Sneakers flipping involves buying limited-edition or high-demand sneakers at retail prices and reselling them for profit in secondary markets, capitalizing on trends and brand hype. Antique collecting requires investing in rare, valuable items with historical significance, leveraging long-term appreciation and cultural value. Explore more to understand which investment strategy aligns with your financial goals and interests.

Why it is important

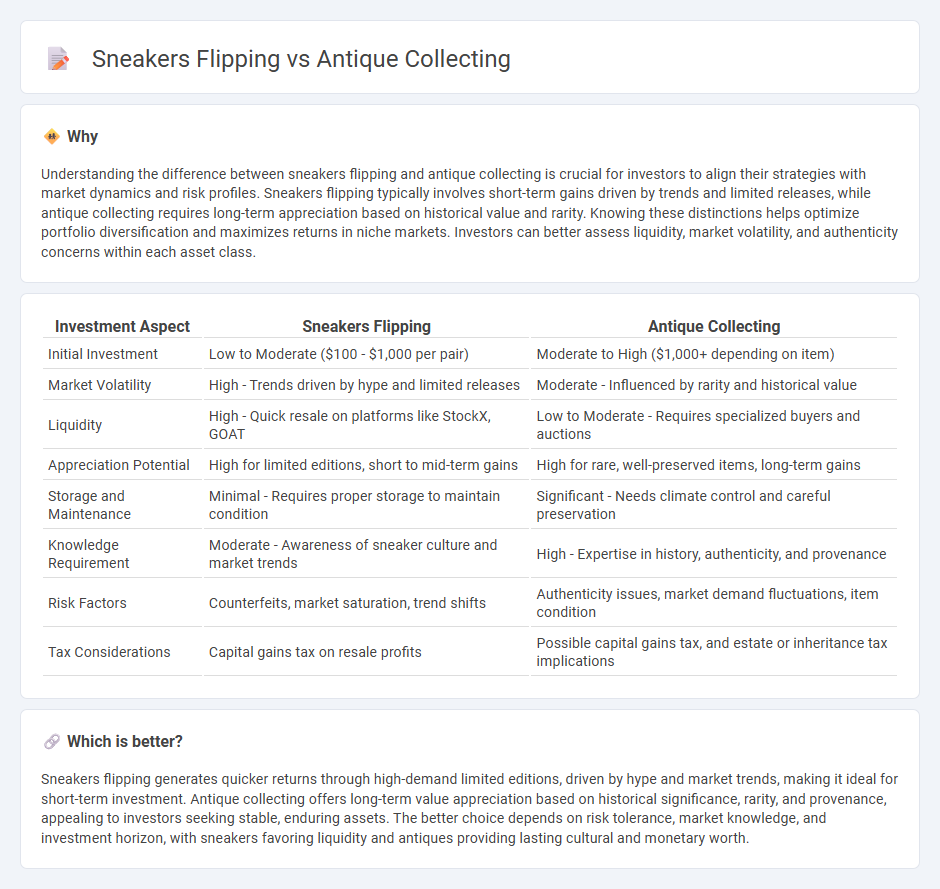

Understanding the difference between sneakers flipping and antique collecting is crucial for investors to align their strategies with market dynamics and risk profiles. Sneakers flipping typically involves short-term gains driven by trends and limited releases, while antique collecting requires long-term appreciation based on historical value and rarity. Knowing these distinctions helps optimize portfolio diversification and maximizes returns in niche markets. Investors can better assess liquidity, market volatility, and authenticity concerns within each asset class.

Comparison Table

| Investment Aspect | Sneakers Flipping | Antique Collecting |

|---|---|---|

| Initial Investment | Low to Moderate ($100 - $1,000 per pair) | Moderate to High ($1,000+ depending on item) |

| Market Volatility | High - Trends driven by hype and limited releases | Moderate - Influenced by rarity and historical value |

| Liquidity | High - Quick resale on platforms like StockX, GOAT | Low to Moderate - Requires specialized buyers and auctions |

| Appreciation Potential | High for limited editions, short to mid-term gains | High for rare, well-preserved items, long-term gains |

| Storage and Maintenance | Minimal - Requires proper storage to maintain condition | Significant - Needs climate control and careful preservation |

| Knowledge Requirement | Moderate - Awareness of sneaker culture and market trends | High - Expertise in history, authenticity, and provenance |

| Risk Factors | Counterfeits, market saturation, trend shifts | Authenticity issues, market demand fluctuations, item condition |

| Tax Considerations | Capital gains tax on resale profits | Possible capital gains tax, and estate or inheritance tax implications |

Which is better?

Sneakers flipping generates quicker returns through high-demand limited editions, driven by hype and market trends, making it ideal for short-term investment. Antique collecting offers long-term value appreciation based on historical significance, rarity, and provenance, appealing to investors seeking stable, enduring assets. The better choice depends on risk tolerance, market knowledge, and investment horizon, with sneakers favoring liquidity and antiques providing lasting cultural and monetary worth.

Connection

Sneaker flipping and antique collecting both capitalize on the principles of market demand, rarity, and historical significance to generate profitable returns on investment. These markets rely on the cultural value and scarcity of items, where limited-edition sneakers and unique antiques appreciate in value over time due to their exclusivity and collector interest. Savvy investors analyze trends and provenance to identify undervalued assets, leveraging niche knowledge for strategic buying and selling.

Key Terms

**Antique Collecting:**

Antique collecting involves acquiring rare and valuable items that hold historical significance, often appreciating in value over time due to scarcity and craftsmanship. Collectors seek authentic antiques, such as furniture, ceramics, and jewelry, that reflect specific periods or artistic movements, enhancing both cultural and financial worth. Explore the rich world of antique collecting to discover investment opportunities and timeless treasures.

Provenance

Provenance plays a crucial role in both antique collecting and sneakers flipping by establishing authenticity, history, and value. In antique collecting, detailed provenance enhances the item's cultural significance and market price, while in sneakers flipping, verified purchase records and limited edition releases drive demand and resale value. Discover how provenance impacts investment strategies and market dynamics in these distinct yet similarly valued markets.

Appraisal

Antique collecting appraises items based on historical significance, rarity, and provenance, often requiring expert authentication and detailed condition reports to establish value. Sneakers flipping relies heavily on market trends, limited edition releases, and resale demand, with condition grading and authenticity verification playing crucial roles in determining price. Explore in-depth appraisal techniques for both hobbies to maximize investment potential.

Source and External Links

Antique Collecting | EBSCO Research Starters - Provides an overview of antique collecting, including its history, types of collectibles, and how the hobby has evolved with the rise of online platforms.

The Beginner's Guide to Collecting Antiques - Offers practical advice for beginners on how to start an antique collection, including choosing a focus, setting a budget, and identifying authentic pieces.

The Art of Collecting Antiques: A Timeless Pursuit - Discusses the reasons people collect antiques and provides guidance on starting a collection, including education, focus, and the importance of provenance.

dowidth.com

dowidth.com