Litigation funding involves financing legal cases in exchange for a portion of the judgment or settlement, providing investors with alternative assets uncorrelated to traditional markets. Cryptocurrency investment entails acquiring digital assets like Bitcoin or Ethereum, characterized by high volatility and the potential for significant returns in decentralized finance ecosystems. Explore the key differences and benefits of each investment strategy to make informed financial decisions.

Why it is important

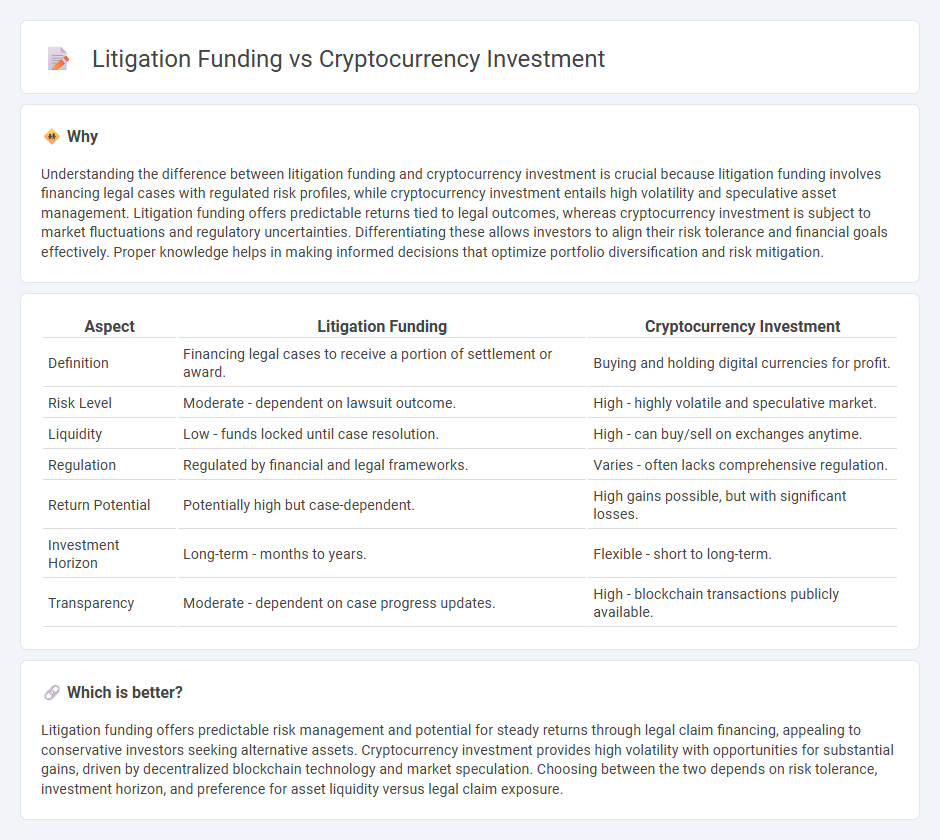

Understanding the difference between litigation funding and cryptocurrency investment is crucial because litigation funding involves financing legal cases with regulated risk profiles, while cryptocurrency investment entails high volatility and speculative asset management. Litigation funding offers predictable returns tied to legal outcomes, whereas cryptocurrency investment is subject to market fluctuations and regulatory uncertainties. Differentiating these allows investors to align their risk tolerance and financial goals effectively. Proper knowledge helps in making informed decisions that optimize portfolio diversification and risk mitigation.

Comparison Table

| Aspect | Litigation Funding | Cryptocurrency Investment |

|---|---|---|

| Definition | Financing legal cases to receive a portion of settlement or award. | Buying and holding digital currencies for profit. |

| Risk Level | Moderate - dependent on lawsuit outcome. | High - highly volatile and speculative market. |

| Liquidity | Low - funds locked until case resolution. | High - can buy/sell on exchanges anytime. |

| Regulation | Regulated by financial and legal frameworks. | Varies - often lacks comprehensive regulation. |

| Return Potential | Potentially high but case-dependent. | High gains possible, but with significant losses. |

| Investment Horizon | Long-term - months to years. | Flexible - short to long-term. |

| Transparency | Moderate - dependent on case progress updates. | High - blockchain transactions publicly available. |

Which is better?

Litigation funding offers predictable risk management and potential for steady returns through legal claim financing, appealing to conservative investors seeking alternative assets. Cryptocurrency investment provides high volatility with opportunities for substantial gains, driven by decentralized blockchain technology and market speculation. Choosing between the two depends on risk tolerance, investment horizon, and preference for asset liquidity versus legal claim exposure.

Connection

Litigation funding and cryptocurrency investment intersect through blockchain's transparency and decentralized financing models, offering novel approaches to capital allocation. Litigation finance platforms increasingly leverage cryptocurrency to facilitate swift funding transfers and reduce transactional friction. This synergy enhances liquidity for legal cases while introducing new asset classes for crypto investors.

Key Terms

Cryptocurrency investment:

Cryptocurrency investment involves purchasing digital assets like Bitcoin and Ethereum, leveraging blockchain technology to achieve potential high returns amid market volatility and regulatory uncertainties. Investors benefit from decentralized finance innovations but must navigate risks such as price fluctuations, security vulnerabilities, and evolving legal frameworks. Explore our detailed analysis to understand the strategic advantages and risks associated with cryptocurrency investment.

Blockchain

Cryptocurrency investment leverages blockchain technology to enable secure, transparent transactions and decentralized asset ownership, while litigation funding utilizes blockchain to streamline capital allocation and enhance trust through immutable records. Both sectors benefit from blockchain's ability to reduce fraud, improve data verification, and optimize contract execution using smart contracts. Discover how integrating blockchain transforms financial dynamics in cryptocurrency and litigation funding by exploring in-depth insights.

Volatility

Cryptocurrency investment is characterized by extreme volatility, with prices capable of swinging over 10% within a single day due to market speculation and regulatory news. Litigation funding, by contrast, offers more stable returns as investments are tied to legal outcomes and settlements, which unfold over months or years, reducing short-term risk fluctuations. Explore the nuances of these asset classes to determine which aligns best with your risk tolerance and financial goals.

Source and External Links

Cryptocurrency Basics: Pros, Cons and How It Works - Cryptocurrency is a digital currency used for alternative payments and speculative investment; it offers potential long-term value growth but is highly volatile and carries risks like inflation impact and speculative bubbles.

What is Cryptocurrency and How Does it Work? - Investing safely in cryptocurrency involves researching exchanges, choosing secure storage options, diversifying investments, and preparing for significant price volatility.

Cryptocurrency Investment Types - Investors can access cryptocurrencies through various options like spot bitcoin/ether funds, mutual funds, OTC coin trusts, listed crypto options, and futures, but should be mindful that crypto investments are speculative and extremely volatile.

dowidth.com

dowidth.com