Litigation finance involves providing capital to plaintiffs in legal cases in exchange for a portion of the judgment or settlement, while venture capital focuses on investing in startups and early-stage companies with high growth potential. Both serve as alternative financing mechanisms but differ fundamentally in risk profiles, returns, and investment duration. Explore the distinct advantages and applications of litigation finance versus venture capital to optimize your investment strategy.

Why it is important

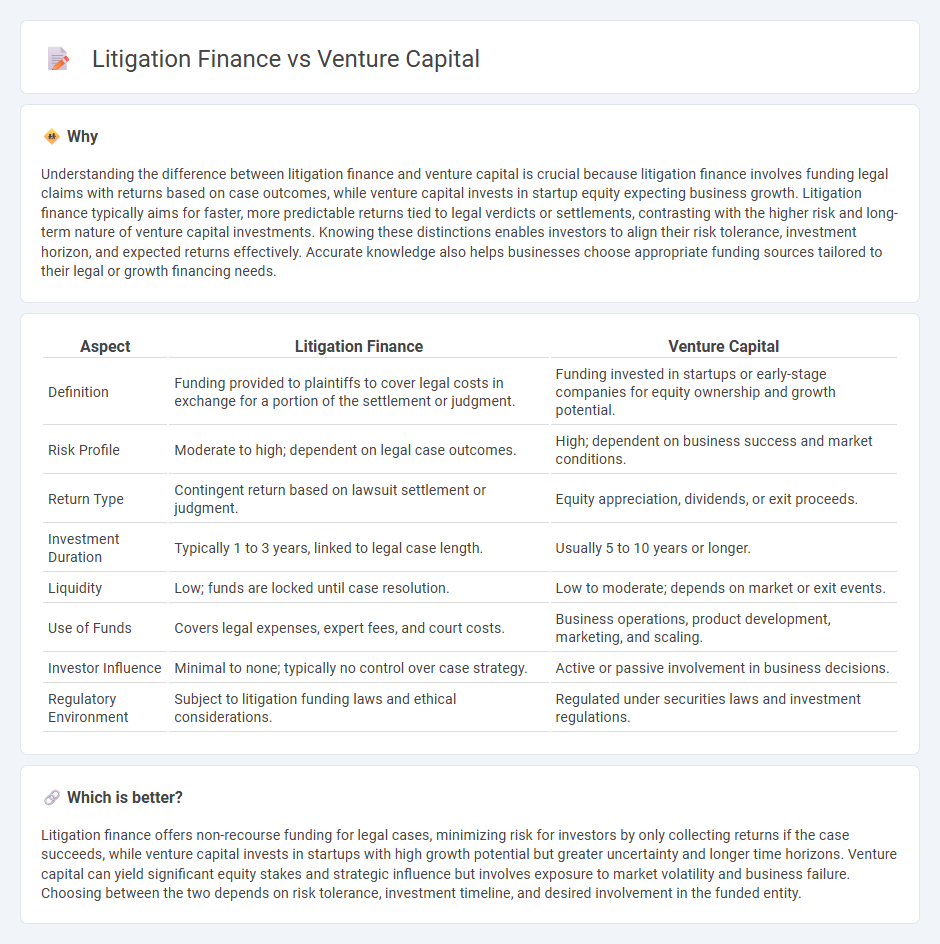

Understanding the difference between litigation finance and venture capital is crucial because litigation finance involves funding legal claims with returns based on case outcomes, while venture capital invests in startup equity expecting business growth. Litigation finance typically aims for faster, more predictable returns tied to legal verdicts or settlements, contrasting with the higher risk and long-term nature of venture capital investments. Knowing these distinctions enables investors to align their risk tolerance, investment horizon, and expected returns effectively. Accurate knowledge also helps businesses choose appropriate funding sources tailored to their legal or growth financing needs.

Comparison Table

| Aspect | Litigation Finance | Venture Capital |

|---|---|---|

| Definition | Funding provided to plaintiffs to cover legal costs in exchange for a portion of the settlement or judgment. | Funding invested in startups or early-stage companies for equity ownership and growth potential. |

| Risk Profile | Moderate to high; dependent on legal case outcomes. | High; dependent on business success and market conditions. |

| Return Type | Contingent return based on lawsuit settlement or judgment. | Equity appreciation, dividends, or exit proceeds. |

| Investment Duration | Typically 1 to 3 years, linked to legal case length. | Usually 5 to 10 years or longer. |

| Liquidity | Low; funds are locked until case resolution. | Low to moderate; depends on market or exit events. |

| Use of Funds | Covers legal expenses, expert fees, and court costs. | Business operations, product development, marketing, and scaling. |

| Investor Influence | Minimal to none; typically no control over case strategy. | Active or passive involvement in business decisions. |

| Regulatory Environment | Subject to litigation funding laws and ethical considerations. | Regulated under securities laws and investment regulations. |

Which is better?

Litigation finance offers non-recourse funding for legal cases, minimizing risk for investors by only collecting returns if the case succeeds, while venture capital invests in startups with high growth potential but greater uncertainty and longer time horizons. Venture capital can yield significant equity stakes and strategic influence but involves exposure to market volatility and business failure. Choosing between the two depends on risk tolerance, investment timeline, and desired involvement in the funded entity.

Connection

Litigation finance and venture capital are connected through their shared focus on funding high-risk, high-reward opportunities by providing essential capital to entities unable to access traditional financing. Both investment strategies utilize rigorous due diligence and risk assessment to identify cases or startups with significant growth potential and the likelihood of substantial returns. This intersection allows investors to diversify portfolios by combining legal claim monetization with equity investments in emerging enterprises.

Key Terms

Venture Capital:

Venture capital involves investing equity capital in early-stage startups with high growth potential, aiming for significant returns through eventual exits such as IPOs or acquisitions. It plays a crucial role in fueling innovation and driving economic growth by providing essential funding to technology firms, biotech companies, and other disruptive industries. Explore the key differences between venture capital and litigation finance to understand strategic investment opportunities.

Equity Stake

Venture capital primarily invests in startups by acquiring equity stakes, aiming for high returns through company growth and eventual exit events such as IPOs or acquisitions. Litigation finance involves funding legal cases in exchange for a portion of the settlement or judgment but rarely entails equity ownership in the financed entity or case. Explore how equity stakes differ fundamentally between venture capital and litigation finance to enhance your investment strategy.

Startup Valuation

Venture capital and litigation finance influence startup valuation through different risk and return mechanisms; venture capital investments depend on growth potential and scalability, often valuing startups based on projected earnings and market traction. Litigation finance offers capital in exchange for a share of potential lawsuit proceeds, impacting valuation by factoring in legal outcome probabilities and expected settlements. Explore deeper insights on how each funding method uniquely shapes startup valuation models and risk assessments.

Source and External Links

What is Venture Capital? - Venture capital is a form of financing that supports high-growth startups by turning ideas into products and services, providing strategic guidance and long-term equity investments typically lasting ten years or more.

Fund your business | U.S. Small Business Administration - Venture capital investors fund startups in exchange for equity and often a board seat, focusing on high-growth companies that require capital beyond traditional loans and usually involve multiple rounds of financing as milestones are met.

What is venture capital? - Silicon Valley Bank - Venture capital is private equity focused on startups and early-stage companies with rapid growth potential, providing both capital and managerial expertise while taking ownership stakes, often through seed and early funding rounds.

dowidth.com

dowidth.com