Litigation finance involves funding legal cases with the expectation of a financial return upon case resolution, offering investors a unique risk profile tied to legal outcomes. Angel investing provides early-stage capital to startups in exchange for equity, focusing on high growth potential and innovation-driven markets. Explore the key differences in risk, return, and strategic impact between litigation finance and angel investing.

Why it is important

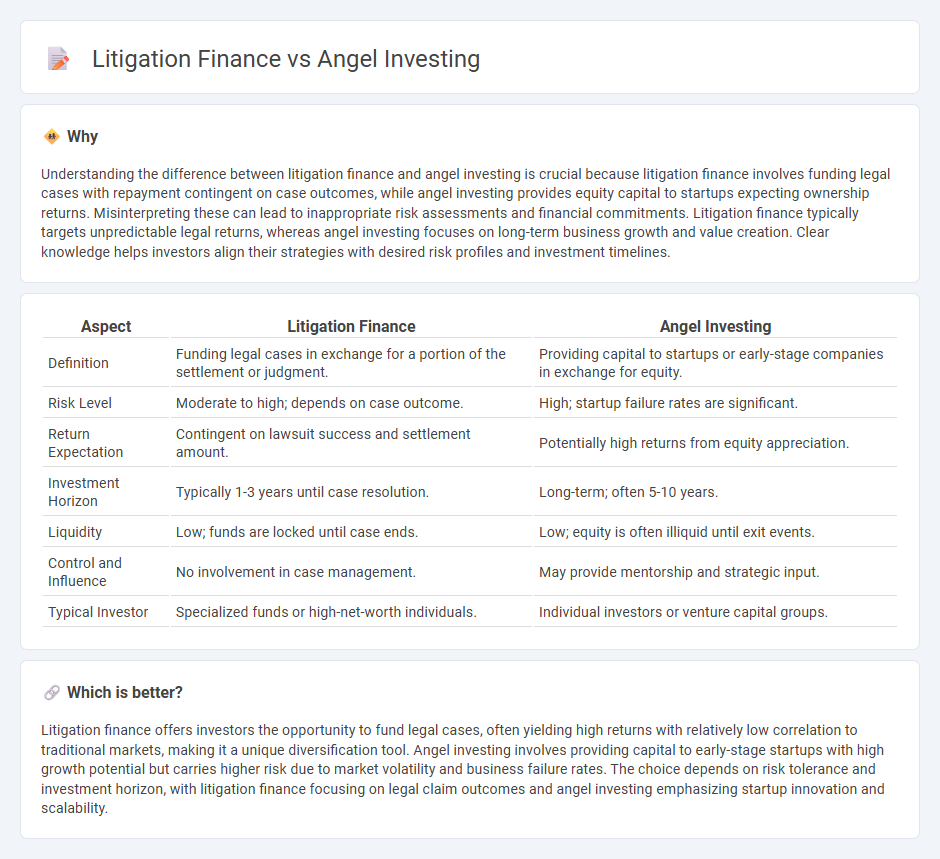

Understanding the difference between litigation finance and angel investing is crucial because litigation finance involves funding legal cases with repayment contingent on case outcomes, while angel investing provides equity capital to startups expecting ownership returns. Misinterpreting these can lead to inappropriate risk assessments and financial commitments. Litigation finance typically targets unpredictable legal returns, whereas angel investing focuses on long-term business growth and value creation. Clear knowledge helps investors align their strategies with desired risk profiles and investment timelines.

Comparison Table

| Aspect | Litigation Finance | Angel Investing |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the settlement or judgment. | Providing capital to startups or early-stage companies in exchange for equity. |

| Risk Level | Moderate to high; depends on case outcome. | High; startup failure rates are significant. |

| Return Expectation | Contingent on lawsuit success and settlement amount. | Potentially high returns from equity appreciation. |

| Investment Horizon | Typically 1-3 years until case resolution. | Long-term; often 5-10 years. |

| Liquidity | Low; funds are locked until case ends. | Low; equity is often illiquid until exit events. |

| Control and Influence | No involvement in case management. | May provide mentorship and strategic input. |

| Typical Investor | Specialized funds or high-net-worth individuals. | Individual investors or venture capital groups. |

Which is better?

Litigation finance offers investors the opportunity to fund legal cases, often yielding high returns with relatively low correlation to traditional markets, making it a unique diversification tool. Angel investing involves providing capital to early-stage startups with high growth potential but carries higher risk due to market volatility and business failure rates. The choice depends on risk tolerance and investment horizon, with litigation finance focusing on legal claim outcomes and angel investing emphasizing startup innovation and scalability.

Connection

Litigation finance and angel investing both provide alternative funding sources that support high-risk ventures with potential for substantial returns. Litigation finance involves third-party funding of legal cases in exchange for a share of the settlement, similar to how angel investors supply capital to startups in exchange for equity. Both models leverage early-stage financial support to unlock value and mitigate traditional financing barriers.

Key Terms

**Angel Investing:**

Angel investing involves providing early-stage capital to startups in exchange for equity, targeting high-growth potential companies. Investors often bring expertise and network connections to support business scaling, enabling startups to accelerate product development and market entry. Explore how angel investing can drive innovation and diversify your investment portfolio.

Equity

Angel investing involves providing capital to early-stage startups in exchange for equity ownership, positioning investors to benefit from the company's growth and potential exit events. Litigation finance offers funding to plaintiffs or law firms, often in exchange for a share of the settlement or judgment, but typically does not confer equity ownership in the legal entity. Explore detailed comparisons to understand which investment aligns better with your equity-focused strategies.

Startup

Angel investing in startups involves providing early-stage capital to high-potential ventures in exchange for equity, enabling founders to scale operations rapidly. Litigation finance, though less common in startup ecosystems, offers legal funding by covering legal costs in exchange for a portion of the settlement or award, primarily aiding startups involved in significant legal disputes. Explore the nuances and benefits of both funding strategies to make informed decisions for your startup's growth and risk management.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors are individuals who provide early-stage capital to startups in exchange for equity or convertible debt, often stepping in after friends and family funding but before institutional investors, and typically offer mentorship and industry connections to help the business grow.

Demystifying Angel Investing - Angel Capital Association - Angel investing allows individuals to finance promising startups with the potential for higher returns than traditional investments, while also supporting regional economic growth and sometimes benefiting from favorable tax incentives.

Angel Investors - The Hartford Insurance - Angel investors are wealthy individuals who invest their own money in startups for equity, often providing smaller amounts of capital than venture capital firms and offering hands-on support, with the expectation of eventually realizing profits through exits like acquisitions or IPOs.

dowidth.com

dowidth.com