Farmland crowdfunding enables individual investors to buy shares in agricultural land projects, offering direct exposure to farmland's income and appreciation potential with relatively low entry costs. Real Estate Investment Trusts (REITs) provide access to diversified portfolios of income-generating properties, including commercial and residential real estate, with liquidity through public trading on stock exchanges. Explore the advantages and risks of farmland crowdfunding and REITs to determine which investment aligns best with your portfolio goals.

Why it is important

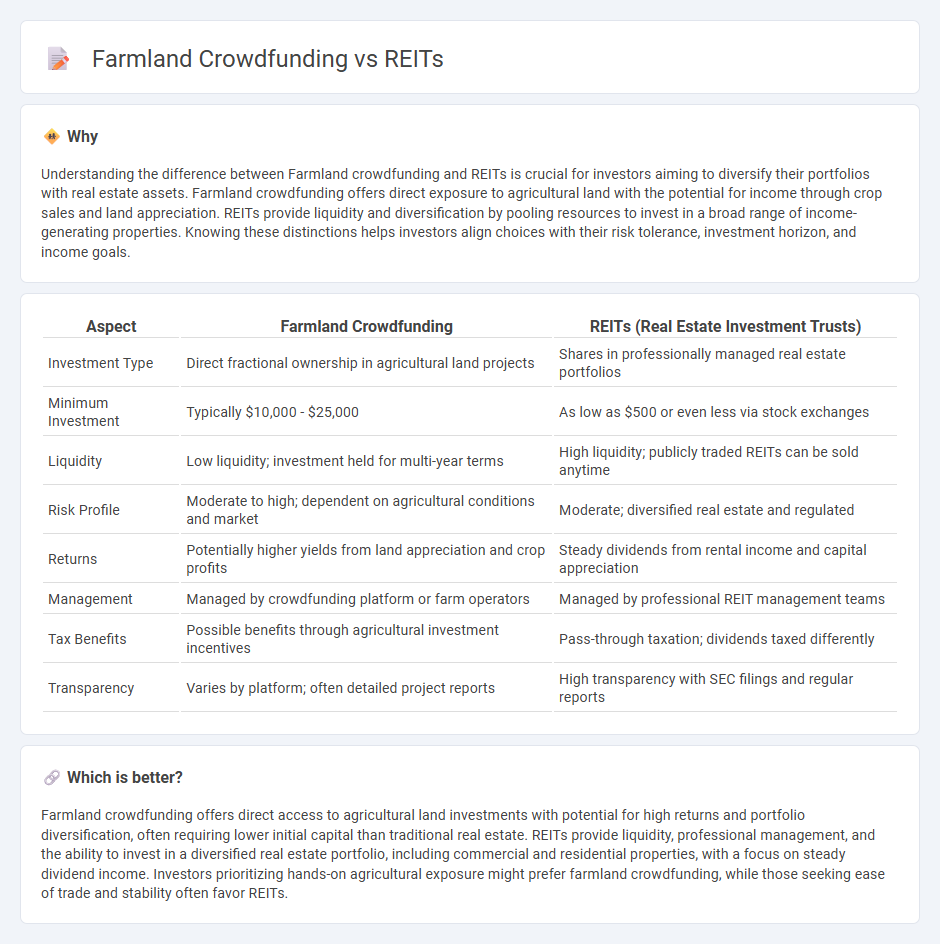

Understanding the difference between Farmland crowdfunding and REITs is crucial for investors aiming to diversify their portfolios with real estate assets. Farmland crowdfunding offers direct exposure to agricultural land with the potential for income through crop sales and land appreciation. REITs provide liquidity and diversification by pooling resources to invest in a broad range of income-generating properties. Knowing these distinctions helps investors align choices with their risk tolerance, investment horizon, and income goals.

Comparison Table

| Aspect | Farmland Crowdfunding | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Investment Type | Direct fractional ownership in agricultural land projects | Shares in professionally managed real estate portfolios |

| Minimum Investment | Typically $10,000 - $25,000 | As low as $500 or even less via stock exchanges |

| Liquidity | Low liquidity; investment held for multi-year terms | High liquidity; publicly traded REITs can be sold anytime |

| Risk Profile | Moderate to high; dependent on agricultural conditions and market | Moderate; diversified real estate and regulated |

| Returns | Potentially higher yields from land appreciation and crop profits | Steady dividends from rental income and capital appreciation |

| Management | Managed by crowdfunding platform or farm operators | Managed by professional REIT management teams |

| Tax Benefits | Possible benefits through agricultural investment incentives | Pass-through taxation; dividends taxed differently |

| Transparency | Varies by platform; often detailed project reports | High transparency with SEC filings and regular reports |

Which is better?

Farmland crowdfunding offers direct access to agricultural land investments with potential for high returns and portfolio diversification, often requiring lower initial capital than traditional real estate. REITs provide liquidity, professional management, and the ability to invest in a diversified real estate portfolio, including commercial and residential properties, with a focus on steady dividend income. Investors prioritizing hands-on agricultural exposure might prefer farmland crowdfunding, while those seeking ease of trade and stability often favor REITs.

Connection

Farmland crowdfunding and Real Estate Investment Trusts (REITs) are connected through their shared goal of democratizing access to agricultural real estate investments. Both platforms enable individual investors to pool capital into farmland, diversifying portfolios while benefiting from the income generated by crop production or land appreciation. This convergence enhances liquidity and transparency in the traditionally illiquid farmland market, offering scalable opportunities within agrarian asset classes.

Key Terms

Liquidity

Real Estate Investment Trusts (REITs) typically offer higher liquidity compared to farmland crowdfunding platforms due to their stock market listings, allowing investors to buy and sell shares quickly. Farmland crowdfunding often involves longer lock-in periods and limited secondary market options, making liquidity more restricted for investors. Discover more about how liquidity differences impact your investment strategy in these asset classes.

Diversification

REITs offer exposure to diversified real estate assets including commercial, residential, and industrial properties, providing liquidity through public trading, whereas farmland crowdfunding focuses on agricultural land investments with potential for steady income from crop yields and land appreciation. Diversification in REITs spreads risk across multiple property types and geographic locations, while farmland crowdfunding allows investors to target specific agricultural regions and crop types for niche portfolio growth. Explore detailed comparisons to understand which investment aligns best with your diversification strategy.

Minimum Investment

REITs typically require a minimum investment ranging from $1,000 to $10,000, making them accessible to many retail investors seeking exposure to real estate markets. Farmland crowdfunding platforms often have lower minimums, sometimes as low as $100, allowing smaller investors to participate in agricultural land ownership and benefit from crop yield revenues. Explore the differences in minimum investment requirements to determine which option best suits your financial goals and risk tolerance.

Source and External Links

Real estate investment trust - Wikipedia - A REIT (real estate investment trust) is a company that owns and usually operates income-producing real estate like offices, apartments, and shopping centers, allowing investors to access real estate assets and typically enjoying tax advantages under most countries' laws.

What's a REIT (Real Estate Investment Trust)? - Nareit - A REIT owns, operates, or finances income-producing real estate and offers investors regular income, diversification, and potential capital appreciation, often trading like stocks on major exchanges.

Real Estate Investment Trust (REIT) - Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate such as office buildings, apartments, hotels, and mortgages by owning and operating these properties rather than developing to resell.

dowidth.com

dowidth.com