Music royalties platforms offer investors consistent income streams by acquiring rights to songs, benefiting from streaming and licensing revenues. Luxury watch investment platforms focus on acquiring rare, high-value timepieces that appreciate over time due to brand prestige, scarcity, and market demand. Discover how each platform uniquely capitalizes on alternative asset classes to diversify your investment portfolio.

Why it is important

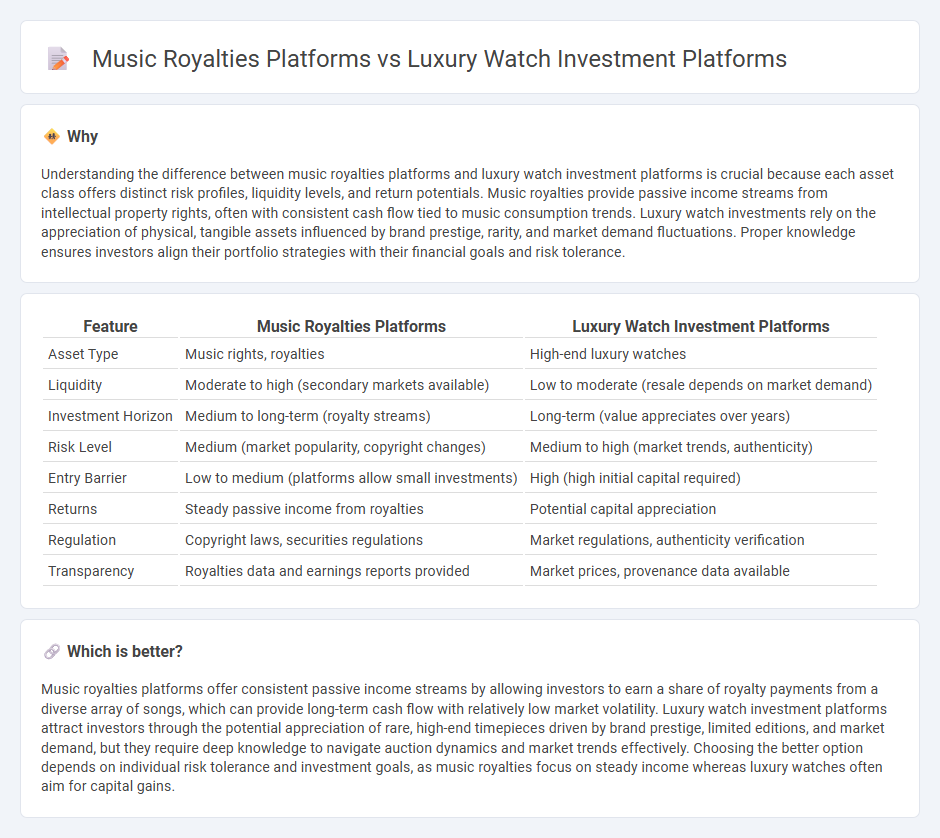

Understanding the difference between music royalties platforms and luxury watch investment platforms is crucial because each asset class offers distinct risk profiles, liquidity levels, and return potentials. Music royalties provide passive income streams from intellectual property rights, often with consistent cash flow tied to music consumption trends. Luxury watch investments rely on the appreciation of physical, tangible assets influenced by brand prestige, rarity, and market demand fluctuations. Proper knowledge ensures investors align their portfolio strategies with their financial goals and risk tolerance.

Comparison Table

| Feature | Music Royalties Platforms | Luxury Watch Investment Platforms |

|---|---|---|

| Asset Type | Music rights, royalties | High-end luxury watches |

| Liquidity | Moderate to high (secondary markets available) | Low to moderate (resale depends on market demand) |

| Investment Horizon | Medium to long-term (royalty streams) | Long-term (value appreciates over years) |

| Risk Level | Medium (market popularity, copyright changes) | Medium to high (market trends, authenticity) |

| Entry Barrier | Low to medium (platforms allow small investments) | High (high initial capital required) |

| Returns | Steady passive income from royalties | Potential capital appreciation |

| Regulation | Copyright laws, securities regulations | Market regulations, authenticity verification |

| Transparency | Royalties data and earnings reports provided | Market prices, provenance data available |

Which is better?

Music royalties platforms offer consistent passive income streams by allowing investors to earn a share of royalty payments from a diverse array of songs, which can provide long-term cash flow with relatively low market volatility. Luxury watch investment platforms attract investors through the potential appreciation of rare, high-end timepieces driven by brand prestige, limited editions, and market demand, but they require deep knowledge to navigate auction dynamics and market trends effectively. Choosing the better option depends on individual risk tolerance and investment goals, as music royalties focus on steady income whereas luxury watches often aim for capital gains.

Connection

Music royalties platforms and luxury watch investment platforms both leverage alternative asset classes to diversify investment portfolios and generate passive income streams. Both markets rely on valuation models that incorporate rarity, demand, and historical performance, attracting investors seeking long-term appreciation beyond traditional stocks and bonds. These platforms use digital technology to fractionalize ownership, enabling broader access and liquidity in typically illiquid asset markets.

Key Terms

Asset Valuation

Luxury watch investment platforms emphasize tangible asset valuation based on brand prestige, rarity, condition, and provenance, often supported by expert appraisals and market demand trends. Music royalties platforms rely on income-based valuation, analyzing historical royalties, streaming data, and contract terms to project future cash flows and overall asset worth. Discover more about how asset valuation methods shape investment strategies across these unique industries.

Liquidity

Luxury watch investment platforms offer higher liquidity through secondary markets where investors can buy and sell authenticated timepieces with relative ease. Music royalty platforms, while providing steady income streams from song royalties, typically exhibit lower liquidity due to the niche market and longer contract durations. Explore detailed comparisons to understand how liquidity impacts your investment strategy in these asset classes.

Ownership Structure

Luxury watch investment platforms typically offer fractional ownership or collective investment schemes, where investors buy shares in a pool of high-value timepieces managed by the platform. Music royalties platforms provide direct ownership or revenue-sharing rights to investors, allowing users to earn income based on the performance of specific songs or catalogs. Explore the nuances of these ownership models to determine which investment aligns best with your portfolio goals.

Source and External Links

Invest in luxury watches - Offers investment opportunities in luxury watches from top brands like Rolex, Patek Philippe, Audemars Piguet, with portfolios tailored by investment scale and minimum 2-year commitment.

The Beginner's Guide to Watch Investing: How to Get Started - Kubera - Describes watch investing funds and fractional investing platforms like Rally, allowing diversified investments in collectible watches via managed funds or shared ownership.

JAY-Z Invests in Luxury Watch Trading Platform Wristcheck - Wristcheck is a luxury watch trading platform backed by celebrity investors, offering a trusted marketplace focused on high-end watch consumers and sellers.

dowidth.com

dowidth.com