Play-to-earn gaming integrates blockchain technology, allowing players to earn real-world value through in-game assets and cryptocurrency rewards, creating new investment opportunities. In contrast, traditional game publishing companies focus on monetizing game sales, subscriptions, and in-game purchases without direct player ownership of assets. Explore the evolving landscape of investment in digital entertainment to understand these dynamic models better.

Why it is important

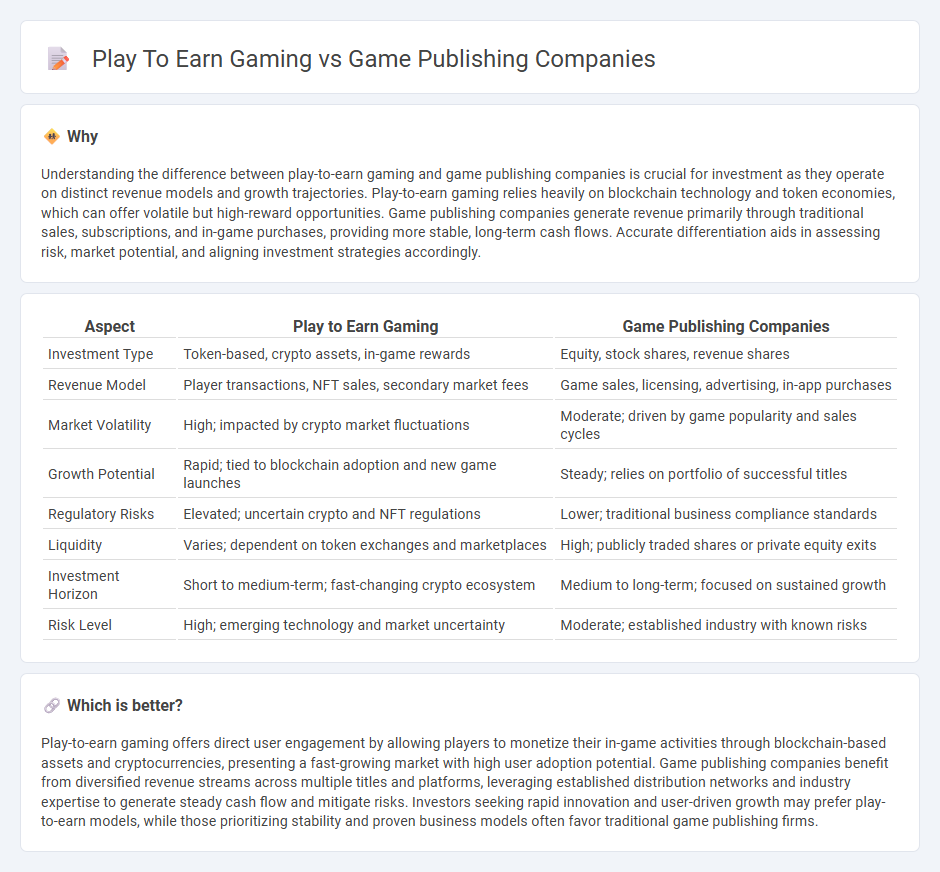

Understanding the difference between play-to-earn gaming and game publishing companies is crucial for investment as they operate on distinct revenue models and growth trajectories. Play-to-earn gaming relies heavily on blockchain technology and token economies, which can offer volatile but high-reward opportunities. Game publishing companies generate revenue primarily through traditional sales, subscriptions, and in-game purchases, providing more stable, long-term cash flows. Accurate differentiation aids in assessing risk, market potential, and aligning investment strategies accordingly.

Comparison Table

| Aspect | Play to Earn Gaming | Game Publishing Companies |

|---|---|---|

| Investment Type | Token-based, crypto assets, in-game rewards | Equity, stock shares, revenue shares |

| Revenue Model | Player transactions, NFT sales, secondary market fees | Game sales, licensing, advertising, in-app purchases |

| Market Volatility | High; impacted by crypto market fluctuations | Moderate; driven by game popularity and sales cycles |

| Growth Potential | Rapid; tied to blockchain adoption and new game launches | Steady; relies on portfolio of successful titles |

| Regulatory Risks | Elevated; uncertain crypto and NFT regulations | Lower; traditional business compliance standards |

| Liquidity | Varies; dependent on token exchanges and marketplaces | High; publicly traded shares or private equity exits |

| Investment Horizon | Short to medium-term; fast-changing crypto ecosystem | Medium to long-term; focused on sustained growth |

| Risk Level | High; emerging technology and market uncertainty | Moderate; established industry with known risks |

Which is better?

Play-to-earn gaming offers direct user engagement by allowing players to monetize their in-game activities through blockchain-based assets and cryptocurrencies, presenting a fast-growing market with high user adoption potential. Game publishing companies benefit from diversified revenue streams across multiple titles and platforms, leveraging established distribution networks and industry expertise to generate steady cash flow and mitigate risks. Investors seeking rapid innovation and user-driven growth may prefer play-to-earn models, while those prioritizing stability and proven business models often favor traditional game publishing firms.

Connection

Play-to-earn gaming creates new investment opportunities by integrating blockchain technology and digital asset ownership, attracting investors seeking high-growth potential in decentralized finance and gaming sectors. Game publishing companies capitalize on this trend by funding play-to-earn game development and distributing titles that incorporate token economies, driving user engagement and revenue streams through NFT sales and in-game transactions. This synergy enhances market liquidity, incentivizes player participation, and expands the overall digital gaming investment landscape.

Key Terms

Revenue Model

Game publishing companies primarily rely on traditional revenue models such as upfront game sales, downloadable content (DLC), and in-game microtransactions to generate consistent income. Play-to-earn gaming introduces a decentralized revenue system where players earn cryptocurrencies or NFTs that can be traded or sold, creating new passive income streams tied to blockchain technology. Explore the evolving landscape of game monetization to understand how these models impact profitability and player engagement.

Tokenomics

Game publishing companies traditionally generate revenue through upfront sales, in-game purchases, and subscriptions, relying heavily on marketing and intellectual property rights. Play-to-earn gaming introduces a novel economic model where players earn tokens or cryptocurrency through gameplay, fostering user engagement and decentralized economies driven by tokenomics. Explore the intricacies of tokenomics in play-to-earn games and how they are reshaping the gaming industry's financial landscape.

User Acquisition

Game publishing companies prioritize user acquisition by leveraging robust marketing strategies, data analytics, and partnerships to drive growth in traditional gaming markets. In contrast, play-to-earn (P2E) games focus on attracting users through blockchain-based incentives, token rewards, and community-driven economies that emphasize player ownership and monetization. Explore detailed insights on how user acquisition tactics differ between game publishing firms and P2E platforms.

Source and External Links

Video Game Publishers - Gamepressure.com - A comprehensive list of top game publishing companies including Ubisoft, Electronic Arts, Sony Interactive Entertainment, Square Enix, Bethesda, Bandai Namco, and others, covering publishers for PC, consoles, handheld, and mobile devices.

Top 50 Leading Indie Game Publishers to Fund Your Indie Games - Highlights leading indie game publishers such as Humble Games, tinyBuild, Team17, and Gearbox Publishing, focusing on companies that fund and support indie games across platforms.

List of video game publishers - Wikipedia - Extensive alphabetical listing of video game publishers worldwide, including major companies and defunct publishers, illustrating the breadth of the industry.

dowidth.com

dowidth.com