Esports franchises represent a rapidly growing sector within the entertainment industry, offering investors opportunities tied to competitive gaming tournaments, sponsorships, and media rights. Cryptocurrency projects, by contrast, focus on decentralized finance, blockchain technology, and digital assets, with potential for high volatility and innovation in digital economies. Explore further to understand which investment avenue aligns with your financial goals and risk tolerance.

Why it is important

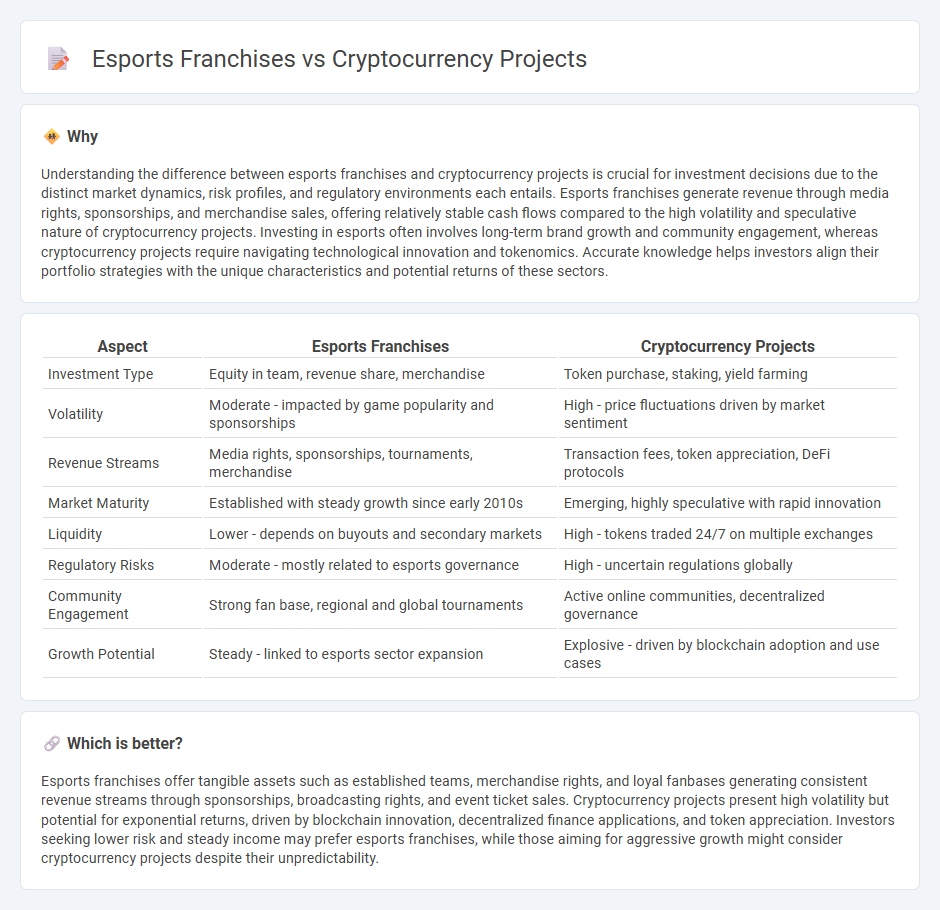

Understanding the difference between esports franchises and cryptocurrency projects is crucial for investment decisions due to the distinct market dynamics, risk profiles, and regulatory environments each entails. Esports franchises generate revenue through media rights, sponsorships, and merchandise sales, offering relatively stable cash flows compared to the high volatility and speculative nature of cryptocurrency projects. Investing in esports often involves long-term brand growth and community engagement, whereas cryptocurrency projects require navigating technological innovation and tokenomics. Accurate knowledge helps investors align their portfolio strategies with the unique characteristics and potential returns of these sectors.

Comparison Table

| Aspect | Esports Franchises | Cryptocurrency Projects |

|---|---|---|

| Investment Type | Equity in team, revenue share, merchandise | Token purchase, staking, yield farming |

| Volatility | Moderate - impacted by game popularity and sponsorships | High - price fluctuations driven by market sentiment |

| Revenue Streams | Media rights, sponsorships, tournaments, merchandise | Transaction fees, token appreciation, DeFi protocols |

| Market Maturity | Established with steady growth since early 2010s | Emerging, highly speculative with rapid innovation |

| Liquidity | Lower - depends on buyouts and secondary markets | High - tokens traded 24/7 on multiple exchanges |

| Regulatory Risks | Moderate - mostly related to esports governance | High - uncertain regulations globally |

| Community Engagement | Strong fan base, regional and global tournaments | Active online communities, decentralized governance |

| Growth Potential | Steady - linked to esports sector expansion | Explosive - driven by blockchain adoption and use cases |

Which is better?

Esports franchises offer tangible assets such as established teams, merchandise rights, and loyal fanbases generating consistent revenue streams through sponsorships, broadcasting rights, and event ticket sales. Cryptocurrency projects present high volatility but potential for exponential returns, driven by blockchain innovation, decentralized finance applications, and token appreciation. Investors seeking lower risk and steady income may prefer esports franchises, while those aiming for aggressive growth might consider cryptocurrency projects despite their unpredictability.

Connection

Esports franchises increasingly integrate cryptocurrency projects to streamline digital transactions, enhance fan engagement through tokenized assets, and create new revenue streams via blockchain-based sponsorships. Cryptocurrency enables secure, transparent in-game purchases and rewards, fostering deeper community involvement and financial innovation within esports ecosystems. This synergy accelerates the adoption of decentralized finance models, transforming traditional investment approaches in the gaming industry.

Key Terms

**Cryptocurrency Projects:**

Cryptocurrency projects leverage blockchain technology to create decentralized finance solutions, NFT platforms, and innovative token economies that drive digital asset ownership and transparency. These projects often prioritize scalability, security, and user adoption within rapidly evolving markets, attracting investors and developers focused on disrupting traditional financial systems. Explore further to understand how cutting-edge cryptocurrency initiatives outpace conventional esports franchises in technological innovation and market potential.

Tokenomics

Cryptocurrency projects prioritize tokenomics by designing utility tokens to incentivize user participation, ensure liquidity, and maintain price stability through mechanisms like staking, burning, and rewards distribution. Esports franchises increasingly adopt tokenomics by creating fan tokens to enhance engagement, enabling fans to vote on team decisions, access exclusive content, and earn rewards within the gaming ecosystem. Explore how tokenomics bridges blockchain innovation with competitive gaming by learning more about their evolving integration.

Blockchain

Cryptocurrency projects leverage blockchain technology to create decentralized finance ecosystems, enabling secure transactions and tokenized assets, while esports franchises utilize blockchain primarily for fan engagement, digital collectibles, and transparent reward systems. Blockchain enhances cryptocurrency projects with immutable ledgers and decentralized governance, whereas esports benefit from interoperability of in-game assets and verified ownership. Explore the evolving synergy between blockchain, cryptocurrency, and esports to understand their transformative potential.

Source and External Links

Crypto Projects - Best Performing & Promising Cryptocurrency Projects - Discover mainstream and emerging crypto projects such as Quant, Solana, and Axie Infinity, with details on their unique functionalities and market positions.

lukasmasuch/best-of-crypto: A ranked list of awesome open-source digital currency and blockchain projects - Browse a curated, regularly updated list ranking thousands of open-source blockchain and cryptocurrency projects, such as Nano and Bitcoin Cash, based on their community activity and technical metrics.

Best Upcoming Cryptocurrencies - CoinMarketCap - View a snapshot of recently launched and upcoming crypto projects, including Trusta.AI, Codatta, and Opensea, with basic details on listing dates and ecosystems.

dowidth.com

dowidth.com