Litigation funding provides capital to plaintiffs in legal cases in exchange for a portion of the judgment or settlement, offering a risk-managed investment with potential high returns tied to legal outcomes. Angel investing involves providing early-stage startup capital in exchange for equity, focusing on company growth and long-term business success with higher risk and reward potential. Explore more to understand which investment approach aligns with your financial goals and risk tolerance.

Why it is important

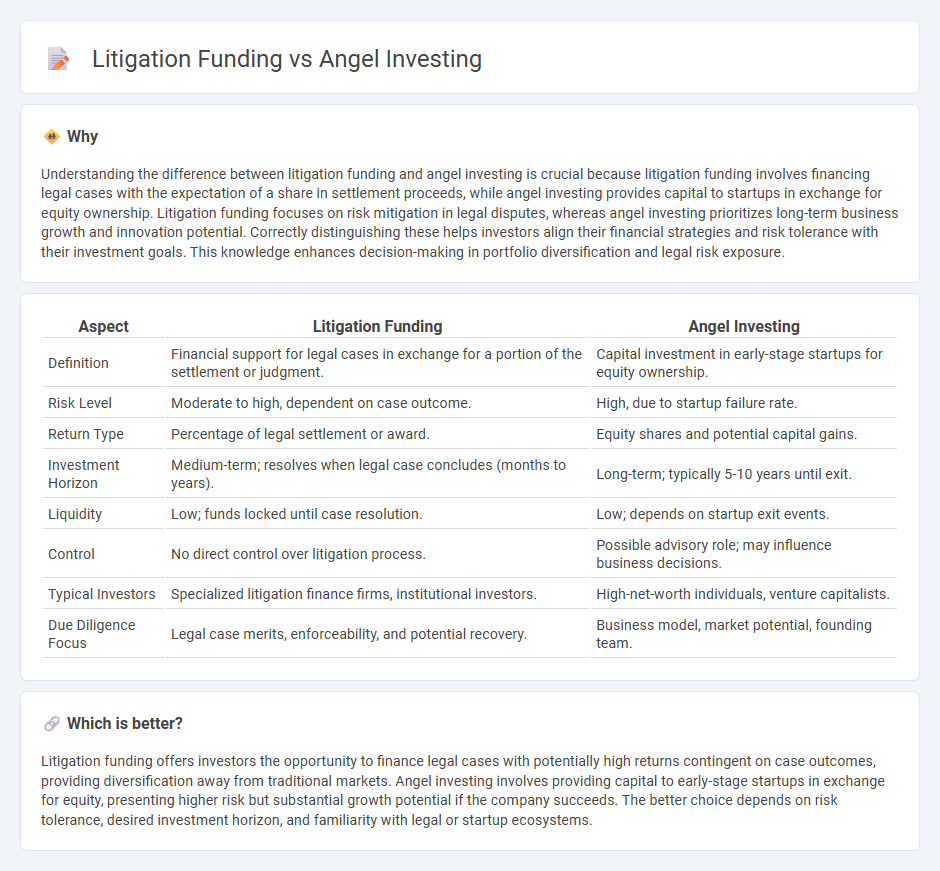

Understanding the difference between litigation funding and angel investing is crucial because litigation funding involves financing legal cases with the expectation of a share in settlement proceeds, while angel investing provides capital to startups in exchange for equity ownership. Litigation funding focuses on risk mitigation in legal disputes, whereas angel investing prioritizes long-term business growth and innovation potential. Correctly distinguishing these helps investors align their financial strategies and risk tolerance with their investment goals. This knowledge enhances decision-making in portfolio diversification and legal risk exposure.

Comparison Table

| Aspect | Litigation Funding | Angel Investing |

|---|---|---|

| Definition | Financial support for legal cases in exchange for a portion of the settlement or judgment. | Capital investment in early-stage startups for equity ownership. |

| Risk Level | Moderate to high, dependent on case outcome. | High, due to startup failure rate. |

| Return Type | Percentage of legal settlement or award. | Equity shares and potential capital gains. |

| Investment Horizon | Medium-term; resolves when legal case concludes (months to years). | Long-term; typically 5-10 years until exit. |

| Liquidity | Low; funds locked until case resolution. | Low; depends on startup exit events. |

| Control | No direct control over litigation process. | Possible advisory role; may influence business decisions. |

| Typical Investors | Specialized litigation finance firms, institutional investors. | High-net-worth individuals, venture capitalists. |

| Due Diligence Focus | Legal case merits, enforceability, and potential recovery. | Business model, market potential, founding team. |

Which is better?

Litigation funding offers investors the opportunity to finance legal cases with potentially high returns contingent on case outcomes, providing diversification away from traditional markets. Angel investing involves providing capital to early-stage startups in exchange for equity, presenting higher risk but substantial growth potential if the company succeeds. The better choice depends on risk tolerance, desired investment horizon, and familiarity with legal or startup ecosystems.

Connection

Litigation funding and angel investing intersect through their shared focus on providing capital to high-risk ventures with the potential for significant returns. Both involve thorough due diligence and risk assessment to support legal cases or startups, often bridging the gap between traditional financing and underserved opportunities. This connection highlights alternative investment strategies that diversify portfolios and capture value in non-traditional asset classes.

Key Terms

Angel investing:

Angel investing involves providing early-stage capital to startups in exchange for equity, typically targeting high-growth potential companies in technology, healthcare, and fintech sectors. Investors gain ownership stakes and the opportunity for significant returns as startups scale and achieve market success. Explore more about angel investing strategies and its impact on startup ecosystems.

Equity

Angel investing involves providing capital to startups in exchange for equity ownership, granting investors potential profit through company growth and exit events. Litigation funding, in contrast, typically involves financing legal cases without acquiring equity, as funders receive repayment only if the case is successful, often via a share of the judgment or settlement. Explore more to understand how equity stakes influence risk and return in these distinct investment models.

Early-stage startups

Angel investing provides early-stage startups with capital in exchange for equity, enabling entrepreneurs to accelerate growth and innovation. Litigation funding, while primarily focused on financing legal claims, can occasionally intersect with startups involved in intellectual property disputes or legal battles affecting their business operations. Explore the distinctions and strategic benefits of each funding option to determine the best fit for your startup's needs.

Source and External Links

Understanding angel financing and investing - Angel investors are individuals who provide capital to early-stage startups in exchange for equity or convertible debt, often helping bridge the gap between initial funding from friends and family and the first professional round of institutional investment.

Angel Investors - Angel investors are wealthy individuals who invest their own money in small businesses or startups for equity, typically offering mentorship and strategic support, with an exit usually sought through acquisition or public offering.

Learn how to find and work with angel investors - Angel investors usually seek a 10%-30% equity stake in a company, and their value often extends beyond funding to include strategic advice, industry connections, and access to future investors.

dowidth.com

dowidth.com