Whiskey cask investment offers unique benefits such as tangible asset appreciation, potential for rare cask value increase, and a niche market less correlated with traditional financial markets compared to gold investment, which is known for liquidity, historic stability, and global acceptance as a safe-haven asset. Whiskey casks can mature and increase in value over time due to aging and limited availability, while gold maintains intrinsic worth irrespective of economic cycles. Explore the detailed advantages and risks of whiskey cask versus gold investment to make an informed decision.

Why it is important

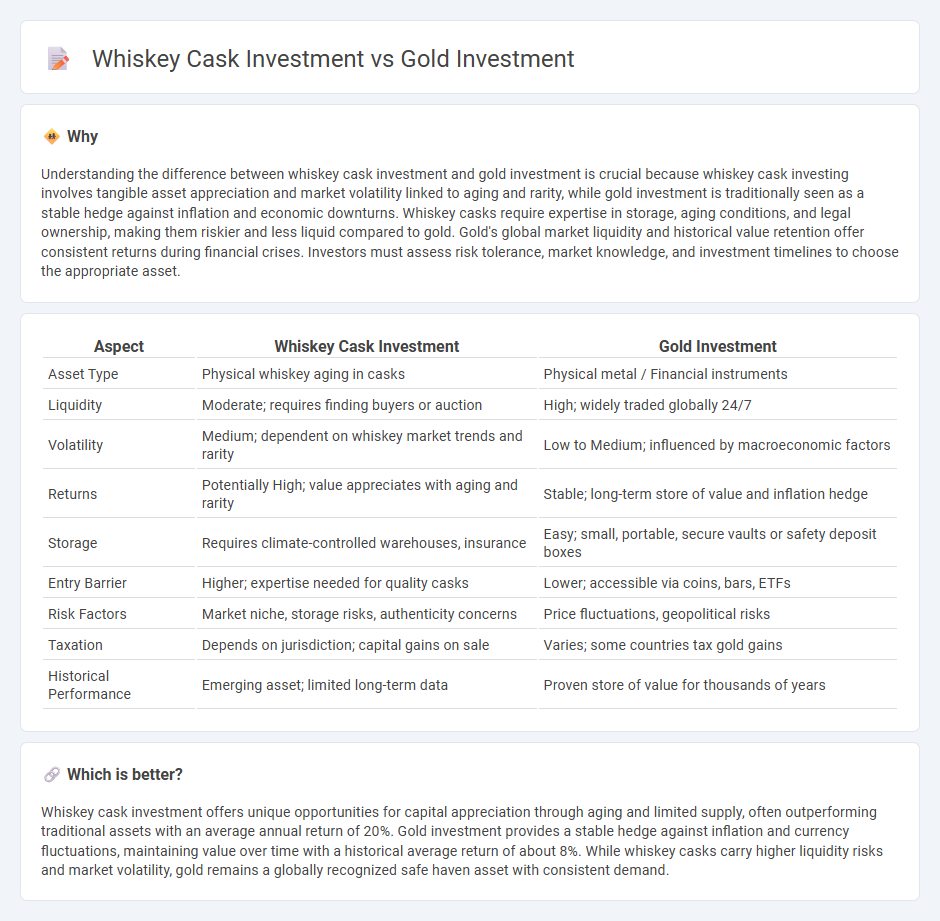

Understanding the difference between whiskey cask investment and gold investment is crucial because whiskey cask investing involves tangible asset appreciation and market volatility linked to aging and rarity, while gold investment is traditionally seen as a stable hedge against inflation and economic downturns. Whiskey casks require expertise in storage, aging conditions, and legal ownership, making them riskier and less liquid compared to gold. Gold's global market liquidity and historical value retention offer consistent returns during financial crises. Investors must assess risk tolerance, market knowledge, and investment timelines to choose the appropriate asset.

Comparison Table

| Aspect | Whiskey Cask Investment | Gold Investment |

|---|---|---|

| Asset Type | Physical whiskey aging in casks | Physical metal / Financial instruments |

| Liquidity | Moderate; requires finding buyers or auction | High; widely traded globally 24/7 |

| Volatility | Medium; dependent on whiskey market trends and rarity | Low to Medium; influenced by macroeconomic factors |

| Returns | Potentially High; value appreciates with aging and rarity | Stable; long-term store of value and inflation hedge |

| Storage | Requires climate-controlled warehouses, insurance | Easy; small, portable, secure vaults or safety deposit boxes |

| Entry Barrier | Higher; expertise needed for quality casks | Lower; accessible via coins, bars, ETFs |

| Risk Factors | Market niche, storage risks, authenticity concerns | Price fluctuations, geopolitical risks |

| Taxation | Depends on jurisdiction; capital gains on sale | Varies; some countries tax gold gains |

| Historical Performance | Emerging asset; limited long-term data | Proven store of value for thousands of years |

Which is better?

Whiskey cask investment offers unique opportunities for capital appreciation through aging and limited supply, often outperforming traditional assets with an average annual return of 20%. Gold investment provides a stable hedge against inflation and currency fluctuations, maintaining value over time with a historical average return of about 8%. While whiskey casks carry higher liquidity risks and market volatility, gold remains a globally recognized safe haven asset with consistent demand.

Connection

Whiskey cask investment and gold investment share a common appeal as tangible, alternative assets that hedge against inflation and market volatility. Both assets benefit from scarcity and historical value retention, with whiskey aging improving its worth over time similar to how gold preserves its intrinsic value. Investors diversify portfolios by including these physical commodities to balance risks associated with traditional financial instruments.

Key Terms

Liquidity

Gold investment offers high liquidity, enabling quick buying and selling through well-established global markets and exchanges. Whiskey cask investment, while potentially lucrative, tends to have lower liquidity due to limited buyers and longer holding periods required for maturation. Explore detailed comparisons and strategies to maximize liquidity benefits in both investment types.

Storage

Gold investment requires secure, insured storage facilities such as vaults or safety deposit boxes to prevent theft and damage, with costs varying based on location and security level. Whiskey cask investment demands specialized storage in bonded warehouses that maintain specific temperature and humidity conditions to preserve quality and comply with legal regulations. Explore detailed comparisons of storage requirements and costs to choose the best investment strategy.

Market Volatility

Gold investment offers a traditionally stable store of value with low correlation to market volatility, often serving as a hedge during economic downturns and inflationary periods. Whiskey cask investment, while less liquid and more niche, can experience unique market fluctuations influenced by trends in luxury collectibles and aging potential, with returns tied closely to cask rarity and demand cycles. Explore more insights on balancing portfolio risk through these alternative assets.

Source and External Links

How to Buy Gold to Diversify Your Portfolio | Charles Schwab - Gold can be added to a portfolio through physical gold (bars, coins), gold mining stocks, or gold ETFs, offering diversification and a potential hedge against market stress.

How To Invest In Different Gold Assets - Gold serves as a diversifier, long-term return source, liquid asset, and portfolio enhancer, with studies suggesting a 4%-15% allocation can improve risk-adjusted returns.

How to buy gold: 2 ways to invest in gold | Fidelity - Investors can choose between physical gold or gold-related financial products like ETFs, mutual funds, futures, and mining stocks, each with distinct characteristics and levels of complexity.

dowidth.com

dowidth.com