Whiskey cask investment offers unique benefits such as tangible asset appreciation, aging value, and global market demand, contrasting with classic car investment which relies heavily on rarity, condition, and collector interest. Whiskey casks provide portfolio diversification and lower maintenance costs compared to the complexities and storage requirements of classic cars. Explore detailed insights to determine which alternative asset aligns best with your investment goals.

Why it is important

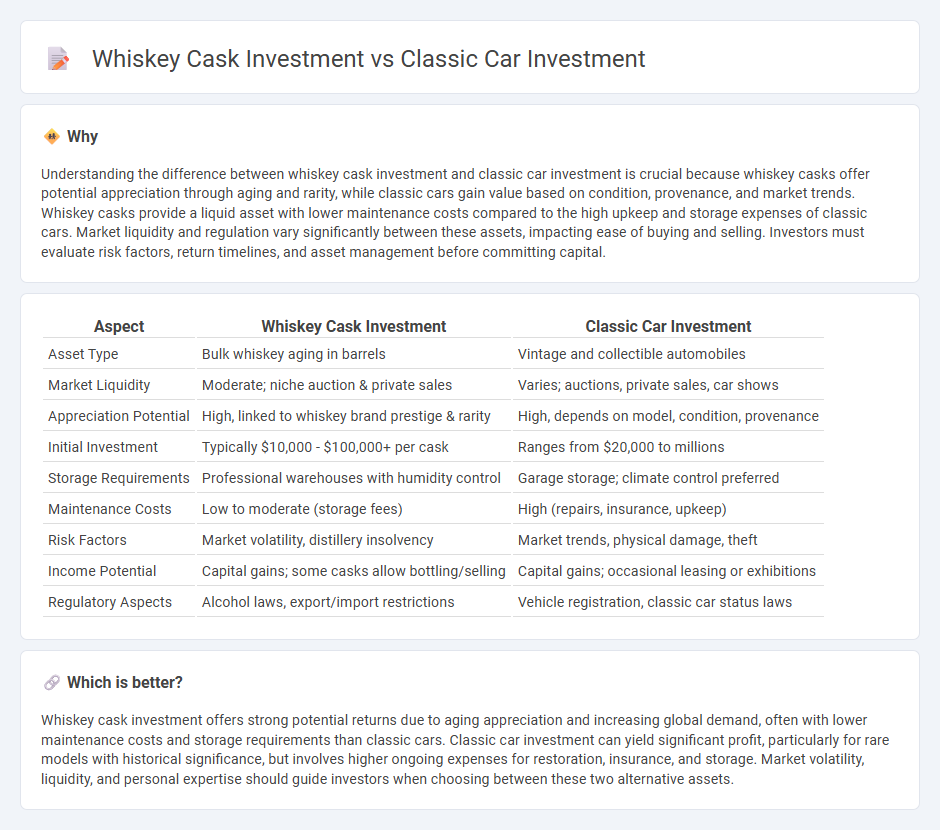

Understanding the difference between whiskey cask investment and classic car investment is crucial because whiskey casks offer potential appreciation through aging and rarity, while classic cars gain value based on condition, provenance, and market trends. Whiskey casks provide a liquid asset with lower maintenance costs compared to the high upkeep and storage expenses of classic cars. Market liquidity and regulation vary significantly between these assets, impacting ease of buying and selling. Investors must evaluate risk factors, return timelines, and asset management before committing capital.

Comparison Table

| Aspect | Whiskey Cask Investment | Classic Car Investment |

|---|---|---|

| Asset Type | Bulk whiskey aging in barrels | Vintage and collectible automobiles |

| Market Liquidity | Moderate; niche auction & private sales | Varies; auctions, private sales, car shows |

| Appreciation Potential | High, linked to whiskey brand prestige & rarity | High, depends on model, condition, provenance |

| Initial Investment | Typically $10,000 - $100,000+ per cask | Ranges from $20,000 to millions |

| Storage Requirements | Professional warehouses with humidity control | Garage storage; climate control preferred |

| Maintenance Costs | Low to moderate (storage fees) | High (repairs, insurance, upkeep) |

| Risk Factors | Market volatility, distillery insolvency | Market trends, physical damage, theft |

| Income Potential | Capital gains; some casks allow bottling/selling | Capital gains; occasional leasing or exhibitions |

| Regulatory Aspects | Alcohol laws, export/import restrictions | Vehicle registration, classic car status laws |

Which is better?

Whiskey cask investment offers strong potential returns due to aging appreciation and increasing global demand, often with lower maintenance costs and storage requirements than classic cars. Classic car investment can yield significant profit, particularly for rare models with historical significance, but involves higher ongoing expenses for restoration, insurance, and storage. Market volatility, liquidity, and personal expertise should guide investors when choosing between these two alternative assets.

Connection

Whiskey cask investment and classic car investment share the characteristic of being alternative assets that offer diversification beyond traditional stocks and bonds. Both markets are driven by rarity, historical appreciation, and strong collector demand, which contribute to potential value growth over time. Investors often seek these tangible assets to hedge against inflation and benefit from unique market dynamics in niche luxury sectors.

Key Terms

Appreciation (Value Increase)

Classic car investment often yields significant appreciation due to rarity, historical value, and market demand, with some models increasing in value by over 10% annually. Whiskey cask investments appreciate as aging enhances flavor profiles and scarcity rises, with certain casks showing value gains of 8-12% per year, driven by global collector interest. Explore the nuances and data behind these alternative assets to make informed investment choices.

Provenance/Authenticity

Classic car investment offers tangible assets with verifiable provenance through documented ownership history, factory records, and expert appraisals, ensuring authentic value appreciation. Whiskey cask investment relies on provenance verified by distillery records, cask numbers, and certification from established whiskey authorities, combining rarity and age to enhance authenticity. Explore deeper insights into how provenance impacts value and risk in these distinctive asset classes.

Liquidity

Classic cars offer moderate liquidity with sales typically requiring several weeks to months due to niche markets and thorough ownership verifications. Whiskey cask investments can provide quicker liquidity through fractional ownership platforms or cask brokerages facilitating easier sales and transfers. Explore further to understand which investment aligns best with your liquidity needs and portfolio goals.

Source and External Links

How to Invest in Classic Cars - Successful classic car investment requires thorough research, a clear budget accounting for maintenance and storage, and focus on rare, high-demand models in the best possible condition for long-term appreciation.

Cars | Rally | Alternative Asset Investment - Classic cars are accessible as an alternative investment with notable historical returns and low volatility, and platforms like Rally allow fractional ownership in vehicles such as Porsches and Aston Martins.

Investing in Classic Cars - The classic car market offers the potential for major profits--as seen in a 500% value increase from 2004 to 2014--but success depends on selecting rare, well-maintained cars that appeal to collectors and fit your budget.

dowidth.com

dowidth.com