Investing in music royalties offers a unique revenue stream through earnings from copyrights, providing consistent passive income influenced by song popularity and usage. Stocks represent ownership in companies, with returns driven by market performance, dividends, and capital appreciation. Explore how diversifying between music royalties and stocks can enhance your investment portfolio.

Why it is important

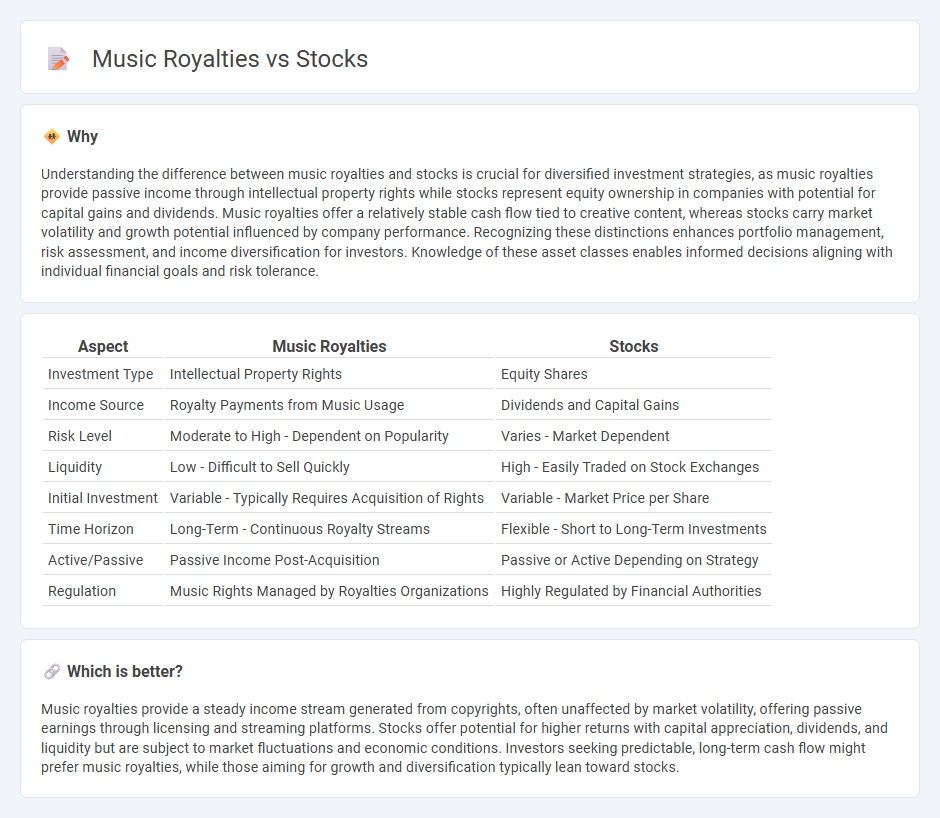

Understanding the difference between music royalties and stocks is crucial for diversified investment strategies, as music royalties provide passive income through intellectual property rights while stocks represent equity ownership in companies with potential for capital gains and dividends. Music royalties offer a relatively stable cash flow tied to creative content, whereas stocks carry market volatility and growth potential influenced by company performance. Recognizing these distinctions enhances portfolio management, risk assessment, and income diversification for investors. Knowledge of these asset classes enables informed decisions aligning with individual financial goals and risk tolerance.

Comparison Table

| Aspect | Music Royalties | Stocks |

|---|---|---|

| Investment Type | Intellectual Property Rights | Equity Shares |

| Income Source | Royalty Payments from Music Usage | Dividends and Capital Gains |

| Risk Level | Moderate to High - Dependent on Popularity | Varies - Market Dependent |

| Liquidity | Low - Difficult to Sell Quickly | High - Easily Traded on Stock Exchanges |

| Initial Investment | Variable - Typically Requires Acquisition of Rights | Variable - Market Price per Share |

| Time Horizon | Long-Term - Continuous Royalty Streams | Flexible - Short to Long-Term Investments |

| Active/Passive | Passive Income Post-Acquisition | Passive or Active Depending on Strategy |

| Regulation | Music Rights Managed by Royalties Organizations | Highly Regulated by Financial Authorities |

Which is better?

Music royalties provide a steady income stream generated from copyrights, often unaffected by market volatility, offering passive earnings through licensing and streaming platforms. Stocks offer potential for higher returns with capital appreciation, dividends, and liquidity but are subject to market fluctuations and economic conditions. Investors seeking predictable, long-term cash flow might prefer music royalties, while those aiming for growth and diversification typically lean toward stocks.

Connection

Music royalties generate consistent cash flow as artists earn income from licensing and streaming, creating a revenue stream similar to dividends in stocks. Investors often evaluate music royalties like stocks by analyzing royalty rights as assets with potential for long-term appreciation and stable returns. The growing digital music market enhances royalty income potential, aligning closely with stock investment principles focused on yield and capital growth.

Key Terms

Dividend

Stocks offer dividend income through company profit sharing, providing investors with regular cash flow and potential for capital appreciation. Music royalties generate income from copyrights, delivering consistent payments based on the usage and licensing of songs. Explore the advantages and risks of dividend income in diverse assets to optimize your investment strategy.

Royalty income

Royalty income from music offers a passive revenue stream based on licensing, streaming, and sales, providing consistent cash flow regardless of market volatility. Stocks, by contrast, generate returns through dividends and capital appreciation but are subject to economic cycles and market fluctuations, impacting predictable income. Explore the benefits and risks of royalty income compared to stock investments to optimize your financial portfolio.

Ownership rights

Stocks represent ownership shares in a company, granting shareholders voting rights and potential dividends, reflecting partial control over the business. Music royalties are payments earned by songwriters, artists, or rights holders for the use and distribution of their copyrighted works, emphasizing intellectual property ownership rather than equity. Explore the detailed differences in ownership rights and financial benefits between stocks and music royalties to make informed investment choices.

Source and External Links

Stocks | Investor.gov - Stocks represent ownership in a company, come in types like common and preferred, and are categorized as growth, income, value, or blue-chip stocks based on their characteristics and performance.

What are stocks? | Charles Schwab - Stocks are shares of a company bought and sold on exchanges, offering a claim on earnings and assets, with potential for growth, income, or short-term trading, and historically higher returns but also greater volatility.

Stocks | FINRA.org - Investing in stocks means buying equity shares in a company, where returns come from price changes and possible dividends, with common stock more volatile and preferred stock offering fixed dividends but less price movement.

dowidth.com

dowidth.com