Collectible sneakers have emerged as a lucrative investment, driven by limited editions and high demand in sneaker culture, often appreciating significantly over time. Music royalties offer steady, passive income by allowing investors to earn from artists' ongoing streams, sales, and licensing deals, providing diversification beyond traditional assets. Explore how these unique investment options can enhance your portfolio and generate long-term value.

Why it is important

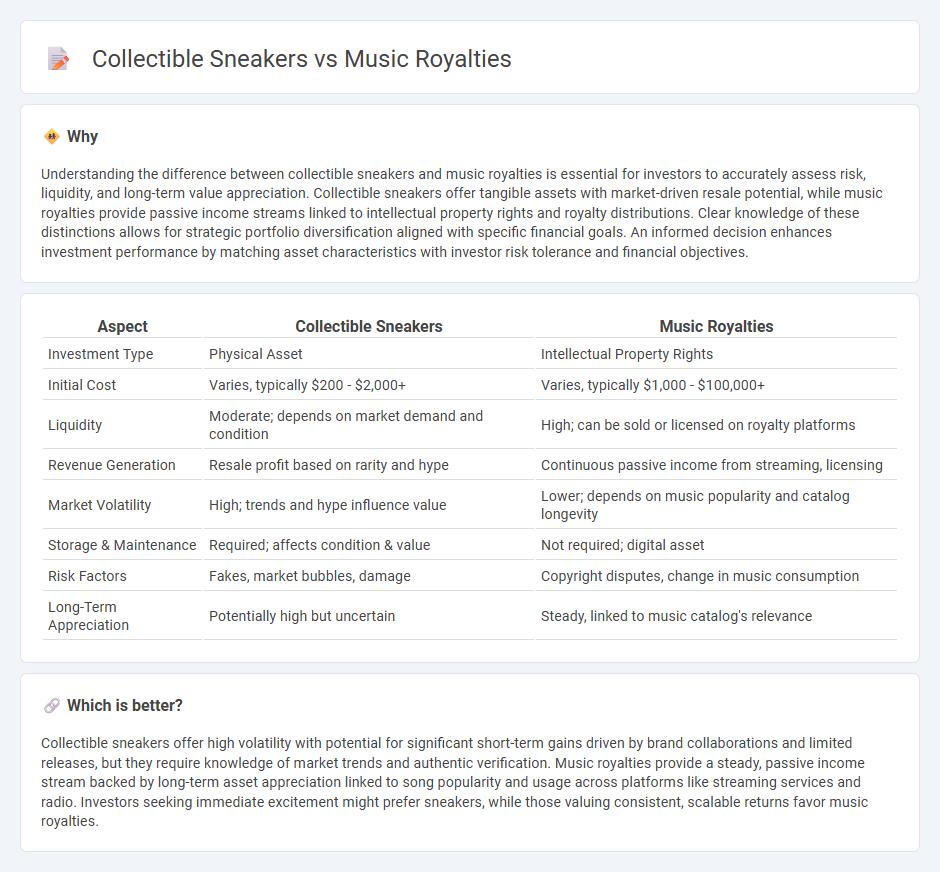

Understanding the difference between collectible sneakers and music royalties is essential for investors to accurately assess risk, liquidity, and long-term value appreciation. Collectible sneakers offer tangible assets with market-driven resale potential, while music royalties provide passive income streams linked to intellectual property rights and royalty distributions. Clear knowledge of these distinctions allows for strategic portfolio diversification aligned with specific financial goals. An informed decision enhances investment performance by matching asset characteristics with investor risk tolerance and financial objectives.

Comparison Table

| Aspect | Collectible Sneakers | Music Royalties |

|---|---|---|

| Investment Type | Physical Asset | Intellectual Property Rights |

| Initial Cost | Varies, typically $200 - $2,000+ | Varies, typically $1,000 - $100,000+ |

| Liquidity | Moderate; depends on market demand and condition | High; can be sold or licensed on royalty platforms |

| Revenue Generation | Resale profit based on rarity and hype | Continuous passive income from streaming, licensing |

| Market Volatility | High; trends and hype influence value | Lower; depends on music popularity and catalog longevity |

| Storage & Maintenance | Required; affects condition & value | Not required; digital asset |

| Risk Factors | Fakes, market bubbles, damage | Copyright disputes, change in music consumption |

| Long-Term Appreciation | Potentially high but uncertain | Steady, linked to music catalog's relevance |

Which is better?

Collectible sneakers offer high volatility with potential for significant short-term gains driven by brand collaborations and limited releases, but they require knowledge of market trends and authentic verification. Music royalties provide a steady, passive income stream backed by long-term asset appreciation linked to song popularity and usage across platforms like streaming services and radio. Investors seeking immediate excitement might prefer sneakers, while those valuing consistent, scalable returns favor music royalties.

Connection

Collectible sneakers and music royalties share a unique intersection as alternative investment assets that offer potential for high returns and portfolio diversification. Both markets rely heavily on cultural trends, brand reputation, and rarity, with sneaker collaborations and limited-edition releases mirroring the exclusivity of music royalty rights tied to hit songs or iconic artists. Investors leverage platforms that facilitate fractional ownership, enabling access to these non-traditional assets while capitalizing on the growing demand from younger demographics seeking tangible and intangible collectibles.

Key Terms

**Music royalties:**

Music royalties generate continuous passive income through rights management of compositions, recordings, and performances, often tracked via organizations like ASCAP and BMI. Investment in music royalties offers diversification, inflation hedging, and exposure to growing streaming revenue, unlike collectible sneakers whose value depends on market trends and rarity. Discover how music royalties can provide long-term financial growth and stability by exploring this alternative asset class further.

Licensing

Music royalties generate income through licensing agreements that allow artists and rights holders to earn from the use of their work in various media such as films, commercials, and streaming platforms. Collectible sneakers leverage licensing by partnering with brands, designers, and franchises to create limited editions, enhancing their market value and exclusivity. Explore the nuances of licensing strategies in both music royalties and collectible sneakers to understand how intellectual property drives value.

Mechanical royalties

Mechanical royalties represent a significant revenue stream in the music industry, earned from the reproduction of copyrighted songs in physical and digital formats. Unlike collectible sneakers, which appreciate based on brand, rarity, and market trends, mechanical royalties generate consistent income tied to song usage and licensing agreements. Explore the intricacies of mechanical royalties to better understand their impact on music revenue streams.

Source and External Links

Music Royalties Inc. | Invest in the Top Artists - Music royalties can be seen as income streams from intellectual property, similar to real estate rent, where investors receive dividends from a diversified portfolio of song royalties secured by copyrights lasting the life of the author plus 70 years, including ongoing earnings from streaming and sync uses.

Music Royalties Explained: The Ultimate Guide for 2024 - Music royalties pay rights holders like producers and session musicians either through flat fees or royalty points which are percentage shares in revenues, governed in some cases by union agreements ensuring fair compensation beyond initial payment.

Explained: How Music Royalties Work in the Music Industry - Music royalties are payments to rights holders such as songwriters, publishers, and record labels based on song usage, with each party receiving different types of royalties (mechanical, performance, sync) according to agreed splits and contracts.

dowidth.com

dowidth.com