Collectible sneakers represent a tangible investment driven by cultural trends and limited editions that can appreciate significantly over time. Venture capital involves providing equity funding to startups with high growth potential, balancing risk with the possibility of substantial financial returns. Explore the differences between these unique investment avenues to determine which aligns with your portfolio goals.

Why it is important

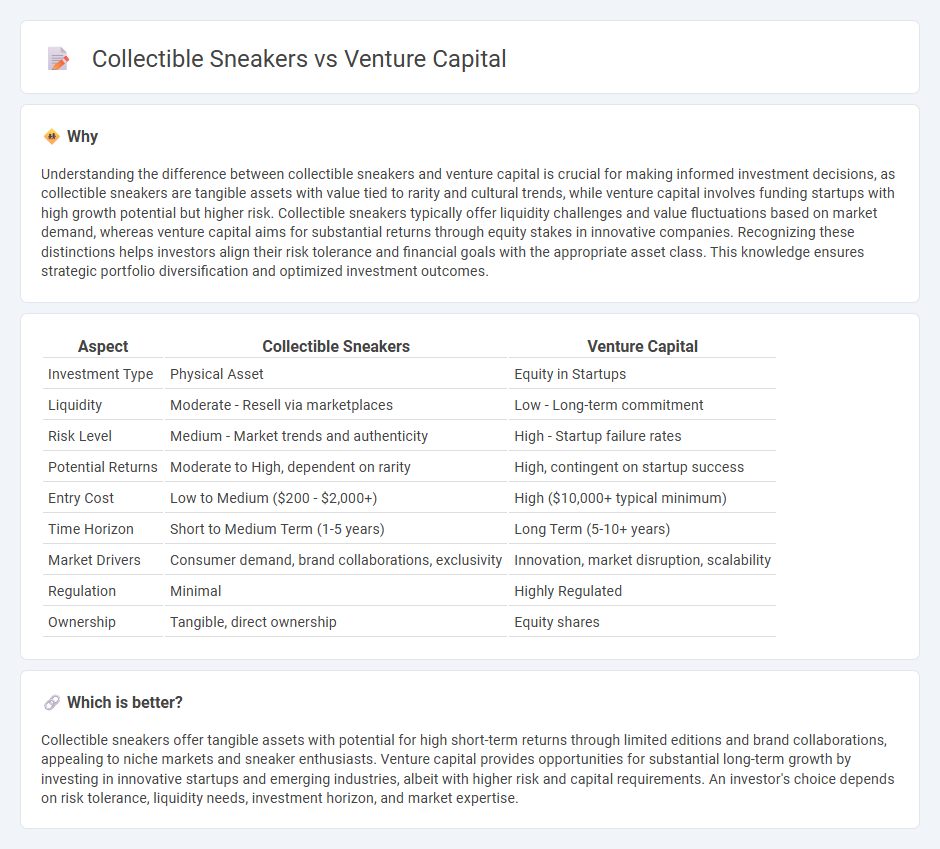

Understanding the difference between collectible sneakers and venture capital is crucial for making informed investment decisions, as collectible sneakers are tangible assets with value tied to rarity and cultural trends, while venture capital involves funding startups with high growth potential but higher risk. Collectible sneakers typically offer liquidity challenges and value fluctuations based on market demand, whereas venture capital aims for substantial returns through equity stakes in innovative companies. Recognizing these distinctions helps investors align their risk tolerance and financial goals with the appropriate asset class. This knowledge ensures strategic portfolio diversification and optimized investment outcomes.

Comparison Table

| Aspect | Collectible Sneakers | Venture Capital |

|---|---|---|

| Investment Type | Physical Asset | Equity in Startups |

| Liquidity | Moderate - Resell via marketplaces | Low - Long-term commitment |

| Risk Level | Medium - Market trends and authenticity | High - Startup failure rates |

| Potential Returns | Moderate to High, dependent on rarity | High, contingent on startup success |

| Entry Cost | Low to Medium ($200 - $2,000+) | High ($10,000+ typical minimum) |

| Time Horizon | Short to Medium Term (1-5 years) | Long Term (5-10+ years) |

| Market Drivers | Consumer demand, brand collaborations, exclusivity | Innovation, market disruption, scalability |

| Regulation | Minimal | Highly Regulated |

| Ownership | Tangible, direct ownership | Equity shares |

Which is better?

Collectible sneakers offer tangible assets with potential for high short-term returns through limited editions and brand collaborations, appealing to niche markets and sneaker enthusiasts. Venture capital provides opportunities for substantial long-term growth by investing in innovative startups and emerging industries, albeit with higher risk and capital requirements. An investor's choice depends on risk tolerance, liquidity needs, investment horizon, and market expertise.

Connection

Collectible sneakers have emerged as alternative assets attracting venture capital due to their high resale value and growing market demand. Venture capital firms invest in startups specializing in sneaker authentication, trading platforms, and fractional ownership models to capitalize on this lucrative niche. The intersection of sneaker culture and technology creates scalable investment opportunities that drive innovation and market expansion.

Key Terms

**Venture Capital:**

Venture capital involves investing in early-stage startups with high growth potential, often in technology, healthcare, or innovative industries, providing both funding and strategic support to accelerate business growth. Typical venture capital firms seek equity stakes and aim for significant returns through exits like IPOs or acquisitions within 5 to 7 years. Explore more to understand how venture capital can drive transformative innovation and create substantial financial opportunities.

Equity

Venture capital investments offer equity stakes in high-growth startups, providing potential for significant long-term returns through ownership shares and influence over company decisions. Collectible sneakers, however, represent a tangible asset class with value driven primarily by rarity, brand reputation, and market demand, lacking traditional equity benefits such as dividends or voting rights. Explore the nuances of equity in both domains to understand which investment aligns with your financial goals.

Term Sheet

Venture capital term sheets outline essential investment terms such as valuation, equity stake, liquidation preferences, and investor rights, providing clear frameworks for startup funding. Collectible sneaker agreements focus on authenticity, provenance, condition grades, and resale terms, emphasizing asset value and market demand. Explore the key differences in detail to understand how these term sheets shape investment strategies and asset management.

Source and External Links

What is Venture Capital? - Venture capital is a form of financing that supports high-growth startups by turning ideas into products and services, providing strategic guidance, and investing risk capital over a long horizon to build companies that can create jobs and economic value.

Fund your business | U.S. Small Business Administration - Venture capital is funding given to high-growth companies in exchange for equity and often a board seat, involving a rigorous process of investor evaluation and ongoing partnership as businesses reach milestones.

What is Venture Capital? | J.P. Morgan - Venture capital finances startups working on innovative technologies with high potential but also high risk, typically providing equity in exchange for long-term growth and a share of ownership.

dowidth.com

dowidth.com