Private credit funds offer direct lending opportunities with potentially higher returns and lower volatility compared to high-yield bonds, which are debt securities issued by companies with lower credit ratings and come with greater market risk. These funds often provide investors with diversification benefits and access to illiquid assets not readily available in public bond markets. Explore the differences between private credit funds and high-yield bonds to determine the best fit for your investment strategy.

Why it is important

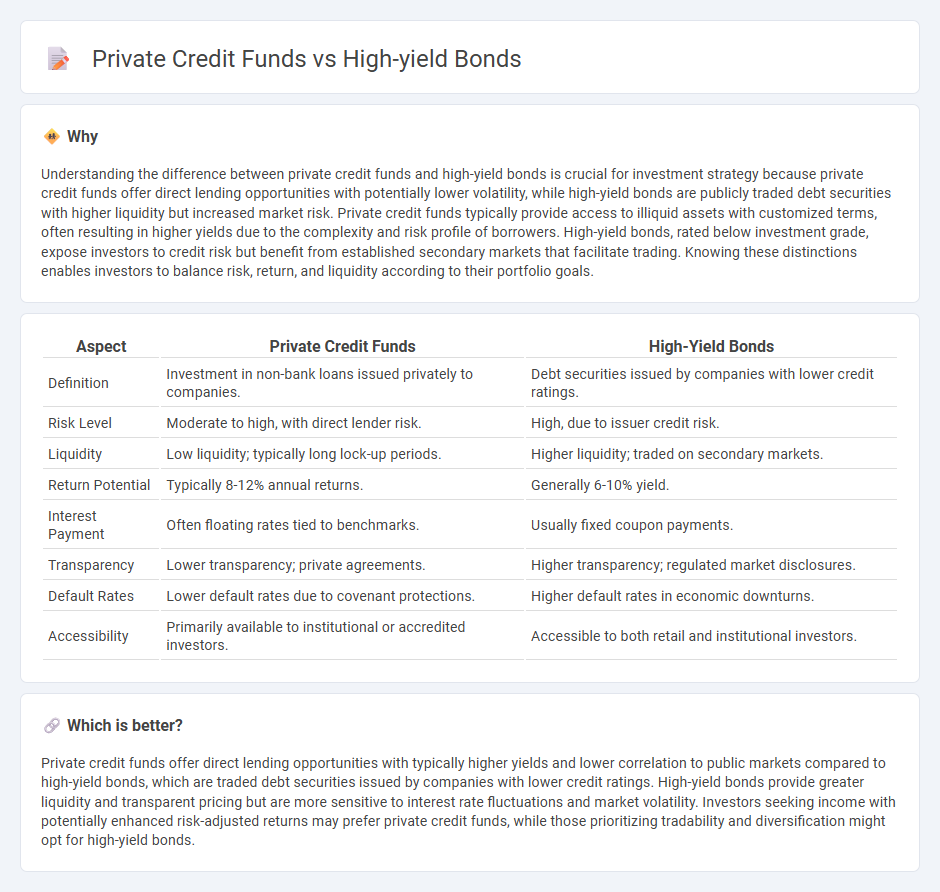

Understanding the difference between private credit funds and high-yield bonds is crucial for investment strategy because private credit funds offer direct lending opportunities with potentially lower volatility, while high-yield bonds are publicly traded debt securities with higher liquidity but increased market risk. Private credit funds typically provide access to illiquid assets with customized terms, often resulting in higher yields due to the complexity and risk profile of borrowers. High-yield bonds, rated below investment grade, expose investors to credit risk but benefit from established secondary markets that facilitate trading. Knowing these distinctions enables investors to balance risk, return, and liquidity according to their portfolio goals.

Comparison Table

| Aspect | Private Credit Funds | High-Yield Bonds |

|---|---|---|

| Definition | Investment in non-bank loans issued privately to companies. | Debt securities issued by companies with lower credit ratings. |

| Risk Level | Moderate to high, with direct lender risk. | High, due to issuer credit risk. |

| Liquidity | Low liquidity; typically long lock-up periods. | Higher liquidity; traded on secondary markets. |

| Return Potential | Typically 8-12% annual returns. | Generally 6-10% yield. |

| Interest Payment | Often floating rates tied to benchmarks. | Usually fixed coupon payments. |

| Transparency | Lower transparency; private agreements. | Higher transparency; regulated market disclosures. |

| Default Rates | Lower default rates due to covenant protections. | Higher default rates in economic downturns. |

| Accessibility | Primarily available to institutional or accredited investors. | Accessible to both retail and institutional investors. |

Which is better?

Private credit funds offer direct lending opportunities with typically higher yields and lower correlation to public markets compared to high-yield bonds, which are traded debt securities issued by companies with lower credit ratings. High-yield bonds provide greater liquidity and transparent pricing but are more sensitive to interest rate fluctuations and market volatility. Investors seeking income with potentially enhanced risk-adjusted returns may prefer private credit funds, while those prioritizing tradability and diversification might opt for high-yield bonds.

Connection

Private credit funds and high-yield bonds are both investment vehicles that target higher returns through lending to borrowers with lower credit ratings or limited access to traditional financing. Private credit funds often provide direct loans to middle-market companies, offering customized terms and potentially higher yields compared to public high-yield bonds, which are traded in fixed-income markets. Both assets carry increased risk and are appealing for portfolio diversification and enhanced income generation in a low-interest-rate environment.

Key Terms

Credit risk

High-yield bonds typically present higher credit risk due to their lower credit ratings and greater susceptibility to default during economic downturns. Private credit funds often mitigate credit risk through direct lending, enhanced due diligence, and covenants that provide greater control over borrower behavior. To understand the nuanced differences and strategic implications of credit risk in these investment options, explore our detailed analysis.

Liquidity

High-yield bonds offer greater liquidity than private credit funds, as they are traded on public markets with regular pricing and easier access to buy or sell. Private credit funds typically involve longer lock-up periods and limited secondary market options, resulting in lower liquidity for investors. Explore in-depth comparisons to understand which investment aligns best with your liquidity needs.

Yield premium

High-yield bonds typically offer a yield premium ranging from 300 to 600 basis points over investment-grade bonds due to higher default risk and market liquidity factors. Private credit funds provide potentially higher yield premiums, often between 400 and 800 basis points, by targeting illiquid, less transparent middle-market loans with lower correlation to public markets. Explore detailed comparisons and risk-adjusted returns to understand which option best suits your investment strategy.

Source and External Links

Understanding High Yield Bonds | PIMCO - This webpage provides an overview of high-yield bonds, highlighting their role in portfolios for diversification and potentially higher returns compared to investment-grade bonds.

5 Best High-Yield Bond Funds - Bankrate - This webpage lists top high-yield bond funds, offering insights into investing in these bonds through mutual funds and ETFs for those willing to take on higher credit risk.

What Are High-yield Corporate Bonds? | SEC.gov - This SEC investor bulletin explains high-yield corporate bonds, also known as "junk bonds," which offer higher yields to compensate for higher default risk.

dowidth.com

dowidth.com