Sports memorabilia funds offer investors unique opportunities by pooling capital to acquire valuable collectibles with potential appreciation tied to athlete fame and market trends. Royalty income funds focus on generating steady cash flow through ownership of intellectual property rights, providing investors with passive income from royalties paid on music, patents, or trademarks. Discover how these distinct investment avenues can diversify your portfolio and align with your financial goals.

Why it is important

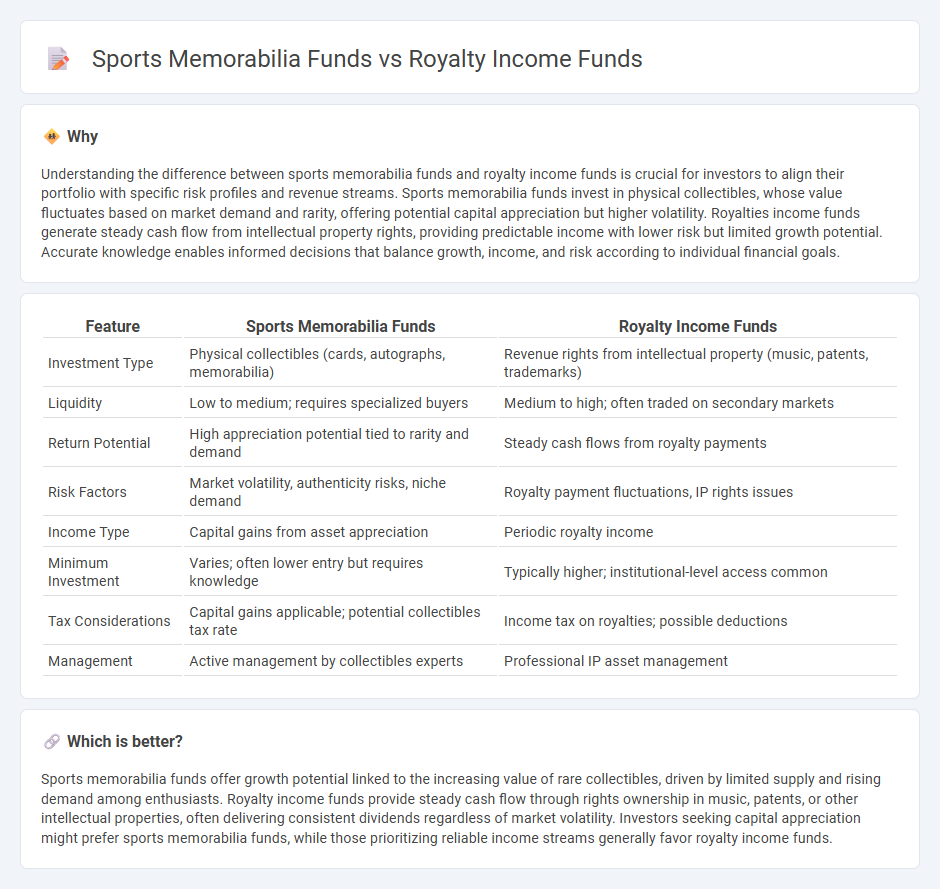

Understanding the difference between sports memorabilia funds and royalty income funds is crucial for investors to align their portfolio with specific risk profiles and revenue streams. Sports memorabilia funds invest in physical collectibles, whose value fluctuates based on market demand and rarity, offering potential capital appreciation but higher volatility. Royalties income funds generate steady cash flow from intellectual property rights, providing predictable income with lower risk but limited growth potential. Accurate knowledge enables informed decisions that balance growth, income, and risk according to individual financial goals.

Comparison Table

| Feature | Sports Memorabilia Funds | Royalty Income Funds |

|---|---|---|

| Investment Type | Physical collectibles (cards, autographs, memorabilia) | Revenue rights from intellectual property (music, patents, trademarks) |

| Liquidity | Low to medium; requires specialized buyers | Medium to high; often traded on secondary markets |

| Return Potential | High appreciation potential tied to rarity and demand | Steady cash flows from royalty payments |

| Risk Factors | Market volatility, authenticity risks, niche demand | Royalty payment fluctuations, IP rights issues |

| Income Type | Capital gains from asset appreciation | Periodic royalty income |

| Minimum Investment | Varies; often lower entry but requires knowledge | Typically higher; institutional-level access common |

| Tax Considerations | Capital gains applicable; potential collectibles tax rate | Income tax on royalties; possible deductions |

| Management | Active management by collectibles experts | Professional IP asset management |

Which is better?

Sports memorabilia funds offer growth potential linked to the increasing value of rare collectibles, driven by limited supply and rising demand among enthusiasts. Royalty income funds provide steady cash flow through rights ownership in music, patents, or other intellectual properties, often delivering consistent dividends regardless of market volatility. Investors seeking capital appreciation might prefer sports memorabilia funds, while those prioritizing reliable income streams generally favor royalty income funds.

Connection

Sports memorabilia funds and royalty income funds are connected through their reliance on unique asset streams that generate consistent revenue. Sports memorabilia funds capitalize on the increasing value of collectible items linked to athletes and sports history, while royalty income funds derive returns from intellectual property rights associated with athlete endorsements or sports media content. Both investment types offer diversification by leveraging niche markets tied to athlete branding and fan engagement.

Key Terms

**Royalty Income Funds:**

Royalty Income Funds generate consistent revenue by investing in intellectual property rights such as music, patents, and trademarks, providing stable cash flow and diversification benefits. These funds often appeal to investors seeking inflation-resistant income streams backed by legal contracts that secure long-term payments. Explore detailed performance metrics and risk profiles to better understand the advantages of Royalty Income Funds.

Licensing Agreements

Royalty income funds generate revenue primarily through licensing agreements that allow investors to earn a passive income stream from intellectual property rights, such as music, patents, or trademarks. In contrast, sports memorabilia funds focus on acquiring licensed collectibles and memorabilia, leveraging licensing agreements to authenticate and enhance the value of assets tied to athletes or teams. Explore the intricate details of licensing agreements in both fund types to better understand their investment potential and risks.

Intellectual Property

Royalty income funds primarily generate revenue through licensing intellectual property such as music, patents, or trademarks, providing investors with steady cash flows tied to ongoing royalties. In contrast, sports memorabilia funds invest in physical assets like signed jerseys or trading cards, where value appreciation depends on collectible market trends rather than recurring intellectual property rights income. Explore the nuances between these fund types to optimize your investment strategy focused on intellectual property assets.

Source and External Links

Royalty fund - Royalty funds are private equity funds that purchase rights to consistent royalty revenue streams from products or services, paying dividends to investors without corporate-level taxation, and investing across industries like mining, pharmaceuticals, and intellectual property.

How to Invest in Royalty Income - Investors can acquire royalty income rights by buying shares of royalty trusts or through royalty auction exchanges, providing steady income often taxed at favorable capital gains rates, with royalties derived from intellectual property or natural resources.

Buy Royalties & Intellectual Property Rights Income - Royalty Exchange offers a marketplace to buy income-generating royalties such as music or patents, which typically yield strong, uncorrelated returns independent of stock and bond markets, making them attractive alternative investments.

dowidth.com

dowidth.com