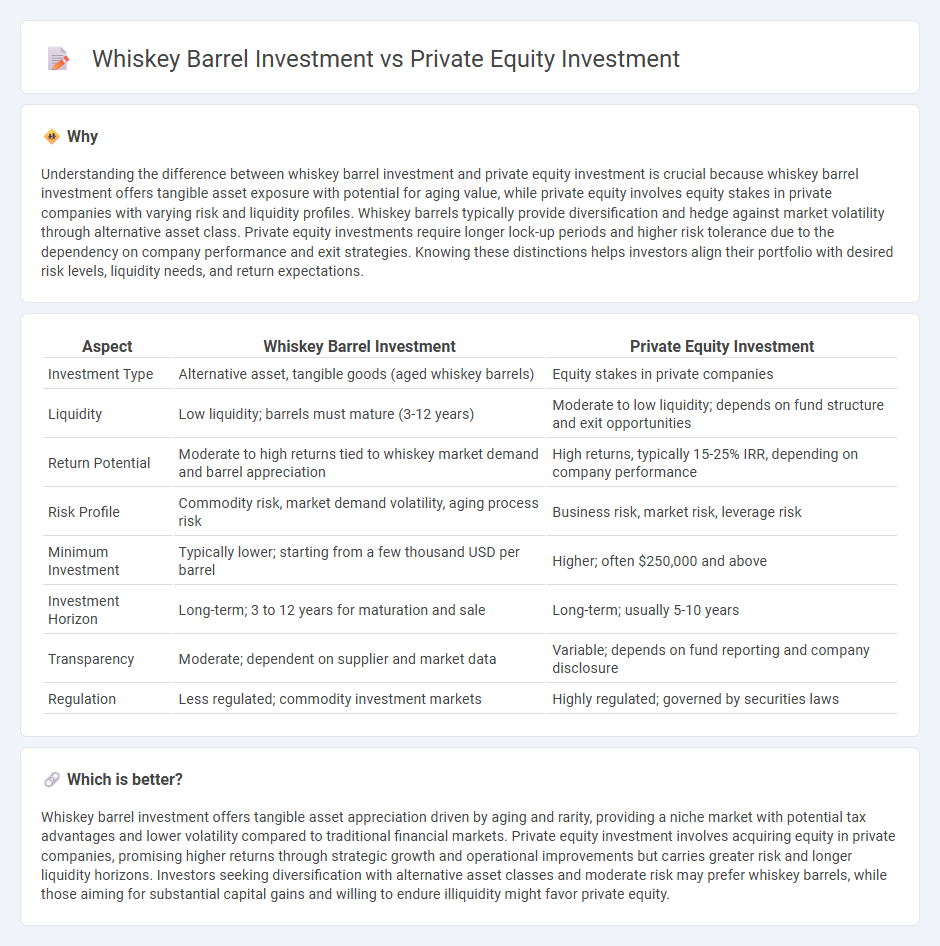

Understanding the difference between whiskey barrel investment and private equity investment is crucial because whiskey barrel investment offers tangible asset exposure with potential for aging value, while private equity involves equity stakes in private companies with varying risk and liquidity profiles. Whiskey barrels typically provide diversification and hedge against market volatility through alternative asset class. Private equity investments require longer lock-up periods and higher risk tolerance due to the dependency on company performance and exit strategies. Knowing these distinctions helps investors align their portfolio with desired risk levels, liquidity needs, and return expectations.

Comparison Table

| Aspect | Whiskey Barrel Investment | Private Equity Investment |

|---|---|---|

| Investment Type | Alternative asset, tangible goods (aged whiskey barrels) | Equity stakes in private companies |

| Liquidity | Low liquidity; barrels must mature (3-12 years) | Moderate to low liquidity; depends on fund structure and exit opportunities |

| Return Potential | Moderate to high returns tied to whiskey market demand and barrel appreciation | High returns, typically 15-25% IRR, depending on company performance |

| Risk Profile | Commodity risk, market demand volatility, aging process risk | Business risk, market risk, leverage risk |

| Minimum Investment | Typically lower; starting from a few thousand USD per barrel | Higher; often $250,000 and above |

| Investment Horizon | Long-term; 3 to 12 years for maturation and sale | Long-term; usually 5-10 years |

| Transparency | Moderate; dependent on supplier and market data | Variable; depends on fund reporting and company disclosure |

| Regulation | Less regulated; commodity investment markets | Highly regulated; governed by securities laws |

Which is better?

Whiskey barrel investment offers tangible asset appreciation driven by aging and rarity, providing a niche market with potential tax advantages and lower volatility compared to traditional financial markets. Private equity investment involves acquiring equity in private companies, promising higher returns through strategic growth and operational improvements but carries greater risk and longer liquidity horizons. Investors seeking diversification with alternative asset classes and moderate risk may prefer whiskey barrels, while those aiming for substantial capital gains and willing to endure illiquidity might favor private equity.

Connection

Whiskey barrel investment and private equity investment both involve alternative asset classes aimed at diversifying portfolios beyond traditional stocks and bonds. Whiskey barrel investment provides tangible asset backing through aging spirits with potential appreciation, aligning with private equity's focus on high-return, long-term investments in non-public entities or unique assets. Both strategies attract investors seeking risk-adjusted returns by capitalizing on niche markets with inherent value growth potential.

Key Terms

Liquidity

Private equity investments typically involve long lock-up periods, limiting liquidity as capital is tied up for several years before potential returns are realized. Whiskey barrel investments offer relatively higher liquidity with opportunities to sell barrels or shares periodically, though market demand and storage considerations can impact ease of exit. Explore detailed comparisons of liquidity factors to make informed investment decisions.

Due Diligence

Due diligence in private equity investment involves comprehensive financial analysis, market evaluation, and legal scrutiny to assess the viability and risks of the target company. Whiskey barrel investment requires specialized knowledge of aging processes, provenance verification, and market demand forecasts to ensure authenticity and potential appreciation. Explore detailed comparisons to understand which due diligence approach aligns best with your investment goals.

Return Profile

Private equity investments typically offer high return potential through equity stakes in growing companies, though they carry significant illiquidity and longer investment horizons. Whiskey barrel investments provide exposure to the appreciation of aging spirits, often yielding steady returns driven by rarity and market demand fluctuations. Explore detailed insights to better understand which investment aligns with your financial goals and risk tolerance.

Source and External Links

An Introduction to Private Equity Basics - Private equity involves investment in privately held (non-public) companies, managed by general partners who aim to grow and ultimately exit these investments for profit, typically holding them for several years.

Private Equity: What You Need to Know - Private equity strategies focus on acquiring and improving private companies, often through operational enhancements, strategic acquisitions, management strengthening, and capital structure optimization to drive value creation over a medium to long-term holding period.

A simplified way to access private equity - Investors can access private equity through primary funds, co-investments, or secondaries, with success heavily dependent on deal sourcing, active management, and portfolio diversification due to the high dispersion of returns in the asset class.

dowidth.com

dowidth.com