The secondaries market offers liquidity by allowing investors to buy and sell pre-existing stakes in private equity funds, contrasting with venture capital where funds are allocated directly to startups during early growth stages. This dynamic creates opportunities for portfolio diversification and risk management, as secondaries transactions often occur at different valuation points than initial venture capital investments. Explore the nuances between these investment approaches to optimize your asset allocation strategy.

Why it is important

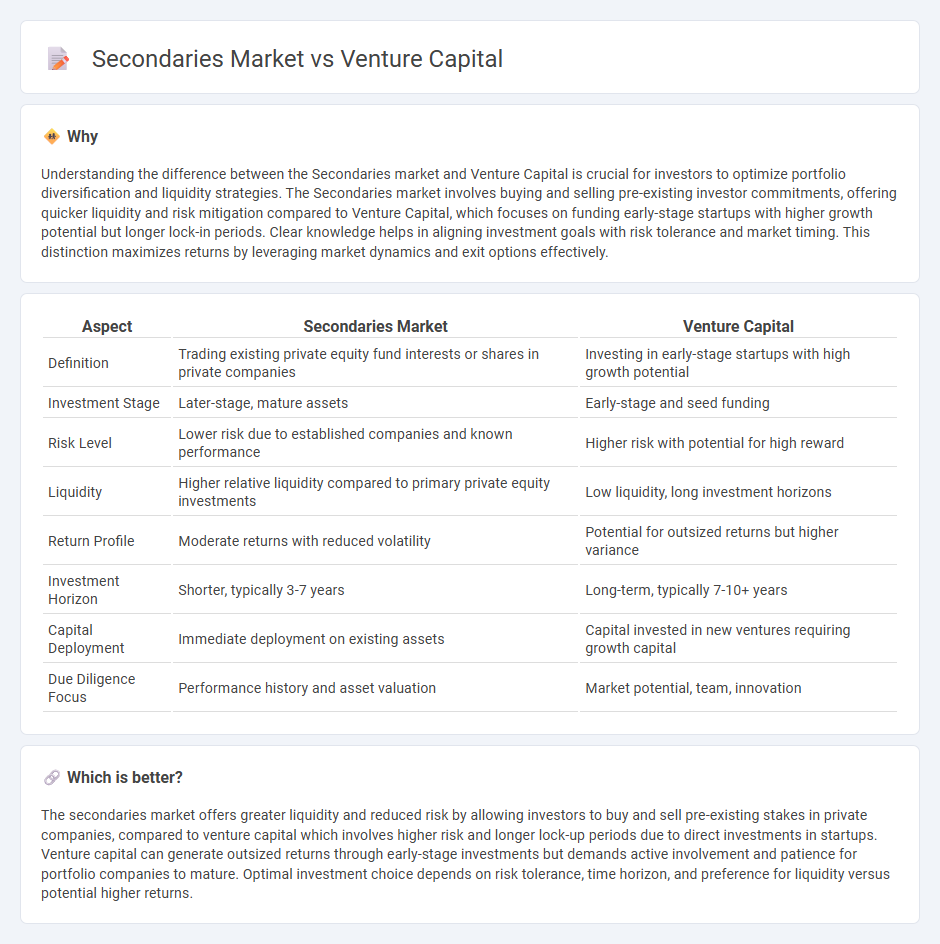

Understanding the difference between the Secondaries market and Venture Capital is crucial for investors to optimize portfolio diversification and liquidity strategies. The Secondaries market involves buying and selling pre-existing investor commitments, offering quicker liquidity and risk mitigation compared to Venture Capital, which focuses on funding early-stage startups with higher growth potential but longer lock-in periods. Clear knowledge helps in aligning investment goals with risk tolerance and market timing. This distinction maximizes returns by leveraging market dynamics and exit options effectively.

Comparison Table

| Aspect | Secondaries Market | Venture Capital |

|---|---|---|

| Definition | Trading existing private equity fund interests or shares in private companies | Investing in early-stage startups with high growth potential |

| Investment Stage | Later-stage, mature assets | Early-stage and seed funding |

| Risk Level | Lower risk due to established companies and known performance | Higher risk with potential for high reward |

| Liquidity | Higher relative liquidity compared to primary private equity investments | Low liquidity, long investment horizons |

| Return Profile | Moderate returns with reduced volatility | Potential for outsized returns but higher variance |

| Investment Horizon | Shorter, typically 3-7 years | Long-term, typically 7-10+ years |

| Capital Deployment | Immediate deployment on existing assets | Capital invested in new ventures requiring growth capital |

| Due Diligence Focus | Performance history and asset valuation | Market potential, team, innovation |

Which is better?

The secondaries market offers greater liquidity and reduced risk by allowing investors to buy and sell pre-existing stakes in private companies, compared to venture capital which involves higher risk and longer lock-up periods due to direct investments in startups. Venture capital can generate outsized returns through early-stage investments but demands active involvement and patience for portfolio companies to mature. Optimal investment choice depends on risk tolerance, time horizon, and preference for liquidity versus potential higher returns.

Connection

The Secondaries market in venture capital provides liquidity by allowing investors to buy and sell pre-existing stakes in startup funds, enhancing portfolio flexibility and risk management. This market connects with venture capital by enabling limited partners to exit positions before fund maturity, thereby attracting more capital into early-stage companies. Increased activity in Secondaries markets boosts overall venture capital ecosystem efficiency and encourages sustained investment flows in innovation-driven startups.

Key Terms

Equity

Venture capital investments primarily target early-stage startups with high growth potential, offering equity stakes that can yield significant returns upon exit events like IPOs or acquisitions. The secondaries market involves buying and selling pre-existing equity stakes from early investors or employees, providing liquidity and risk diversification without directly funding the company. Explore the advantages and risks of both equity approaches to optimize your investment strategy.

Liquidity

Venture capital investments typically have longer lock-up periods, often spanning 7 to 10 years, limiting immediate liquidity for investors. The secondaries market provides enhanced liquidity options by allowing investors to buy and sell pre-existing stakes in private companies, reducing the traditional wait time tied to venture capital fund life cycles. Explore deeper insights on how these liquidity differences impact investment strategies and portfolio management.

Valuation

Venture capital valuations often reflect future growth potential and are typically based on projected earnings and market opportunities, leading to higher premiums. In contrast, the secondaries market values investments primarily on current performance metrics, liquidity, and risk mitigation, resulting in more conservative pricing. Explore the nuances of valuation methodologies in these markets to make informed investment decisions.

Source and External Links

What is Venture Capital? - Venture capital is a form of high-risk, long-term equity investment that fuels high-growth companies by turning ideas and research into market-shaping products and services, often providing strategic guidance and operational support alongside funding.

Fund your business | U.S. Small Business Administration - Venture capital is funding provided to high-growth startups in exchange for equity and often a board seat, differing from traditional loans by focusing on equity participation and a longer-term investment horizon.

What is venture capital? - Venture capital supports early-stage companies with rapid growth potential by providing not only financial backing but also managerial expertise, with investors gaining ownership stakes and often active roles in the businesses they fund.

dowidth.com

dowidth.com