Litigation funding involves financing legal cases in exchange for a portion of the settlement or judgment, offering high returns linked to case outcomes and legal expertise. Infrastructure investment focuses on long-term projects such as roads, bridges, and energy assets that provide steady cash flow and lower risk due to government backing and essential service demand. Explore the key differences, risks, and benefits to determine which investment aligns with your financial goals.

Why it is important

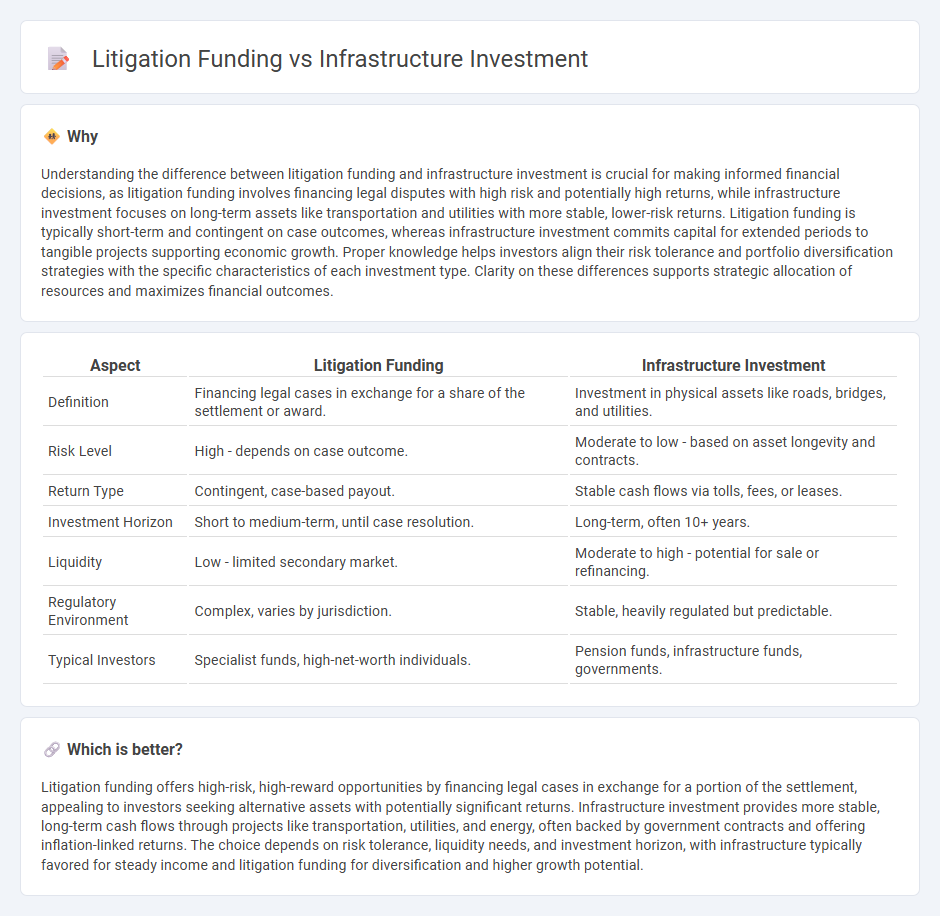

Understanding the difference between litigation funding and infrastructure investment is crucial for making informed financial decisions, as litigation funding involves financing legal disputes with high risk and potentially high returns, while infrastructure investment focuses on long-term assets like transportation and utilities with more stable, lower-risk returns. Litigation funding is typically short-term and contingent on case outcomes, whereas infrastructure investment commits capital for extended periods to tangible projects supporting economic growth. Proper knowledge helps investors align their risk tolerance and portfolio diversification strategies with the specific characteristics of each investment type. Clarity on these differences supports strategic allocation of resources and maximizes financial outcomes.

Comparison Table

| Aspect | Litigation Funding | Infrastructure Investment |

|---|---|---|

| Definition | Financing legal cases in exchange for a share of the settlement or award. | Investment in physical assets like roads, bridges, and utilities. |

| Risk Level | High - depends on case outcome. | Moderate to low - based on asset longevity and contracts. |

| Return Type | Contingent, case-based payout. | Stable cash flows via tolls, fees, or leases. |

| Investment Horizon | Short to medium-term, until case resolution. | Long-term, often 10+ years. |

| Liquidity | Low - limited secondary market. | Moderate to high - potential for sale or refinancing. |

| Regulatory Environment | Complex, varies by jurisdiction. | Stable, heavily regulated but predictable. |

| Typical Investors | Specialist funds, high-net-worth individuals. | Pension funds, infrastructure funds, governments. |

Which is better?

Litigation funding offers high-risk, high-reward opportunities by financing legal cases in exchange for a portion of the settlement, appealing to investors seeking alternative assets with potentially significant returns. Infrastructure investment provides more stable, long-term cash flows through projects like transportation, utilities, and energy, often backed by government contracts and offering inflation-linked returns. The choice depends on risk tolerance, liquidity needs, and investment horizon, with infrastructure typically favored for steady income and litigation funding for diversification and higher growth potential.

Connection

Litigation funding and infrastructure investment are connected through the strategic allocation of capital to high-value, long-term projects with predictable returns. Infrastructure projects require substantial upfront funding, often supported by litigation finance firms that invest in legal claims related to project disputes or contract enforcement. This intersection allows investors to diversify risk by combining stable infrastructure assets with litigation portfolios that can generate premium yields upon successful case resolutions.

Key Terms

**Infrastructure investment:**

Infrastructure investment involves allocating capital to projects such as transportation networks, energy facilities, and utilities, offering stable, long-term returns linked to essential public services. It typically provides predictable cash flows and low correlation with traditional financial markets, making it a key diversifier in investment portfolios. Discover more about how infrastructure investment can enhance portfolio resilience and generate steady income streams.

Public-Private Partnership (PPP)

Infrastructure investment in Public-Private Partnerships (PPPs) involves allocating capital to develop essential public assets such as roads, bridges, and utilities, driving economic growth and improving community services. Litigation funding, by contrast, provides financial support to legal cases, enabling parties to pursue claims without immediate financial burden but does not contribute directly to physical infrastructure development. Explore the comprehensive advantages and strategic roles of PPPs in infrastructure financing to understand how they shape modern public projects.

Capital Expenditure (CapEx)

Infrastructure investment typically involves significant Capital Expenditure (CapEx) for projects like transportation, energy, and utilities, which provide long-term asset growth and steady cash flow. Litigation funding, by contrast, requires relatively lower CapEx, focusing instead on financing legal claims with the potential for high returns but increased risk and liquidity challenges. Discover how these distinct capital allocation strategies impact portfolio diversification and risk management.

Source and External Links

Investment Pays - ASCE's 2025 Infrastructure Report Card - The U.S. infrastructure investment need through 2033 totals $9.1 trillion with significant gaps in roads, bridges, energy, and water systems funding despite current federal investments.

Infrastructure investment - OECD - Infrastructure investment includes spending on new transport construction and improvements, critically boosting economic productivity and regional development across different countries.

The basics of infrastructure investing | abrdn - Aberdeen Group - Long-term infrastructure investment is driven by themes such as energy transition, demographic changes, and urbanization, offering diverse opportunities including renewable energy and transport network upgrades.

dowidth.com

dowidth.com