Space economy investment targets emerging technologies and infrastructure supporting activities beyond Earth, including satellite development, space tourism, and extraterrestrial mining, focusing on long-term growth and innovation in a high-risk, high-reward sector. Venture capital investment emphasizes early-stage companies across various industries, seeking rapid scalability and financial returns through equity stakes, often within shorter timeframes. Discover more about how these distinct investment approaches shape the future of technology and economic expansion.

Why it is important

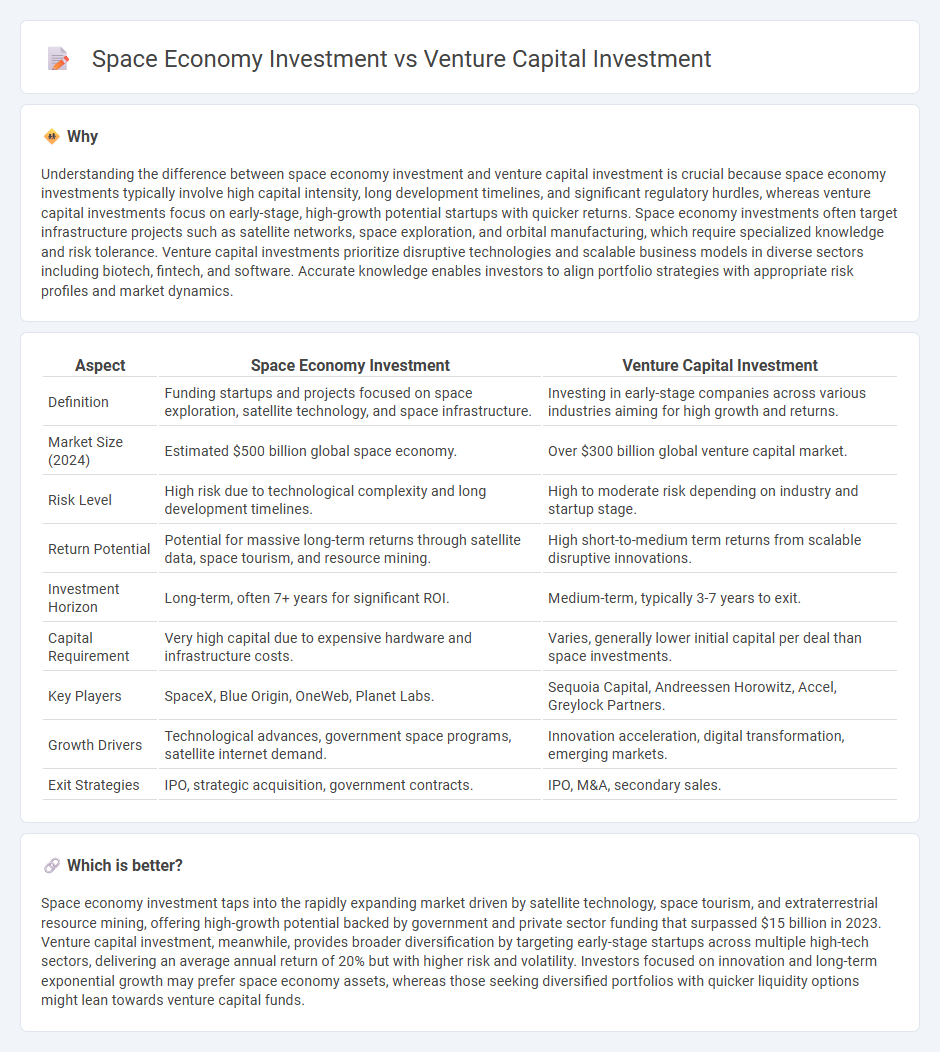

Understanding the difference between space economy investment and venture capital investment is crucial because space economy investments typically involve high capital intensity, long development timelines, and significant regulatory hurdles, whereas venture capital investments focus on early-stage, high-growth potential startups with quicker returns. Space economy investments often target infrastructure projects such as satellite networks, space exploration, and orbital manufacturing, which require specialized knowledge and risk tolerance. Venture capital investments prioritize disruptive technologies and scalable business models in diverse sectors including biotech, fintech, and software. Accurate knowledge enables investors to align portfolio strategies with appropriate risk profiles and market dynamics.

Comparison Table

| Aspect | Space Economy Investment | Venture Capital Investment |

|---|---|---|

| Definition | Funding startups and projects focused on space exploration, satellite technology, and space infrastructure. | Investing in early-stage companies across various industries aiming for high growth and returns. |

| Market Size (2024) | Estimated $500 billion global space economy. | Over $300 billion global venture capital market. |

| Risk Level | High risk due to technological complexity and long development timelines. | High to moderate risk depending on industry and startup stage. |

| Return Potential | Potential for massive long-term returns through satellite data, space tourism, and resource mining. | High short-to-medium term returns from scalable disruptive innovations. |

| Investment Horizon | Long-term, often 7+ years for significant ROI. | Medium-term, typically 3-7 years to exit. |

| Capital Requirement | Very high capital due to expensive hardware and infrastructure costs. | Varies, generally lower initial capital per deal than space investments. |

| Key Players | SpaceX, Blue Origin, OneWeb, Planet Labs. | Sequoia Capital, Andreessen Horowitz, Accel, Greylock Partners. |

| Growth Drivers | Technological advances, government space programs, satellite internet demand. | Innovation acceleration, digital transformation, emerging markets. |

| Exit Strategies | IPO, strategic acquisition, government contracts. | IPO, M&A, secondary sales. |

Which is better?

Space economy investment taps into the rapidly expanding market driven by satellite technology, space tourism, and extraterrestrial resource mining, offering high-growth potential backed by government and private sector funding that surpassed $15 billion in 2023. Venture capital investment, meanwhile, provides broader diversification by targeting early-stage startups across multiple high-tech sectors, delivering an average annual return of 20% but with higher risk and volatility. Investors focused on innovation and long-term exponential growth may prefer space economy assets, whereas those seeking diversified portfolios with quicker liquidity options might lean towards venture capital funds.

Connection

Space economy investment leverages venture capital to fund startups developing cutting-edge space technologies, satellite infrastructure, and space exploration initiatives. Venture capital investment accelerates innovation by providing critical financial resources and strategic support to emerging space sector companies, driving growth in commercial space markets. This convergence enhances technology commercialization, expands market opportunities, and fosters a competitive edge in the global space economy.

Key Terms

**Venture capital investment:**

Venture capital investment drives innovation by funding startups and high-growth companies, particularly in technology, healthcare, and fintech sectors, yielding high returns despite elevated risks. This investment approach often involves early-stage funding rounds such as seed, Series A, and Series B, targeting scalable businesses with potential for exponential growth. Explore more to understand how venture capital shapes emerging industries and economic landscapes.

Equity ownership

Equity ownership in venture capital investments typically involves acquiring significant stakes in startups with high growth potential, whereas space economy investments often require substantial capital infusion for long-term infrastructure projects with emerging market valuation models. Space economy equity can include ownership in satellite technology, space exploration, and related ventures, offering unique portfolio diversification opportunities compared to traditional venture capital sectors. Explore more about how equity structures differ between these dynamic investment arenas.

Startup valuation

Startup valuation in venture capital investment often hinges on projected market growth, competitive positioning, and management team expertise, while space economy investments emphasize technological innovation, regulatory environment, and long-term scalability. Valuing startups within the space economy requires understanding complex factors such as satellite technology development, launch costs, and potential revenue from satellite data or space services. Discover detailed insights on how these valuation criteria shape investment decisions in both sectors.

Source and External Links

What is Venture Capital? - Venture capital is a form of risk capital investing in high-growth startups, providing funding to turn ideas and research into successful products and companies, often requiring long-term investment and active partnership with entrepreneurs.

Venture Capital investing | Investment Strategies - Venture capitalists invest in early-stage, high-potential startups in exchange for equity stakes, aiming for substantial returns by supporting firms from startup through profitability, often filling gaps left by traditional financing.

Venture capital - Venture capital investment typically happens in multiple rounds, supports innovative early-stage companies, involves minority equity stakes, and often leads to exits via IPOs or acquisitions within five to seven years, with government schemes helping reduce investor risk.

dowidth.com

dowidth.com