Virtual land real estate offers digital ownership in metaverse platforms, enabling users to buy, sell, and develop parcels of virtual property through blockchain technology, while REITs provide investors with a way to earn dividends from real estate portfolios without directly owning physical property. The value of virtual land is driven by platform popularity and community engagement, contrasting with REITs, which depend on real-world asset performance and market conditions. Explore the unique opportunities and risks associated with virtual land and REITs to make informed investment decisions.

Why it is important

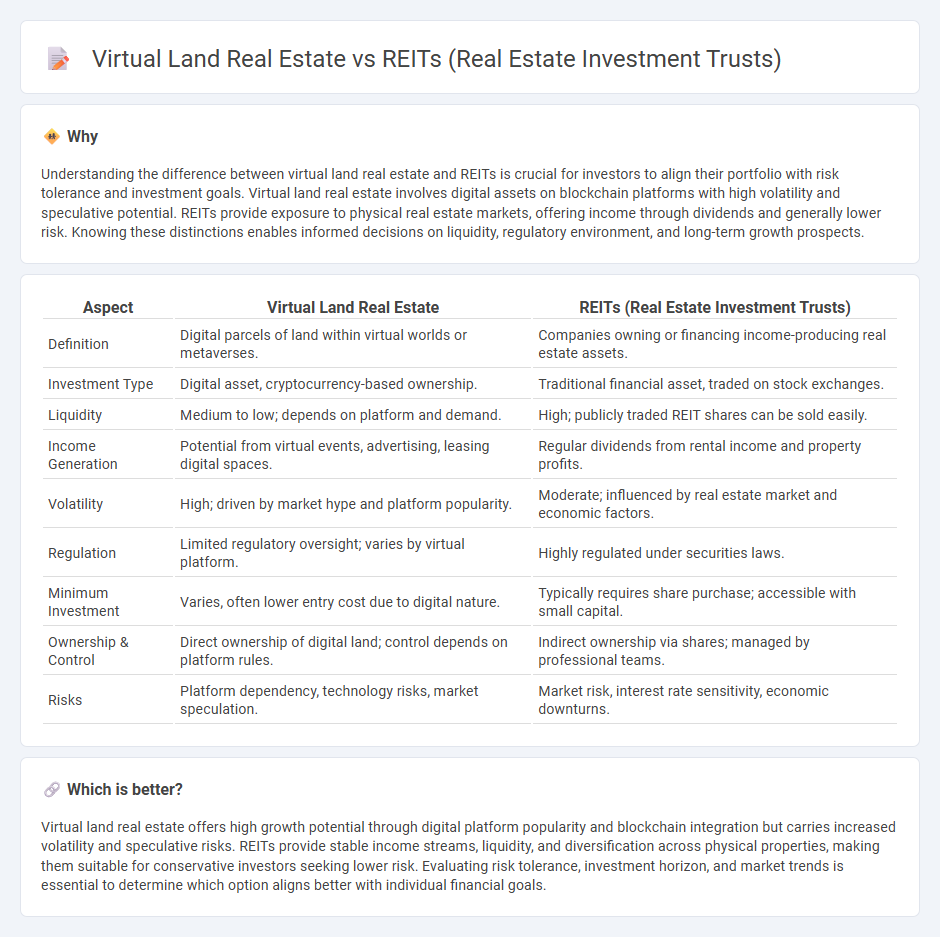

Understanding the difference between virtual land real estate and REITs is crucial for investors to align their portfolio with risk tolerance and investment goals. Virtual land real estate involves digital assets on blockchain platforms with high volatility and speculative potential. REITs provide exposure to physical real estate markets, offering income through dividends and generally lower risk. Knowing these distinctions enables informed decisions on liquidity, regulatory environment, and long-term growth prospects.

Comparison Table

| Aspect | Virtual Land Real Estate | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Definition | Digital parcels of land within virtual worlds or metaverses. | Companies owning or financing income-producing real estate assets. |

| Investment Type | Digital asset, cryptocurrency-based ownership. | Traditional financial asset, traded on stock exchanges. |

| Liquidity | Medium to low; depends on platform and demand. | High; publicly traded REIT shares can be sold easily. |

| Income Generation | Potential from virtual events, advertising, leasing digital spaces. | Regular dividends from rental income and property profits. |

| Volatility | High; driven by market hype and platform popularity. | Moderate; influenced by real estate market and economic factors. |

| Regulation | Limited regulatory oversight; varies by virtual platform. | Highly regulated under securities laws. |

| Minimum Investment | Varies, often lower entry cost due to digital nature. | Typically requires share purchase; accessible with small capital. |

| Ownership & Control | Direct ownership of digital land; control depends on platform rules. | Indirect ownership via shares; managed by professional teams. |

| Risks | Platform dependency, technology risks, market speculation. | Market risk, interest rate sensitivity, economic downturns. |

Which is better?

Virtual land real estate offers high growth potential through digital platform popularity and blockchain integration but carries increased volatility and speculative risks. REITs provide stable income streams, liquidity, and diversification across physical properties, making them suitable for conservative investors seeking lower risk. Evaluating risk tolerance, investment horizon, and market trends is essential to determine which option aligns better with individual financial goals.

Connection

Virtual land real estate and REITs (Real Estate Investment Trusts) both represent innovative avenues for diversifying investment portfolios within the real estate sector. Virtual land real estate involves purchasing and trading digital plots in metaverse platforms, offering potential for value appreciation and income generation through virtual developments and leasing. REITs provide investors with access to income-producing physical properties, enabling liquidity and diversification without direct property management, linking traditional and digital real estate investment strategies through asset-backed opportunities.

Key Terms

Ownership structure

REITs are structured as corporations or trusts that pool investors' capital to own, operate, or finance income-generating real estate, providing shareholders with fractional ownership through tradable shares. Virtual land real estate ownership is recorded on blockchain technology as non-fungible tokens (NFTs), granting exclusive, provable digital property rights within metaverse platforms. Explore the nuances of these ownership models to understand their investment potential and legal frameworks.

Tangible vs. digital assets

REITs offer investors access to tangible real estate assets such as commercial buildings, apartments, and warehouses, generating income through rents and property appreciation. Virtual land real estate exists solely in digital environments within metaverses and blockchain platforms, providing opportunities for digital asset trading and virtual business development. Explore the unique benefits and risks of both tangible and digital real estate assets to make informed investment choices.

Income generation methods

REITs generate income primarily through rental payments from diversified portfolios of physical real estate properties, offering investors regular dividends backed by tangible assets. Virtual land real estate income arises from leasing digital spaces, selling NFTs, or hosting events within metaverse platforms, creating revenue streams from virtual property development and user engagement. Explore the distinctive income models and investment potential in both REITs and virtual land real estate to enhance your portfolio strategy.

Source and External Links

Real estate investment trust - Wikipedia - A REIT (Real Estate Investment Trust) is a company that owns and often operates income-producing real estate such as office buildings, apartments, warehouses, and shopping centers, categorized mainly into equity and mortgage REITs, and offering tax advantages and liquidity to investors.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, providing investors with regular income, diversification, and long-term capital appreciation, often traded publicly on stock exchanges.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate like offices, malls, and apartments, often publicly traded or non-traded, offering a means to earn income from commercial real estate without direct ownership.

dowidth.com

dowidth.com