Collectible sneakers have surged in value due to limited editions and cultural influence, attracting younger investors seeking high returns in shorter timeframes. Classic cars offer long-term appreciation driven by rarity, historical significance, and meticulous restoration, appealing to traditional collectors and luxury asset enthusiasts. Explore the distinct investment opportunities and risks of collectible sneakers versus classic cars to make informed decisions.

Why it is important

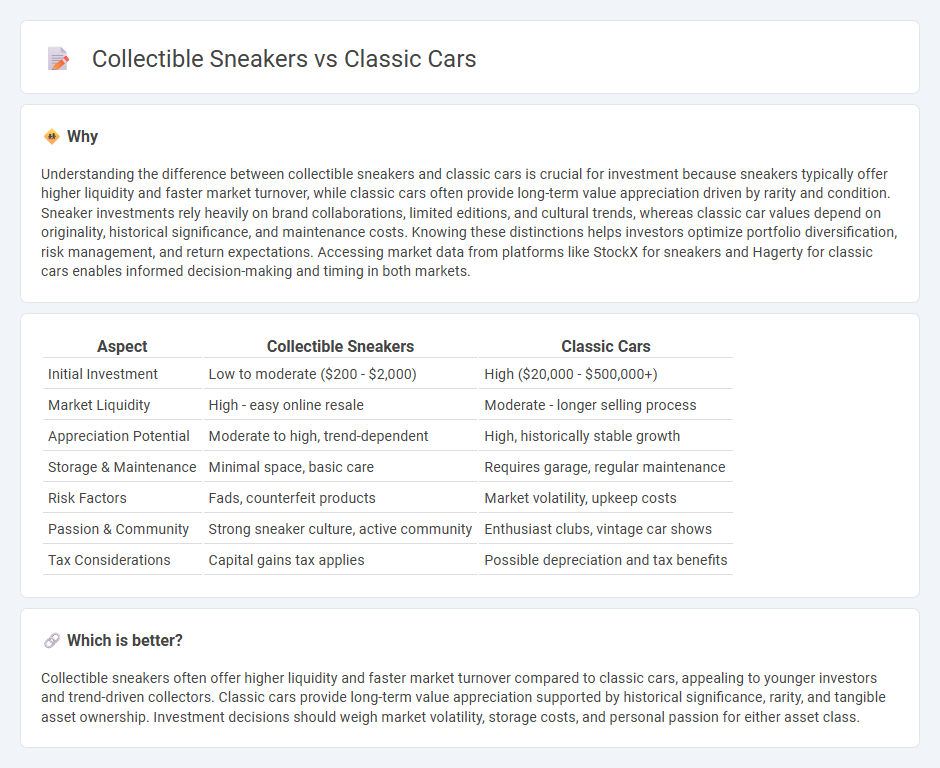

Understanding the difference between collectible sneakers and classic cars is crucial for investment because sneakers typically offer higher liquidity and faster market turnover, while classic cars often provide long-term value appreciation driven by rarity and condition. Sneaker investments rely heavily on brand collaborations, limited editions, and cultural trends, whereas classic car values depend on originality, historical significance, and maintenance costs. Knowing these distinctions helps investors optimize portfolio diversification, risk management, and return expectations. Accessing market data from platforms like StockX for sneakers and Hagerty for classic cars enables informed decision-making and timing in both markets.

Comparison Table

| Aspect | Collectible Sneakers | Classic Cars |

|---|---|---|

| Initial Investment | Low to moderate ($200 - $2,000) | High ($20,000 - $500,000+) |

| Market Liquidity | High - easy online resale | Moderate - longer selling process |

| Appreciation Potential | Moderate to high, trend-dependent | High, historically stable growth |

| Storage & Maintenance | Minimal space, basic care | Requires garage, regular maintenance |

| Risk Factors | Fads, counterfeit products | Market volatility, upkeep costs |

| Passion & Community | Strong sneaker culture, active community | Enthusiast clubs, vintage car shows |

| Tax Considerations | Capital gains tax applies | Possible depreciation and tax benefits |

Which is better?

Collectible sneakers often offer higher liquidity and faster market turnover compared to classic cars, appealing to younger investors and trend-driven collectors. Classic cars provide long-term value appreciation supported by historical significance, rarity, and tangible asset ownership. Investment decisions should weigh market volatility, storage costs, and personal passion for either asset class.

Connection

Collectible sneakers and classic cars both represent alternative investment assets that combine cultural significance with scarcity and high demand. Their value is driven by limited editions, historical importance, and strong community engagement, which create robust secondary markets. Investors seek these tangible assets for portfolio diversification alongside traditional stocks and bonds due to their potential for substantial appreciation over time.

Key Terms

Appreciation

Classic cars and collectible sneakers both experience appreciation, driven by rarity, condition, and cultural significance, with classic cars often benefiting from decades of historical value and tangible craftsmanship. Collectible sneakers gain value through limited releases, brand collaborations, and influence within streetwear culture, frequently appreciating rapidly over a shorter time span. Explore detailed analyses of market trends and investment potential in both to understand their unique appreciation dynamics.

Rarity

Classic cars often gain value through limited production runs and unique historical significance, making models like the 1962 Ferrari 250 GTO incredibly rare and sought after. Collectible sneakers achieve rarity through limited editions and collaborations, exemplified by releases like the Nike Air Yeezy 1, which are produced in small quantities and often tied to high-profile personalities. Explore how rarity drives value in both markets and discover key factors influencing collectibility today.

Liquidity

Classic cars typically offer high liquidity in niche markets with auction houses and specialized dealers facilitating quick sales, but valuation varies widely based on rarity and condition. Collectible sneakers exhibit growing liquidity due to online platforms like StockX and GOAT, enabling real-time price discovery and rapid transactions driven by limited releases and brand hype. Explore the evolving dynamics of asset liquidity in these unique collector domains to understand investment potential.

Source and External Links

Classic Auto Mall Inventory - Features a curated indoor collection of American and European classic, muscle, and specialty cars from the 1940s to 2020s, including rare models and well-preserved originals.

Classics on Autotrader - A national marketplace with thousands of classic cars and trucks for sale, spanning popular makes like Chevrolet, Ford, and Porsche, as well as upcoming auction events.

ClassicCars.com - The largest online platform offering over 38,000 classic, collector, and vintage vehicles for sale, including American, European, and Asian brands, with detailed listings from private sellers and dealers.

dowidth.com

dowidth.com