Sneaker flipping and sports cards investing are lucrative markets driven by collector demand and limited releases. Both assets offer high return potential, with sneakers capitalizing on streetwear trends and sports cards benefiting from nostalgia and athlete performance. Explore the nuances of sneaker flipping versus sports cards investing to determine the best fit for your portfolio.

Why it is important

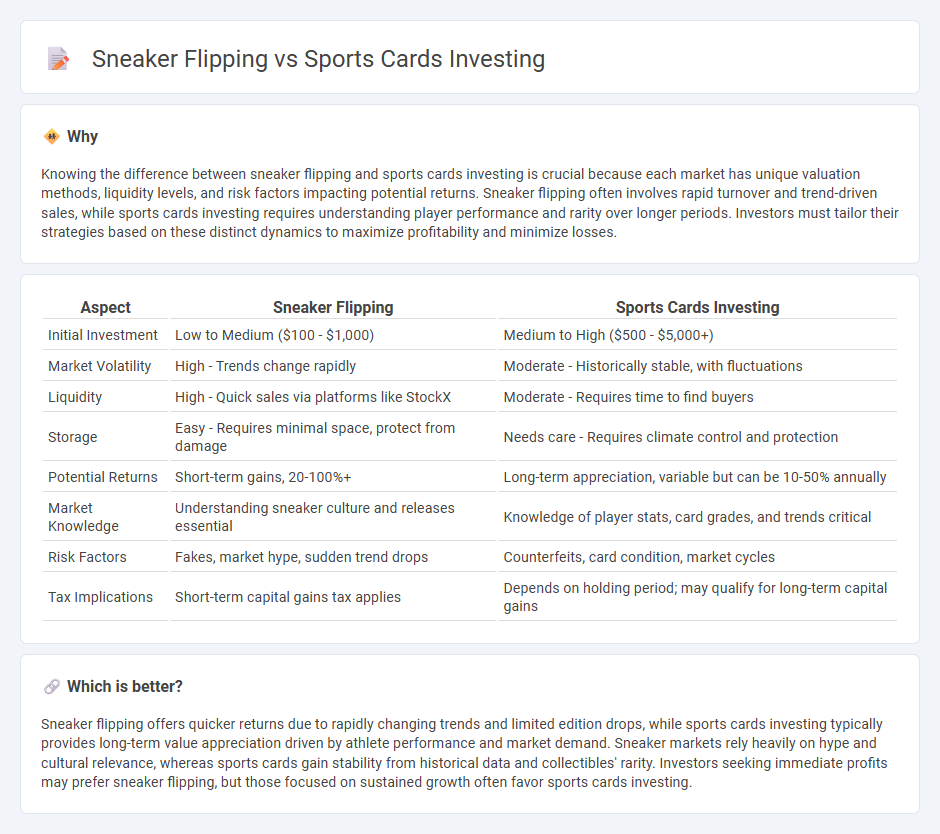

Knowing the difference between sneaker flipping and sports cards investing is crucial because each market has unique valuation methods, liquidity levels, and risk factors impacting potential returns. Sneaker flipping often involves rapid turnover and trend-driven sales, while sports cards investing requires understanding player performance and rarity over longer periods. Investors must tailor their strategies based on these distinct dynamics to maximize profitability and minimize losses.

Comparison Table

| Aspect | Sneaker Flipping | Sports Cards Investing |

|---|---|---|

| Initial Investment | Low to Medium ($100 - $1,000) | Medium to High ($500 - $5,000+) |

| Market Volatility | High - Trends change rapidly | Moderate - Historically stable, with fluctuations |

| Liquidity | High - Quick sales via platforms like StockX | Moderate - Requires time to find buyers |

| Storage | Easy - Requires minimal space, protect from damage | Needs care - Requires climate control and protection |

| Potential Returns | Short-term gains, 20-100%+ | Long-term appreciation, variable but can be 10-50% annually |

| Market Knowledge | Understanding sneaker culture and releases essential | Knowledge of player stats, card grades, and trends critical |

| Risk Factors | Fakes, market hype, sudden trend drops | Counterfeits, card condition, market cycles |

| Tax Implications | Short-term capital gains tax applies | Depends on holding period; may qualify for long-term capital gains |

Which is better?

Sneaker flipping offers quicker returns due to rapidly changing trends and limited edition drops, while sports cards investing typically provides long-term value appreciation driven by athlete performance and market demand. Sneaker markets rely heavily on hype and cultural relevance, whereas sports cards gain stability from historical data and collectibles' rarity. Investors seeking immediate profits may prefer sneaker flipping, but those focused on sustained growth often favor sports cards investing.

Connection

Sneaker flipping and sports cards investing are connected through the shared principle of valuing collectibles with strong cultural and market demand, resulting in profitable resale opportunities. Both markets rely on limited editions, brand reputation, and athlete endorsements to drive scarcity and increase asset appreciation. They attract enthusiasts who leverage market trends, rarity, and hype cycles to maximize investment returns in alternative asset classes.

Key Terms

**Sports Cards Investing:**

Sports cards investing offers unique value through rarity, athlete performance, and historical significance, driving sustained market demand and potential high returns. Grading services like PSA and Beckett authenticate and enhance card value, making condition a critical factor in investment decisions. Explore detailed analysis on market trends, top-performing cards, and expert tips to maximize your sports card investments.

Grading

Grading plays a crucial role in sports card investing and sneaker flipping, directly impacting the market value and resale price. Sports cards graded by PSA, Beckett, or SGC show a precise condition level that collectors trust, often leading to significant price premiums for high grades such as PSA 10 or BGS 9.5, while sneaker grading by companies like StockX or Crep Protect evaluates authenticity and condition to boost buyer confidence and determine fair market prices; explore more differences and strategies in grading to enhance your investment success.

Rookie Card

Investing in rookie sports cards offers significant long-term value due to their rarity and historical importance in sports memorabilia markets. Rookie cards for athletes like LeBron James or Tom Brady can appreciate substantially, often outperforming many sneaker resell items. Explore detailed analysis and strategies to maximize profits from rookie card investments.

Source and External Links

Investing in Sports Cards in 2025 - Sports trading cards offer portfolio diversification, acting independently from traditional assets, with flexible options across vintage, modern, and niche sports cards, making it an exciting alternative investment when approached wisely.

Investing in Sports Cards: A Guide to Long-Term vs. Short-Term Gains - Long-term investing focuses on stable vintage cards likely to appreciate over years, whereas short-term investing targets quick flips by acquiring new releases early, both strategies resembling stock market tactics with varying risk and reward.

Are sports cards a good investment? What you need to know - Key tips for smart investing include doing thorough research, starting small, buying graded cards for authenticity, diversifying between vintage and modern cards, and proper storage to protect long-term value.

dowidth.com

dowidth.com