Music royalties offer investors a steady income stream derived from licensing and royalties generated by copyrighted musical works, providing diversification and passive earnings in the entertainment sector. Peer-to-peer lending connects individual borrowers with investors willing to provide direct loans, often yielding higher returns compared to traditional fixed-income assets but with increased credit risk. Discover the unique benefits and risks of music royalties and peer-to-peer lending to enhance your investment portfolio.

Why it is important

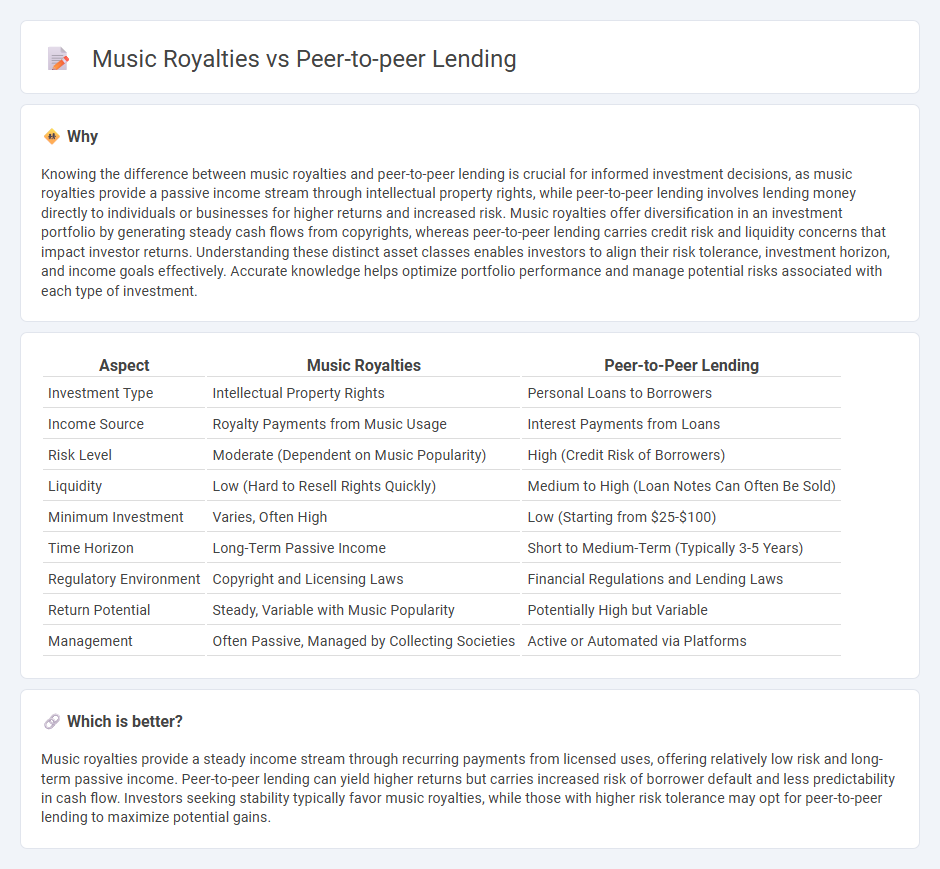

Knowing the difference between music royalties and peer-to-peer lending is crucial for informed investment decisions, as music royalties provide a passive income stream through intellectual property rights, while peer-to-peer lending involves lending money directly to individuals or businesses for higher returns and increased risk. Music royalties offer diversification in an investment portfolio by generating steady cash flows from copyrights, whereas peer-to-peer lending carries credit risk and liquidity concerns that impact investor returns. Understanding these distinct asset classes enables investors to align their risk tolerance, investment horizon, and income goals effectively. Accurate knowledge helps optimize portfolio performance and manage potential risks associated with each type of investment.

Comparison Table

| Aspect | Music Royalties | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Intellectual Property Rights | Personal Loans to Borrowers |

| Income Source | Royalty Payments from Music Usage | Interest Payments from Loans |

| Risk Level | Moderate (Dependent on Music Popularity) | High (Credit Risk of Borrowers) |

| Liquidity | Low (Hard to Resell Rights Quickly) | Medium to High (Loan Notes Can Often Be Sold) |

| Minimum Investment | Varies, Often High | Low (Starting from $25-$100) |

| Time Horizon | Long-Term Passive Income | Short to Medium-Term (Typically 3-5 Years) |

| Regulatory Environment | Copyright and Licensing Laws | Financial Regulations and Lending Laws |

| Return Potential | Steady, Variable with Music Popularity | Potentially High but Variable |

| Management | Often Passive, Managed by Collecting Societies | Active or Automated via Platforms |

Which is better?

Music royalties provide a steady income stream through recurring payments from licensed uses, offering relatively low risk and long-term passive income. Peer-to-peer lending can yield higher returns but carries increased risk of borrower default and less predictability in cash flow. Investors seeking stability typically favor music royalties, while those with higher risk tolerance may opt for peer-to-peer lending to maximize potential gains.

Connection

Music royalties generate passive income streams that can be tokenized and traded on peer-to-peer lending platforms, allowing investors to fund artists directly in exchange for future royalty payments. This innovative financing model leverages blockchain technology to increase transparency and liquidity in the music industry. Peer-to-peer lending thus bridges traditional royalty revenue with decentralized investment opportunities, diversifying income for both artists and investors.

Key Terms

Risk assessment

Peer-to-peer lending risk assessment primarily centers on borrower creditworthiness, default probabilities, and economic conditions impacting repayment reliability. Music royalties risk evaluation involves analyzing catalog stability, royalty stream predictability, and market trends affecting royalty income consistency. Explore in-depth comparisons to understand the nuanced risk profiles of both investment types.

Return on investment (ROI)

Peer-to-peer lending offers investors a variable ROI typically ranging from 5% to 12%, influenced by borrower creditworthiness and platform fees, whereas music royalties provide a more passive income stream with potentially higher long-term returns but significant variability tied to the artist's popularity and streaming trends. While P2P lending delivers more predictable short-term cash flow through scheduled borrower repayments, music royalty investments benefit from multiple revenue sources such as streaming, sync licensing, and physical sales, allowing diversification within the entertainment sector. Explore deeper insights on the risk-return profiles and economic factors shaping these alternative investments.

Liquidity

Peer-to-peer lending offers higher liquidity through regular interest payments and defined loan terms, allowing investors to recover capital more predictably. Music royalties present lower liquidity as earnings depend on the fluctuating popularity and usage of the music catalog, often requiring longer holding periods to realize returns. Explore detailed comparisons to understand which investment aligns best with your liquidity needs.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending allows borrowers to apply for loans directly from individual investors via specialized websites, bypassing traditional banks and often offering lower eligibility requirements and flexible terms.

Peer-to-peer lending - Wikipedia - P2P lending involves individuals or businesses lending and borrowing money through online platforms that match lenders with borrowers, typically without any prior relationship, and loans are not usually protected by government insurance.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending is a marketplace where individuals or businesses lend money to borrowers in exchange for interest, generally offering higher returns than savings accounts but with greater risk of default.

dowidth.com

dowidth.com