Wine investing offers tangible asset growth through the appreciation of rare vintage bottles, often insulated from stock market volatility. Peer-to-peer lending provides diversified income streams by connecting investors directly with borrowers through online platforms, yielding higher returns but with increased credit risk. Discover the advantages and risks of both to determine the best fit for your investment portfolio.

Why it is important

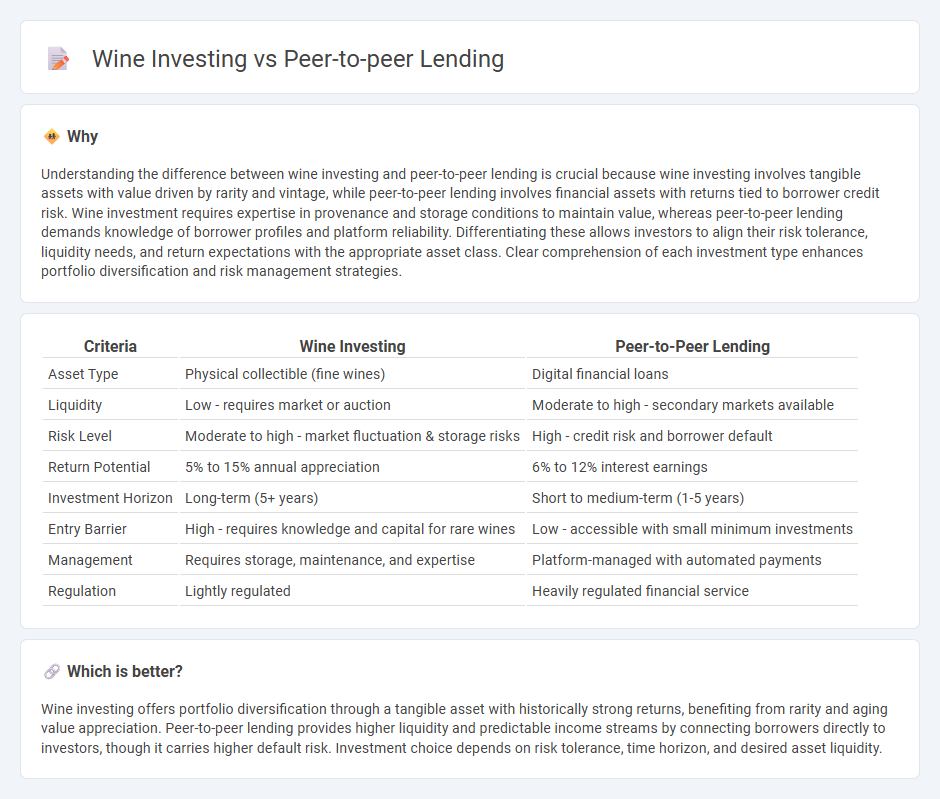

Understanding the difference between wine investing and peer-to-peer lending is crucial because wine investing involves tangible assets with value driven by rarity and vintage, while peer-to-peer lending involves financial assets with returns tied to borrower credit risk. Wine investment requires expertise in provenance and storage conditions to maintain value, whereas peer-to-peer lending demands knowledge of borrower profiles and platform reliability. Differentiating these allows investors to align their risk tolerance, liquidity needs, and return expectations with the appropriate asset class. Clear comprehension of each investment type enhances portfolio diversification and risk management strategies.

Comparison Table

| Criteria | Wine Investing | Peer-to-Peer Lending |

|---|---|---|

| Asset Type | Physical collectible (fine wines) | Digital financial loans |

| Liquidity | Low - requires market or auction | Moderate to high - secondary markets available |

| Risk Level | Moderate to high - market fluctuation & storage risks | High - credit risk and borrower default |

| Return Potential | 5% to 15% annual appreciation | 6% to 12% interest earnings |

| Investment Horizon | Long-term (5+ years) | Short to medium-term (1-5 years) |

| Entry Barrier | High - requires knowledge and capital for rare wines | Low - accessible with small minimum investments |

| Management | Requires storage, maintenance, and expertise | Platform-managed with automated payments |

| Regulation | Lightly regulated | Heavily regulated financial service |

Which is better?

Wine investing offers portfolio diversification through a tangible asset with historically strong returns, benefiting from rarity and aging value appreciation. Peer-to-peer lending provides higher liquidity and predictable income streams by connecting borrowers directly to investors, though it carries higher default risk. Investment choice depends on risk tolerance, time horizon, and desired asset liquidity.

Connection

Wine investing and peer-to-peer lending intersect through alternative asset financing, where investors diversify portfolios by combining tangible assets like fine wine with direct lending opportunities. Both methods leverage market inefficiencies, providing high potential returns independent of traditional stock markets. Utilizing platforms that facilitate peer-to-peer lending can fund wine acquisitions and vineyard expansions, creating symbiotic financial growth avenues.

Key Terms

Risk diversification

Peer-to-peer lending offers risk diversification by spreading investments across multiple borrowers, reducing exposure to individual defaults through platform credit assessments and borrower vetting. Wine investing diversifies risk by focusing on tangible assets whose value often appreciates over time, with market demand influenced by rarity and provenance rather than economic cycles. Explore detailed comparisons to understand which risk diversification strategy aligns best with your investment goals.

Liquidity

Peer-to-peer lending platforms typically offer moderate liquidity, allowing investors to exit early through secondary markets, though availability and pricing can vary. Wine investing generally presents lower liquidity, with transactions often requiring time-consuming auctions or private sales and higher transaction costs. Explore more insights on managing liquidity in alternative investments to optimize your portfolio strategy.

Return on investment (ROI)

Peer-to-peer lending offers average ROI between 5% and 12%, with relatively low risk and liquidity, making it a popular choice for steady income. Wine investing, while less liquid and more volatile, can yield ROI ranging from 8% to 15% depending on the vintage and market trends, often benefiting from rarity and collector demand. Explore detailed comparisons on risk profiles, liquidity, and market behavior to determine the optimal investment strategy for your portfolio.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P) is an online method of lending money directly to individuals or businesses through platforms that match lenders and borrowers, often without traditional financial intermediaries, featuring unsecured or secured loans and enabling lenders to choose borrowers or invest broadly with services including credit checks and loan servicing provided by the platform.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending allows individuals to lend money to borrowers online as an alternative to banks, typically offering higher interest rates with higher risk, where lenders can either spread their money across many loans or select individual borrowers, and it is important to use FCA-regulated platforms.

Peer-to-Peer Lending - NASAA - Peer-to-peer lending is an online financial service facilitating unsecured loans from individuals to others via an internet marketplace, often for loans between $1,000 and $25,000, serving as an alternative when traditional bank loans are difficult to obtain.

dowidth.com

dowidth.com