Fractionalized art investment allows multiple investors to own shares of high-value artworks, providing diversification and accessibility beyond traditional single-asset ownership. Commodity trading involves buying and selling physical goods like oil, gold, and agricultural products, focusing on market fluctuations and supply-demand dynamics. Explore the unique advantages and risks of both investment strategies to make informed financial decisions.

Why it is important

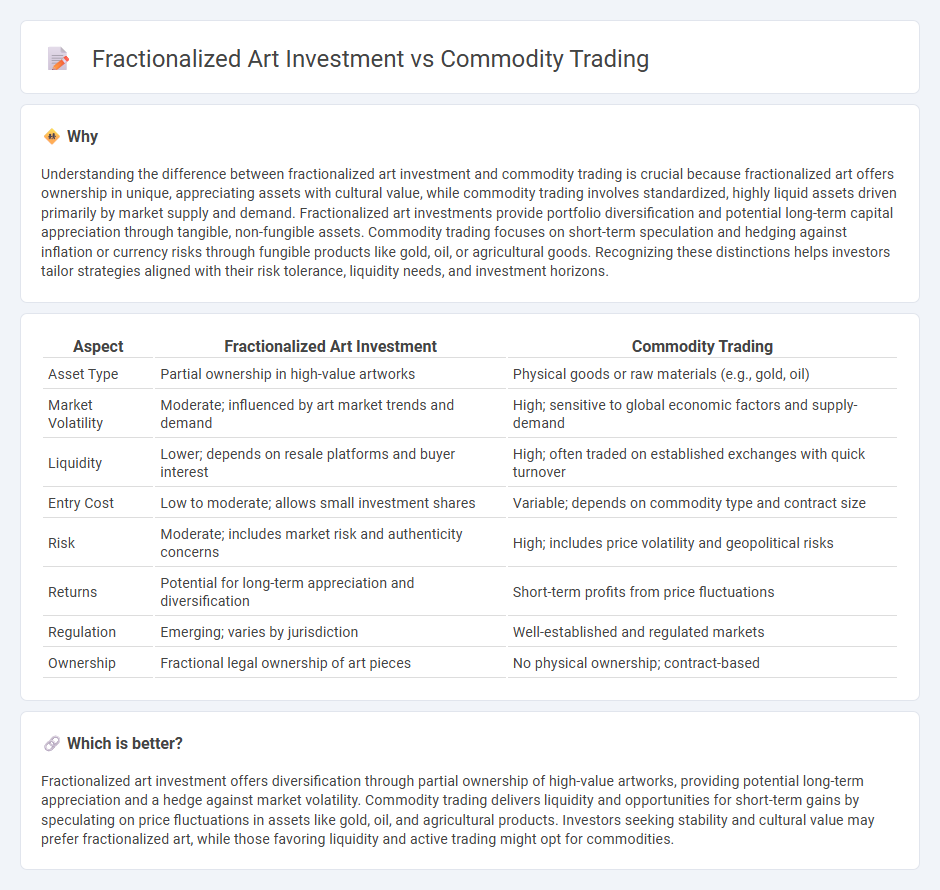

Understanding the difference between fractionalized art investment and commodity trading is crucial because fractionalized art offers ownership in unique, appreciating assets with cultural value, while commodity trading involves standardized, highly liquid assets driven primarily by market supply and demand. Fractionalized art investments provide portfolio diversification and potential long-term capital appreciation through tangible, non-fungible assets. Commodity trading focuses on short-term speculation and hedging against inflation or currency risks through fungible products like gold, oil, or agricultural goods. Recognizing these distinctions helps investors tailor strategies aligned with their risk tolerance, liquidity needs, and investment horizons.

Comparison Table

| Aspect | Fractionalized Art Investment | Commodity Trading |

|---|---|---|

| Asset Type | Partial ownership in high-value artworks | Physical goods or raw materials (e.g., gold, oil) |

| Market Volatility | Moderate; influenced by art market trends and demand | High; sensitive to global economic factors and supply-demand |

| Liquidity | Lower; depends on resale platforms and buyer interest | High; often traded on established exchanges with quick turnover |

| Entry Cost | Low to moderate; allows small investment shares | Variable; depends on commodity type and contract size |

| Risk | Moderate; includes market risk and authenticity concerns | High; includes price volatility and geopolitical risks |

| Returns | Potential for long-term appreciation and diversification | Short-term profits from price fluctuations |

| Regulation | Emerging; varies by jurisdiction | Well-established and regulated markets |

| Ownership | Fractional legal ownership of art pieces | No physical ownership; contract-based |

Which is better?

Fractionalized art investment offers diversification through partial ownership of high-value artworks, providing potential long-term appreciation and a hedge against market volatility. Commodity trading delivers liquidity and opportunities for short-term gains by speculating on price fluctuations in assets like gold, oil, and agricultural products. Investors seeking stability and cultural value may prefer fractionalized art, while those favoring liquidity and active trading might opt for commodities.

Connection

Fractionalized art investment democratizes access to high-value artworks by allowing multiple investors to purchase shares, paralleling commodity trading where investors buy and sell physical goods or contracts in smaller units. Both markets rely on liquidity and asset tokenization, enhancing market accessibility and diversification opportunities. Blockchain technology further connects these sectors by ensuring transparency, security, and traceability in ownership transactions.

Key Terms

Commodity trading:

Commodity trading involves buying and selling raw materials like oil, gold, and agricultural products on regulated exchanges, leveraging market volatility for profit. It requires understanding supply-demand dynamics, geopolitical factors, and technical analysis to effectively manage risk and maximize returns. Explore more to grasp strategic approaches and market insights in commodity trading.

Futures contracts

Futures contracts in commodity trading involve standardized agreements to buy or sell assets like oil, gold, or wheat at predetermined prices and dates, offering liquidity and hedging opportunities. Fractionalized art investment uses blockchain to divide ownership of high-value artworks into smaller shares, allowing investors to buy fractions without full asset control or futures trading mechanisms. Explore more about how futures contracts differentiate investment strategies in these evolving markets.

Spot price

Commodity trading centers on the spot price, which reflects the current market value of physical goods like oil, gold, or wheat, enabling traders to buy or sell assets for immediate delivery. Fractionalized art investment, however, does not solely rely on spot prices but depends on appraisal values, market demand, and the rarity of the artwork, making price discovery less transparent than traditional commodities. Explore the differences in valuation mechanisms to better understand how spot prices influence each investment type.

Source and External Links

Commodity market - Wikipedia - Commodity markets trade primary-sector goods like agricultural products, metals, and energy, using spot, futures, and options contracts on global exchanges such as CME Group and Euronext.

The critical role of commodity trading in times of uncertainty - McKinsey - Commodity trading remains resilient amid decreased price volatility and global uncertainty, with supply chain disruptions and geopolitical events continuing to impact product availability and prices.

How Commodity Traders Can Invest In The Future - Oliver Wyman - After record margins in 2022, the industry rebalanced in 2023, with traders accumulating cash reserves and shifting roles to become strategic investors in green energy and supply chain security.

dowidth.com

dowidth.com