Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, such as reforestation and renewable energy initiatives, directly mitigating climate change. Circular economy funds prioritize investments in businesses that design out waste and promote resource efficiency through recycling, remanufacturing, and sustainable product life cycles. Explore how these innovative investment strategies can align with your sustainability goals and financial growth.

Why it is important

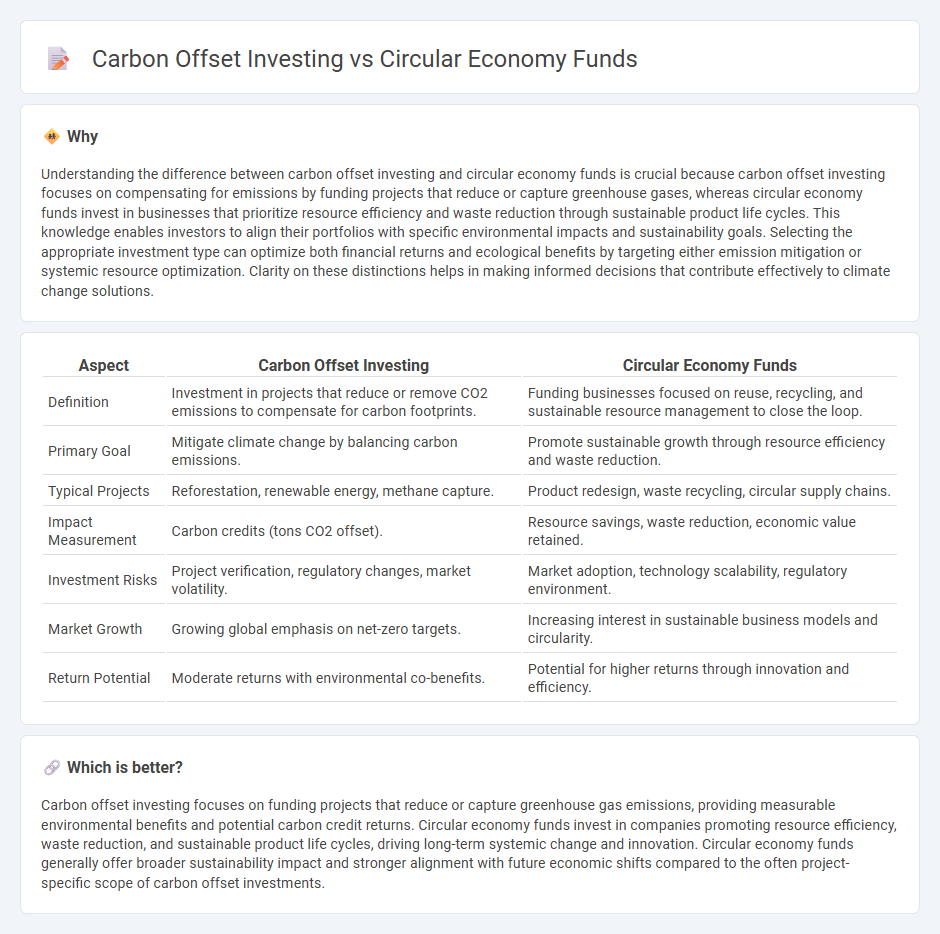

Understanding the difference between carbon offset investing and circular economy funds is crucial because carbon offset investing focuses on compensating for emissions by funding projects that reduce or capture greenhouse gases, whereas circular economy funds invest in businesses that prioritize resource efficiency and waste reduction through sustainable product life cycles. This knowledge enables investors to align their portfolios with specific environmental impacts and sustainability goals. Selecting the appropriate investment type can optimize both financial returns and ecological benefits by targeting either emission mitigation or systemic resource optimization. Clarity on these distinctions helps in making informed decisions that contribute effectively to climate change solutions.

Comparison Table

| Aspect | Carbon Offset Investing | Circular Economy Funds |

|---|---|---|

| Definition | Investment in projects that reduce or remove CO2 emissions to compensate for carbon footprints. | Funding businesses focused on reuse, recycling, and sustainable resource management to close the loop. |

| Primary Goal | Mitigate climate change by balancing carbon emissions. | Promote sustainable growth through resource efficiency and waste reduction. |

| Typical Projects | Reforestation, renewable energy, methane capture. | Product redesign, waste recycling, circular supply chains. |

| Impact Measurement | Carbon credits (tons CO2 offset). | Resource savings, waste reduction, economic value retained. |

| Investment Risks | Project verification, regulatory changes, market volatility. | Market adoption, technology scalability, regulatory environment. |

| Market Growth | Growing global emphasis on net-zero targets. | Increasing interest in sustainable business models and circularity. |

| Return Potential | Moderate returns with environmental co-benefits. | Potential for higher returns through innovation and efficiency. |

Which is better?

Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions, providing measurable environmental benefits and potential carbon credit returns. Circular economy funds invest in companies promoting resource efficiency, waste reduction, and sustainable product life cycles, driving long-term systemic change and innovation. Circular economy funds generally offer broader sustainability impact and stronger alignment with future economic shifts compared to the often project-specific scope of carbon offset investments.

Connection

Carbon offset investing directly supports the circular economy by channeling funds into projects that reduce carbon footprints through sustainable resource management and waste reduction. Circular economy funds prioritize investments in businesses adopting closed-loop systems, enhancing carbon offset initiatives by promoting renewable energy, recycling, and efficient material use. This synergy amplifies environmental impact by aligning financial growth with carbon neutrality and resource conservation.

Key Terms

**Circular economy funds:**

Circular economy funds invest in companies that prioritize sustainable resource management, waste reduction, and product life extension to create a regenerative economic model. These funds support innovative technologies and business practices that turn waste into valuable inputs, promoting eco-efficiency and reducing environmental impact. Discover how circular economy funds drive long-term sustainability while offering investment growth opportunities.

Resource efficiency

Investing in circular economy funds targets resource efficiency by promoting the reuse, recycling, and sustainable management of materials to minimize waste and reduce environmental impact. Carbon offset investing primarily focuses on balancing emissions through projects like reforestation or renewable energy but may not directly enhance resource utilization. Explore detailed comparisons to understand how each investment strategy advances sustainability goals.

Waste reduction

Circular economy funds prioritize investments in businesses and technologies that actively reduce waste by promoting resource reuse, recycling, and sustainable product design. Carbon offset investing primarily targets projects that capture or reduce greenhouse gases but may not directly address waste reduction as effectively. Explore the differences and benefits of each approach to optimize your impact on sustainability and waste management.

Source and External Links

Candriam Sustainable Equity Circular Economy - LU2109440870 - This fund invests globally in companies providing solutions aligned with circular economy principles, using AI to identify firms contributing to waste reduction, recycled material use, and product lifespan extension in their business models.

Robeco Circular Economy I EUR - LU2092759021 - An actively managed global fund that invests in companies aligned with circular economy principles through fundamental and sustainability-driven stock selection aiming for sustainable investment and better returns than the index.

Circulate Capital | Investment Management in Circular Economy - A leading investment management firm focused on circular economy solutions in emerging markets, partnering with institutional investors and global brands to finance scalable plastic circular supply chain innovations and more.

dowidth.com

dowidth.com