Investing in music royalties offers a steady income stream through licensing fees and royalties, supported by digital streaming platforms generating consistent revenue. Art investing, by contrast, focuses on capital appreciation with asset value influenced by artist reputation, rarity, and market trends. Explore the benefits and risks of each investment type to make an informed decision.

Why it is important

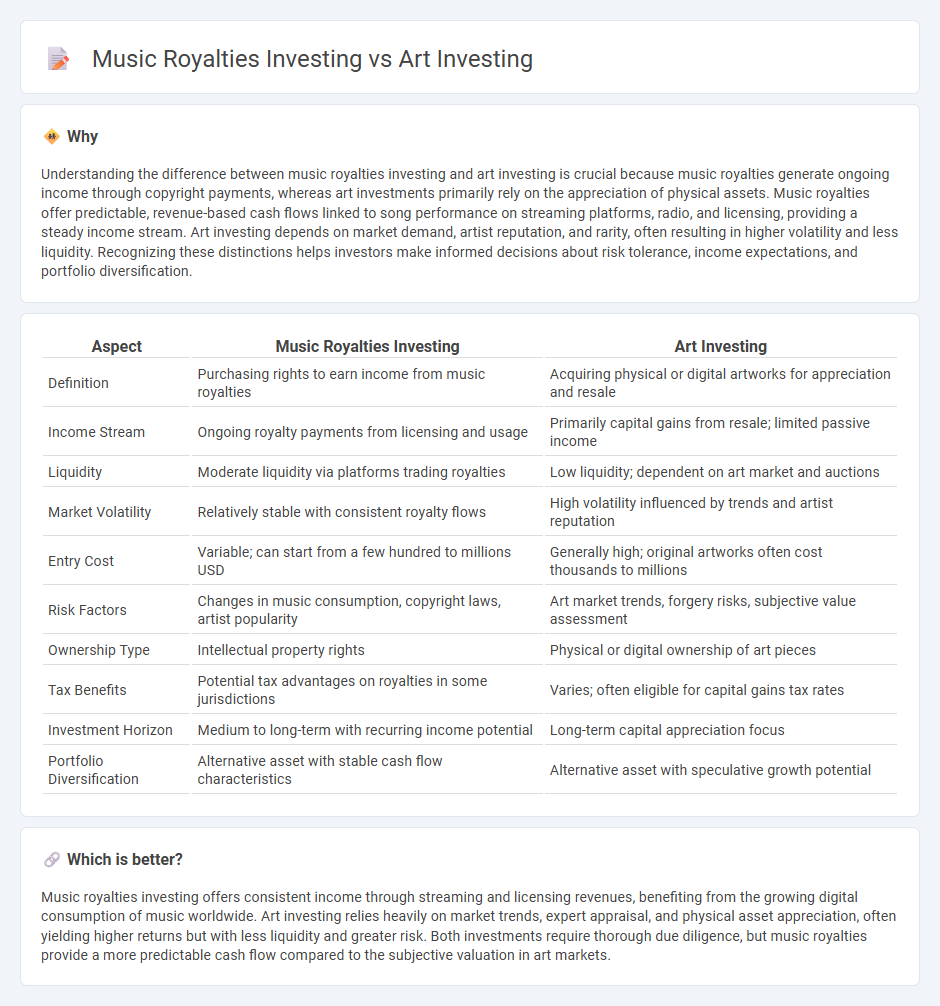

Understanding the difference between music royalties investing and art investing is crucial because music royalties generate ongoing income through copyright payments, whereas art investments primarily rely on the appreciation of physical assets. Music royalties offer predictable, revenue-based cash flows linked to song performance on streaming platforms, radio, and licensing, providing a steady income stream. Art investing depends on market demand, artist reputation, and rarity, often resulting in higher volatility and less liquidity. Recognizing these distinctions helps investors make informed decisions about risk tolerance, income expectations, and portfolio diversification.

Comparison Table

| Aspect | Music Royalties Investing | Art Investing |

|---|---|---|

| Definition | Purchasing rights to earn income from music royalties | Acquiring physical or digital artworks for appreciation and resale |

| Income Stream | Ongoing royalty payments from licensing and usage | Primarily capital gains from resale; limited passive income |

| Liquidity | Moderate liquidity via platforms trading royalties | Low liquidity; dependent on art market and auctions |

| Market Volatility | Relatively stable with consistent royalty flows | High volatility influenced by trends and artist reputation |

| Entry Cost | Variable; can start from a few hundred to millions USD | Generally high; original artworks often cost thousands to millions |

| Risk Factors | Changes in music consumption, copyright laws, artist popularity | Art market trends, forgery risks, subjective value assessment |

| Ownership Type | Intellectual property rights | Physical or digital ownership of art pieces |

| Tax Benefits | Potential tax advantages on royalties in some jurisdictions | Varies; often eligible for capital gains tax rates |

| Investment Horizon | Medium to long-term with recurring income potential | Long-term capital appreciation focus |

| Portfolio Diversification | Alternative asset with stable cash flow characteristics | Alternative asset with speculative growth potential |

Which is better?

Music royalties investing offers consistent income through streaming and licensing revenues, benefiting from the growing digital consumption of music worldwide. Art investing relies heavily on market trends, expert appraisal, and physical asset appreciation, often yielding higher returns but with less liquidity and greater risk. Both investments require thorough due diligence, but music royalties provide a more predictable cash flow compared to the subjective valuation in art markets.

Connection

Music royalties investing and art investing are connected through the shared principle of acquiring intangible assets that generate passive income and appreciate over time. Both investments leverage the cultural value and intellectual property rights tied to creative works, offering portfolio diversification beyond traditional stocks and bonds. Market demand for unique, scarce content drives asset valuation, providing opportunities for long-term capital growth and steady cash flow.

Key Terms

Art Investing:

Art investing offers tangible assets appreciating through provenance, artist reputation, and market demand, often yielding long-term capital gains and portfolio diversification. Unlike music royalties, art investments require expertise in authentication, condition assessment, and market trends to mitigate risks such as forgery and illiquidity. Explore the nuances of art investment strategies and market dynamics to enhance your investment portfolio.

Provenance

Provenance plays a crucial role in art investing by providing a transparent ownership history that authenticates and enhances an artwork's value. In music royalties investing, provenance is traced through verifiable rights and royalty payment records, ensuring the legitimacy and potential income stream of the asset. Explore deeper insights into how provenance influences these investment opportunities.

Authenticity

Art investing centers on acquiring original pieces by recognized artists, where authenticity verification is crucial to preserving value and ensuring provenance. Music royalties investing involves purchasing rights to an artist's compositions or recordings, with authenticity tied to legal ownership and clear royalty streams documented through performing rights organizations. Explore deeper into how authenticity shapes investment security and potential returns in both markets.

Source and External Links

Invest in Art - Own Shares in Masterpieces - You can invest in art through fractional ownership in diversified portfolios of fine art, which historically have outperformed the S&P 500 since 2000, but such investments are speculative, illiquid, and carry significant risks.

How To Invest In Art | MyArtBroker | Article - Art is considered an alternative asset that can diversify traditional portfolios; new models like fractional ownership and AI-driven valuations make art investing more accessible and transparent in 2025, accommodating a range of budgets and investor profiles.

Investing in art: What to know about turning a passion into ... - Investing in art offers benefits such as diversification, inflation protection, potential high returns, and tax advantages, but also involves risks including illiquidity, value fluctuations based on trends, and the importance of provenance and authenticity.

dowidth.com

dowidth.com