Whiskey barrel investment offers a unique alternative asset class with potential for value appreciation as rare barrels mature and scarcity increases, contrasting with classic car investment which relies heavily on historical significance, condition, and market demand. Both investments require careful market analysis and understanding of factors like aging, provenance, and liquidity, but whiskey barrels may benefit from continuous appreciation during maturation. Explore more about the risks, returns, and market dynamics of these distinctive investment opportunities.

Why it is important

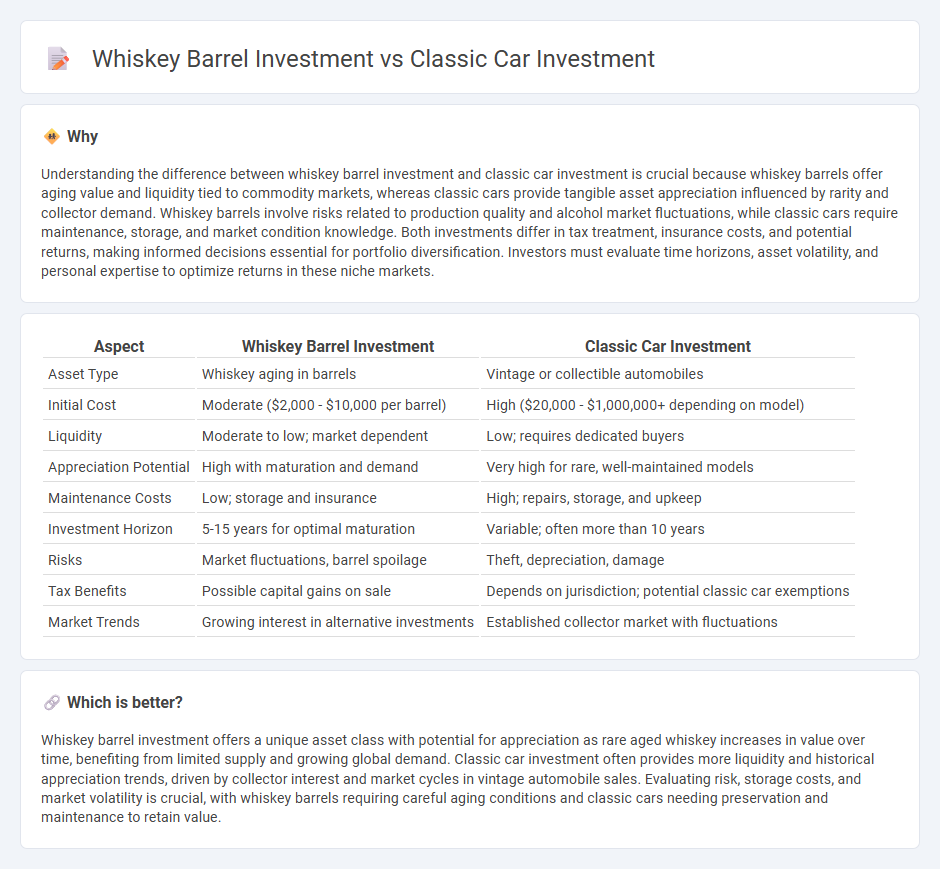

Understanding the difference between whiskey barrel investment and classic car investment is crucial because whiskey barrels offer aging value and liquidity tied to commodity markets, whereas classic cars provide tangible asset appreciation influenced by rarity and collector demand. Whiskey barrels involve risks related to production quality and alcohol market fluctuations, while classic cars require maintenance, storage, and market condition knowledge. Both investments differ in tax treatment, insurance costs, and potential returns, making informed decisions essential for portfolio diversification. Investors must evaluate time horizons, asset volatility, and personal expertise to optimize returns in these niche markets.

Comparison Table

| Aspect | Whiskey Barrel Investment | Classic Car Investment |

|---|---|---|

| Asset Type | Whiskey aging in barrels | Vintage or collectible automobiles |

| Initial Cost | Moderate ($2,000 - $10,000 per barrel) | High ($20,000 - $1,000,000+ depending on model) |

| Liquidity | Moderate to low; market dependent | Low; requires dedicated buyers |

| Appreciation Potential | High with maturation and demand | Very high for rare, well-maintained models |

| Maintenance Costs | Low; storage and insurance | High; repairs, storage, and upkeep |

| Investment Horizon | 5-15 years for optimal maturation | Variable; often more than 10 years |

| Risks | Market fluctuations, barrel spoilage | Theft, depreciation, damage |

| Tax Benefits | Possible capital gains on sale | Depends on jurisdiction; potential classic car exemptions |

| Market Trends | Growing interest in alternative investments | Established collector market with fluctuations |

Which is better?

Whiskey barrel investment offers a unique asset class with potential for appreciation as rare aged whiskey increases in value over time, benefiting from limited supply and growing global demand. Classic car investment often provides more liquidity and historical appreciation trends, driven by collector interest and market cycles in vintage automobile sales. Evaluating risk, storage costs, and market volatility is crucial, with whiskey barrels requiring careful aging conditions and classic cars needing preservation and maintenance to retain value.

Connection

Whiskey barrel investment and classic car investment both represent alternative asset classes that offer potential value appreciation through rarity, historical significance, and limited availability. These investments share characteristics such as tangible ownership, market-driven valuation increases, and appeal to collectors seeking both financial returns and passion assets. Their market dynamics are influenced by trends in luxury goods, scarcity, and cultural heritage, making them attractive diversification options beyond traditional stocks and bonds.

Key Terms

Classic Car Investment:

Classic car investment offers tangible assets with appreciating value based on rarity, brand prestige, and historical significance, often outperforming traditional markets over long periods. Factors such as maintenance costs, storage conditions, and market trends in collectible vehicles significantly affect returns. Explore comprehensive insights on maximizing gains and risk management in classic car investments.

Provenance

Classic car investment relies heavily on documented provenance to authenticate rarity and enhance value, with detailed ownership history and maintenance records playing pivotal roles. Whiskey barrel investment values provenance through distillery reputation, aging process, and cask uniqueness, which directly influence market demand and price appreciation. Explore detailed guides to understand the impact of provenance on these distinct alternative investments.

Restoration

Classic car investment often requires extensive restoration involving parts sourcing, skilled labor, and substantial capital to enhance vehicle value and authenticity. Whiskey barrel investment centers on optimal aging conditions and barrel quality to increase the spirit's maturity and market worth. Explore detailed strategies to maximize returns in both restoration-focused investments.

Source and External Links

Investing in Classic Cars - Nationwide - Classic car investment involves buying vehicles typically 15-25 years old or older that have unique qualities such as rarity or limited production, providing both financial return and personal enjoyment; values have risen significantly, with a 500% increase noted between 2004 and 2014.

How to Invest in Classic Cars | Nasdaq - Successful classic car investing requires thorough market research, understanding maintenance and storage costs, and a long-term perspective, as value depends on rarity, condition, and market trends, making it both a financial opportunity and a passion-driven investment.

Cars | Rally | Alternative Asset Investment - The global classic car market, valued over $30 billion, is considered a strong alternative investment with historical stable returns and low volatility, exemplified by remarkable appreciation in models like the 1955 Porsche 356 Speedster, which saw a 568.5% gain from 2002 to 2021.

dowidth.com

dowidth.com