Social token investment offers unique opportunities for early access, community engagement, and potential utility within digital ecosystems, contrasting with traditional stock investment that provides established market liquidity, regulatory oversight, and dividend potential. While traditional stocks represent ownership in established companies with historical financial data, social tokens often derive value from community participation and brand loyalty, introducing higher volatility but innovative reward mechanisms. Explore the differences and potential benefits of each investment type to make informed decisions aligned with your financial goals.

Why it is important

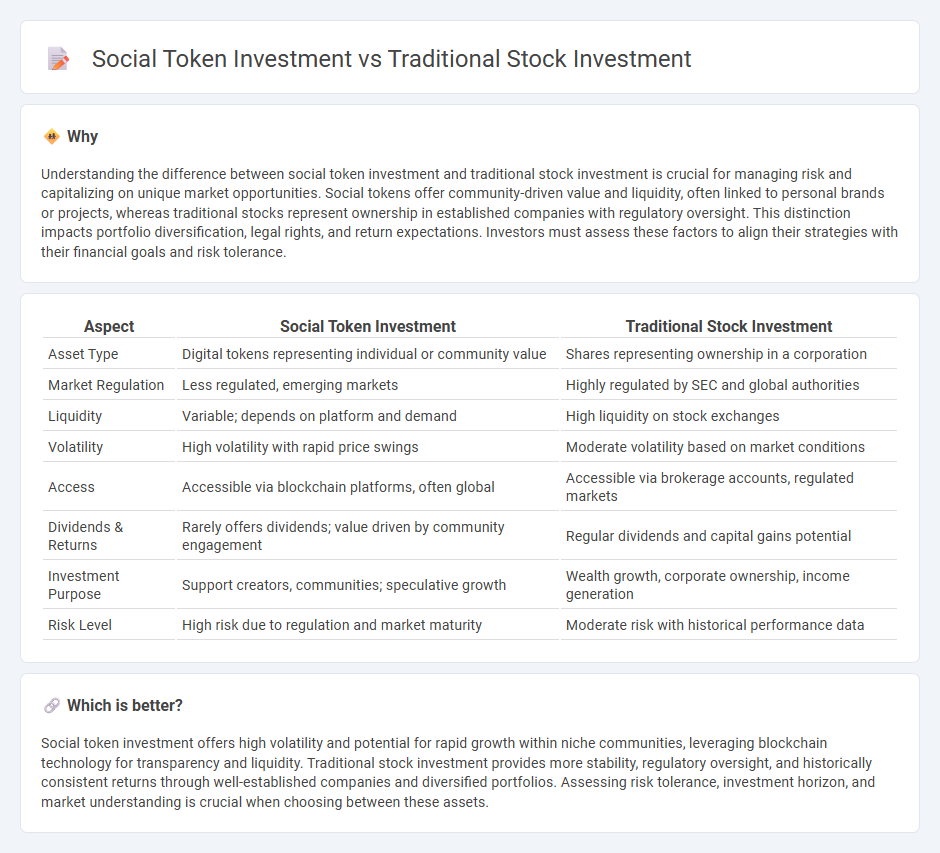

Understanding the difference between social token investment and traditional stock investment is crucial for managing risk and capitalizing on unique market opportunities. Social tokens offer community-driven value and liquidity, often linked to personal brands or projects, whereas traditional stocks represent ownership in established companies with regulatory oversight. This distinction impacts portfolio diversification, legal rights, and return expectations. Investors must assess these factors to align their strategies with their financial goals and risk tolerance.

Comparison Table

| Aspect | Social Token Investment | Traditional Stock Investment |

|---|---|---|

| Asset Type | Digital tokens representing individual or community value | Shares representing ownership in a corporation |

| Market Regulation | Less regulated, emerging markets | Highly regulated by SEC and global authorities |

| Liquidity | Variable; depends on platform and demand | High liquidity on stock exchanges |

| Volatility | High volatility with rapid price swings | Moderate volatility based on market conditions |

| Access | Accessible via blockchain platforms, often global | Accessible via brokerage accounts, regulated markets |

| Dividends & Returns | Rarely offers dividends; value driven by community engagement | Regular dividends and capital gains potential |

| Investment Purpose | Support creators, communities; speculative growth | Wealth growth, corporate ownership, income generation |

| Risk Level | High risk due to regulation and market maturity | Moderate risk with historical performance data |

Which is better?

Social token investment offers high volatility and potential for rapid growth within niche communities, leveraging blockchain technology for transparency and liquidity. Traditional stock investment provides more stability, regulatory oversight, and historically consistent returns through well-established companies and diversified portfolios. Assessing risk tolerance, investment horizon, and market understanding is crucial when choosing between these assets.

Connection

Social token investment and traditional stock investment are connected through their shared foundation in asset value and market dynamics, allowing investors to diversify portfolios across digital and conventional assets. Both investment types rely on market demand, investor sentiment, and regulatory frameworks that influence asset liquidity and price volatility. The growing integration of blockchain technology in financial markets bridges the gap between social tokens and traditional stocks, fostering innovative investment strategies and expanding access to capital markets.

Key Terms

Traditional stock investment:

Traditional stock investment involves purchasing shares of established companies traded on regulated exchanges, providing investors with ownership stakes and potential dividends. It offers long-term growth prospects, historical performance data, and liquidity through well-developed markets. Explore more to understand how traditional stock investment compares with emerging social token opportunities.

Shares

Traditional stock investment involves purchasing shares of established companies listed on stock exchanges, granting ownership and potential dividends, with regulated market oversight and historical data aiding risk assessment. Social token investment represents ownership or engagement within creator economies or decentralized communities, often providing access, influence, or rewards rather than traditional equity rights, with emerging valuation models driven by social metrics. Discover how these investment types differ in shareholder value, liquidity, and market dynamics by exploring expert analyses.

Dividends

Traditional stock investments typically provide dividends as a steady income stream based on company profits distributed to shareholders. Social token investments, often linked to digital communities or creators, may offer alternative benefits like access, voting rights, or profit-sharing but generally lack consistent dividend payouts. Explore the unique financial and engagement advantages to decide which investment aligns best with your portfolio goals.

Source and External Links

Traditional investments - Wikipedia - Provides an overview of traditional investments, including stocks, which involve purchasing equity in companies expecting price increases.

Traditional Investment Strategies: A Guide for Modern Investors - Discusses traditional investment strategies, including stock investments, as a means to achieve financial objectives through diversification and asset allocation.

Traditional investment - Urbanitae Blog - Explains traditional investments such as stocks as a conservative approach to investing, offering stability and predictable returns by diversifying portfolios through mutual funds or ETFs.

dowidth.com

dowidth.com