Collectible sneakers have surged in value with a global market worth over $10 billion, driven by limited releases and cultural trends, while farmland offers stable, long-term returns through crop production and land appreciation, currently averaging 6-8% annual growth. Sneaker investments benefit from liquidity and hype cycles but carry higher risk and volatility compared to the tangible asset of farmland, which provides diversification and inflation protection. Explore detailed comparisons to determine which asset aligns best with your investment strategy.

Why it is important

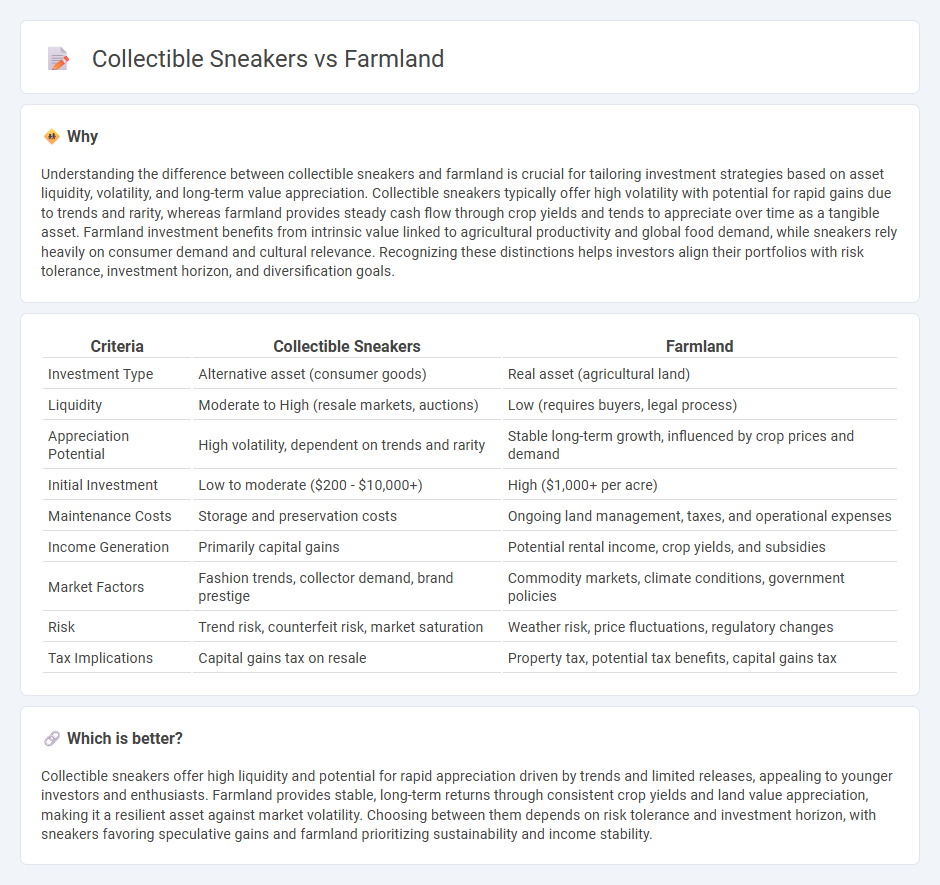

Understanding the difference between collectible sneakers and farmland is crucial for tailoring investment strategies based on asset liquidity, volatility, and long-term value appreciation. Collectible sneakers typically offer high volatility with potential for rapid gains due to trends and rarity, whereas farmland provides steady cash flow through crop yields and tends to appreciate over time as a tangible asset. Farmland investment benefits from intrinsic value linked to agricultural productivity and global food demand, while sneakers rely heavily on consumer demand and cultural relevance. Recognizing these distinctions helps investors align their portfolios with risk tolerance, investment horizon, and diversification goals.

Comparison Table

| Criteria | Collectible Sneakers | Farmland |

|---|---|---|

| Investment Type | Alternative asset (consumer goods) | Real asset (agricultural land) |

| Liquidity | Moderate to High (resale markets, auctions) | Low (requires buyers, legal process) |

| Appreciation Potential | High volatility, dependent on trends and rarity | Stable long-term growth, influenced by crop prices and demand |

| Initial Investment | Low to moderate ($200 - $10,000+) | High ($1,000+ per acre) |

| Maintenance Costs | Storage and preservation costs | Ongoing land management, taxes, and operational expenses |

| Income Generation | Primarily capital gains | Potential rental income, crop yields, and subsidies |

| Market Factors | Fashion trends, collector demand, brand prestige | Commodity markets, climate conditions, government policies |

| Risk | Trend risk, counterfeit risk, market saturation | Weather risk, price fluctuations, regulatory changes |

| Tax Implications | Capital gains tax on resale | Property tax, potential tax benefits, capital gains tax |

Which is better?

Collectible sneakers offer high liquidity and potential for rapid appreciation driven by trends and limited releases, appealing to younger investors and enthusiasts. Farmland provides stable, long-term returns through consistent crop yields and land value appreciation, making it a resilient asset against market volatility. Choosing between them depends on risk tolerance and investment horizon, with sneakers favoring speculative gains and farmland prioritizing sustainability and income stability.

Connection

Collectible sneakers and farmland both represent alternative investment assets that diversify traditional portfolios by offering potential high returns unrelated to stock market fluctuations. Sneaker markets capitalize on rarity, brand value, and cultural trends, while farmland investments rely on agricultural productivity, land appreciation, and sustainable resource management. Both asset classes attract investors seeking inflation hedges and long-term value growth through distinct market dynamics.

Key Terms

Asset Appreciation

Farmland has consistently demonstrated stable asset appreciation driven by increasing global food demand, limited arable land, and inflation-hedging properties, with average annual returns ranging from 8% to 12%. Collectible sneakers, although highly volatile, can achieve rapid appreciation based on brand exclusivity, limited editions, and cultural trends, sometimes yielding returns exceeding 20% in short periods. Explore further to understand which asset best aligns with your investment goals and risk tolerance.

Liquidity

Farmland investments offer relatively low liquidity due to lengthy transaction processes and regulatory requirements, often taking months to sell. Collectible sneakers provide higher liquidity, as they can be sold quickly through online marketplaces and auction platforms with global reach. Explore the detailed comparisons to understand which asset better suits your liquidity needs.

Risk Diversification

Farmland offers stability with low correlation to traditional markets, providing consistent returns through crop yields and land appreciation, which mitigates risk during economic downturns. Collectible sneakers present high volatility, driven by trends and market demand, resulting in potential for significant gains but also considerable losses and liquidity challenges. Explore comprehensive strategies for balancing these distinct asset classes to optimize risk diversification.

Source and External Links

Farm Land - A chill and idle farming game where players grow fields, raise animals, and expand their farm.

American Farmland Trust - An organization dedicated to protecting farmland, promoting sound farming practices, and supporting farmers.

FarmLand - A farming simulator where players restore an island farm town by cultivating crops and selling them to customers.

dowidth.com

dowidth.com